Why we are happy having a big cash weighting

13th June 2022 14:39

by Douglas Chadwick from ii contributor

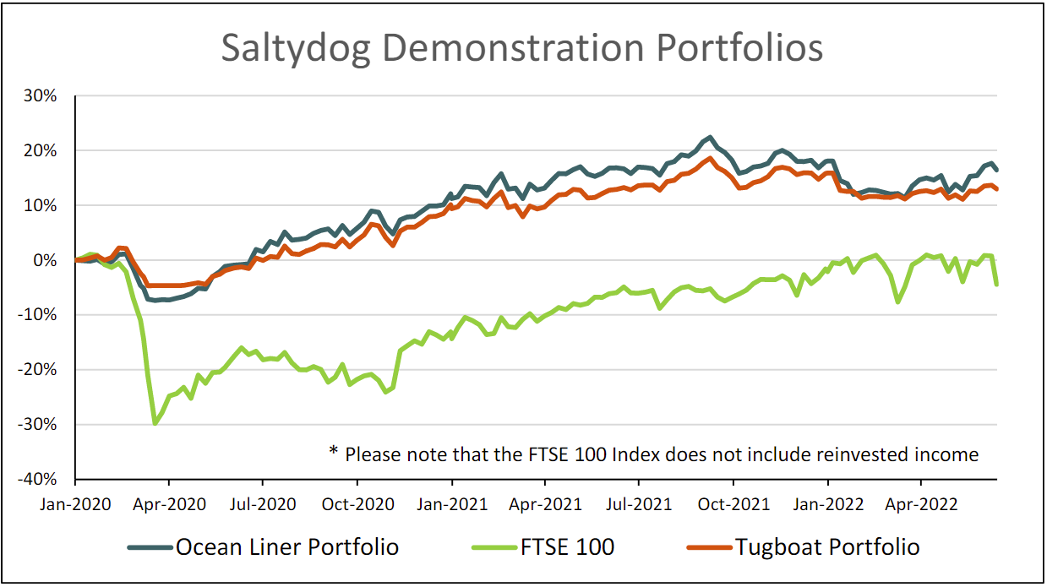

Saltydog explains how tactically dashing for cash can prove more profitable than the ‘keep calm and carry on’ approach.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

In one breath, the professionals tell us amateur investors that in times of stock market sector collapses, we should just sit out the fall and not run for the safety of cash. After all, they say, the markets will eventually recover.

Then, last week I read in The Times that these same people, the fund managers, have reduced their investments within the set limits of their operational sectors and are now holding more cash than ever previously recorded. Strange that!

Most UK-domiciled funds are classified to one of the Investment Association (IA) sectors, and to qualify they must stick to the sector rules. So, for example, if a fund is in the UK All Companies sector, then it must “invest at least 80% of its assets in UK equities, which have a primary objective of achieving capital growth”. That is great, because as an investor we know what it is invested in.

However, from the fund managers' point of view, it means that even when conditions for the sector look terrible, the maximum amount of cash that the fund can hold is limited to 20%. The rest must be invested in equities, even if they are plummeting.

- How Saltydog invests: a guide to its momentum approach

- Two funds on the rise that we’ve been buying more of

- The fund and investment trust sectors with the highest yields

As private investors ,we are not so constrained and can move 100% into cash and sometimes, in our Saltydog demonstration portfolios, we have.

To illustrate why we might do this, consider the following situation. Assume a £1,000 investment and a market drop of 40%, and then over time a 40% recovery. £1,000 less 40% equals £600. Then a 40% recovery results in a value of £840. Instead, a 67% gain is required to get back to even.

Now it is not reasonable to expect to pick the top and bottom of the market to make your moves, so we will assume that you react 10% from the top and 10% from the bottom, and go entirely into and then out of cash.

This is where it gets a bit more complicated…

If you start with 1,000 units worth £1 each, then the total value is £1,000. The price drops by 10% to 90p and you sell, giving you £900. The price then falls all the way down to 60p (40% down on where it started). It then goes up by 10% to 66p and you buy back, using the full £900. The price then goes up to 84p (40% above its lowest point), at which point your investment is worth £1,145. This compares with £840 if you had done nothing. You would be sitting on a 14.5% gain, instead of a 16% loss.

If the price eventually gets back to £1, then instead of just being back where you started, you would have £1,363, a gain of 36%.

Obviously, it does not always work out like that. If the market falls by 10% and then immediately starts to recover, you will not look so clever. However, you have still got 90% of your capital and can quickly get back into the markets. The problem comes when you suffer a large loss and only have a limited amount of time to make it back up again.

I am not suggesting that timing the market is easy, but that does not mean that it should automatically be ruled out. Sometimes market conditions are clearly less favourable than at other times. If that is the case, then why not hold more cash and reduce your exposure to the markets?

In our portfolios, we did this early in 2020 and as a result did not suffer the full impact of the coronavirus crash.

Past performance is not a guide to future performance.

You may also think that a 40% market fall is unlikely, but it is what happened in the dotcom crash in 2000-2003 and again during the 2008-09 financial crash.

Even now, the S&P 500 is 19% lower than it was when it peaked at the beginning of the year, and the Nasdaq is nearly 30% down from its all-time high at the end of last year. They are still trending lower.

The FTSE 100 has still never been above the record that it set in May 2018.

At an individual fund level, over the past six months the Baillie Gifford Long Term Global Growth fund has fallen by 40%, T. Rowe Price Global Technology Equity is down 46%, and Baillie Gifford American, which was the best-performing fund in 2020, has lost 50%. It just goes to show how the tide can turn.

At the beginning of March, our cash holding in the Tugboat portfolio was 90% and in the Ocean Liner it was 70%. Since then, cash levels have dropped to 64% in the Tugboat and 44% in the Ocean Liner. Even when overall markets may be trending down, certain sectors can do well. We are currently holding a few funds investing in energy and natural resources that have performed well for us: TB Guinness Global Energy, Schroder ISF Global Energy, and JPM Natural Resources.

In the last few days, we have seen stock markets falling again. On Friday, the S&P 500 fell by 2.9% and the Nasdaq was down 3.5%. The Asian markets have followed suit and are significantly down on where they were at the end of last week.

In the UK, the FTSE 100 fell by 2.1% on Friday and the FTSE 250 only did slightly better, down 2.0%. This morning the FTSE 100 lost a further 1.7% and the FTSE 250 was down 2.1%.

Once again, it seems sensible to be holding cash and not fully exposed to the markets.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.