Why Solid State has recovery potential

3rd July 2018 16:53

by Lee Wild from interactive investor

Solid State is a well-regarded business, but has hit some hurdles in recent years. Lee Wild hears how management is turning things round.

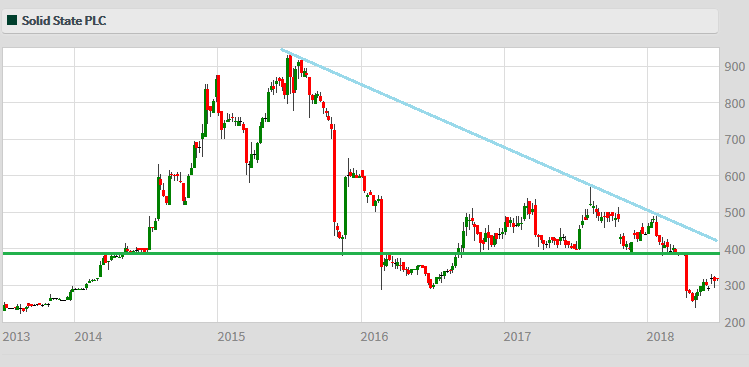

Solid State has not had an easy time of it since the shares peaked three years ago at above 900p. The company is well-run and is a great ambassador for British business abroad, but problems with a Ministry of Justice contract and, more recently, a slowdown at the communications unit, have relegated the stock to more modest valuation multiples.

But Solid has bounced back before, and a reorganisation of the business and greater focus on higher margin products in exciting areas like robotics, artificial intelligence and fanless PCs, makes them one to keep on the watch list.

Results published Tuesday show a 4% drop in adjusted pre-tax profit for year ended 31 March 2018 to £3 million on revenue up 16% at £46.3 million. The 137 basis-point reduction in operating margin to 6.56% is blamed on a big jump in sales at the lower margin value-added distribution division, which now generates a larger proportion of group sales.

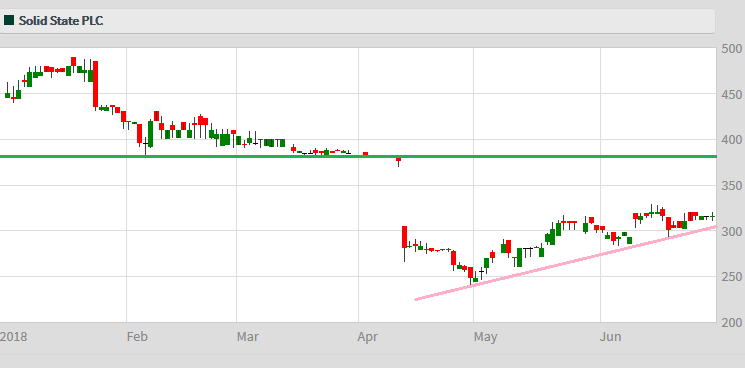

Source: interactive investor Past performance is not a guide to future performance

However, new orders have flooded in during the first two months of the new financial year, and numbers for the period are currently on track to meet expectations. The open order book currently stands at £23 million, up 11% on last year, with £19 million due for delivery before the end of March 2019.

Two years after acquisition, custom batteries business Creasefield is scaled up and Solid is starting to see the fruits of that work. Bought for just £1.6 million, it’s already won a £4.8 million smart warehouse contract with a company understood to be Ocado. There could be more work there in future, but Solid is still working through Creasefield’s legacy contracts at poor margins. It is increasing prices, but it takes time.

Sales in the US ballooned from £900,000 to almost £3 million, but that still trails the UK at £36 million, and management will have wanted more given the sums invested in facilities there.

"We’re noting a definite sway toward buying domestically, especially in the US defence sector," chief executive Gary March told me.

"We have won a small contract though, which is encouraging."

Source: interactive investor Past performance is not a guide to future performance

Expect distribution and power to drive the business over the next 12-18 months, while oil & gas has come back and is stronger. Wireless is another big area for Solid, with its technology allowing things to talk to the internet. Its parts are used in tracking devices loved by car insurance companies, too.

House brokers finnCap and WH Ireland remain optimistic, and a price/earnings (PE) multiple of 12 is modest alongside a forward dividend yield nudging 4%. Closest peer and another great company, DiscoverIE, trades on almost 17 times earnings and yields not much more than 2%.

David Buxton, respected analyst at finnCap, still thinks the shares are worth 400p, which equates to a PE 15.8 and implies 30% potential upside. Avoid hitting any more hurdles and technical analysts will be betting Solid “fills the gap” opened up after the April profit warning, also up to around the 400p level.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.