Wild’s Winter Portfolios 2021: big rewards for consistency in December

7th January 2022 15:28

by Lee Wild from interactive investor

Find out how this portfolio of reliable stocks continues to thrash the wider market, and why one laggard is causing problems for the higher-risk basket of shares.

After a mixed start to the 2021-22 winter portfolios, stocks began December in fine style, quickly recouping all the losses suffered during the previous month’s Omicron sell-off and more. A Santa rally had begun, and Wild’s Winter Portfolios were big beneficiaries.

Investors were encouraged that, while the new Covid variant was more easily transmitted, it was less likely to hospitalise sufferers. The UK government’s decision not to introduce more draconian measures to combat the virus helped sentiment, while positive economic data out of the US was well-received.

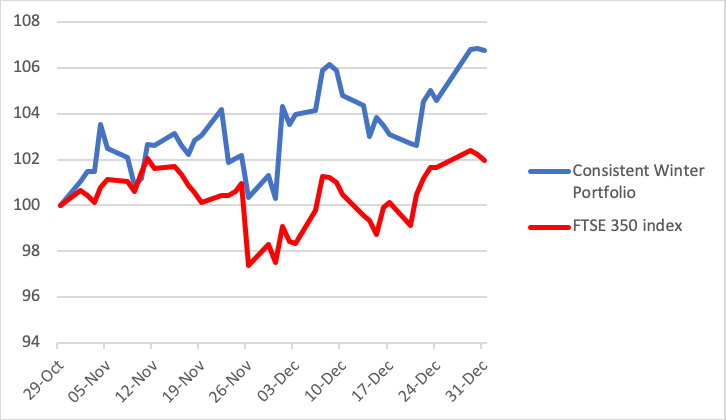

The first month had already gone well for the Consistent Winter Portfolio, ending November with a small gain and way ahead of the FTSE 350 benchmark index, which had fallen 2.5%. The portfolio, made up of the five most reliable stocks in the FTSE 350 over the past 10 years, rallied 6.4% in December, taking gains so far this winter to 6.7%. The FTSE 350 rose 4.5% and is now up 2% this season.

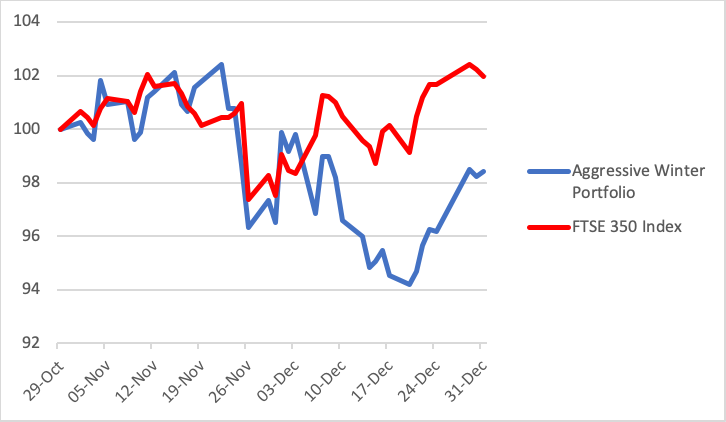

Extra risk is meant to offer the opportunity for bigger returns. Unfortunately, the Aggressive Winter Portfolio is being hamstrung by a single laggard. More on that below. As a result, and despite improving by 2% in December, the portfolio is down 1.6% during this latest seasonal strategy.

Consistent Winter Portfolio 2021-22

Source: interactive investor. Past performance is not a guide to future performance.

Self-storage firm Safestore (LSE:SAFE) made a storming start to the winter and, after adding almost 11% in the first month, rose 5.9% in December to take its gains so far to 17.2%. With no fresh company news, the shares continued to bask in the success spelled out in November’s fourth-quarter trading update. General optimism about the state of the economy and a government decision not to enforce Covid restrictions in England beyond Plan B, were helpful.

Fund manager Liontrust Asset Management (LSE:LIO) did even better in December, notching up a gain of 7.6%. Enthusiasm for the shares was buoyed by rising markets, a 93% increase in annual adjusted pre-tax profit announced at the start of the month, and acquisition of Majedie Asset Management for £120 million. Liontrust is now up 0.9% for this season’s portfolio having more than offset November’s losses.

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- Subscribe for free to the ii YouTube channel for our latest share tips and fund manager interviews

Insurer Admiral (LSE:ADM) has been a star performer this winter, now up 10% after a cracking gain of 6.8% in the past month. There’s been little company specific news, but the investment community clearly believes a rapid 30% decline from August’s record high was overdone. Annual results are due out on 3 March.

Technology conglomerate Halma (LSE:HLMA) was just behind with a 6.6% return for the month, giving an 8% profit so far this winter. While some argue against the stock’s high valuation, fans of the FTSE 100 constituent point to its involvement in lots of defensive industries where spending continues through thick and thin. This helped drive the share price to a record high in the final week of 2022.

It had looked like XP Power (LSE:XPP) would be a stock to watch this winter following a near-6% rally within just a few days of the seasonal strategy’s launch. It didn’t last, and shares in the manufacturer of power adapters have struggled to keep their heads above water ever since. However, a 5.4% jump in December did narrow the winter deficit to 2.5%.

Aggressive Winter Portfolio 2021-22

Source: interactive investor. Past performance is not a guide to future performance.

Safestore and Liontrust Asset Management appear in the aggressive portfolio, too, so there’s a nice kicker from the pair’s strong December performance.

Elsewhere, there was decent upside at precision instrumentation expert Spectris (LSE:SXS) and infrastructure products company Hill & Smith (LSE:HILS), up 4.4% and 6.4% respectively. The latter benefited from bargain hunting following the late-November Omicron sell-off, including a £30,000 purchase by non-executive director Annette Kelleher. However, both are still down slightly this winter.

I’ve left the worst till last this month. Synthomer (LSE:SYNT) has been a significant drag on the aggressive portfolio, and it spent December extending losses by 15.1%, taking the total deficit over two months to 21.1%.

That’s at odds with its historic seasonal performance. Shares in the supplier of chemicals used to make paint and latex gloves have risen every winter for at least the past 12 years, except in 2018. Its average winter share price return over the decade is 21.4%, including a 34.8% gain a year ago.

But this year’s winter portfolio coincided with the company’s $1 billion acquisition of the adhesive resins business of Eastman Chemical Company. The deal, approved at a general meeting on 17 December, was part-funded by a share placing at 485p.

- Lee Wild's AIM share for 2022

- Best 39 growth stocks for 2022

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

"Today's vote represents an overwhelming endorsement from our shareholders and demonstrates their confidence in our strategic rationale for this transaction,” said new chief executive Michael Willome.

“Having now spent almost two months as Synthomer's CEO, I have seen how the combination of Adhesive Technologies, the Omnova acquisition last year and the investment in multiple areas across the business has resulted in a significant step change in profitability and gives us a strong platform for future growth.”

During December, directors spent over £270,000 on Synthomer shares at less than 400p.

However, analysts at broker Morgan Stanley were not so confident, downgrading their rating from ‘overweight’ to ‘underweight’ and price target from 568p to 400p.

They worry about “a sharp deterioration in the supply outlook and associated risk of faster than expected normalisation in earnings.” A mix of volume risks, a management transition and higher debt skew risk to the downside.

That assessment is largely pinned on a reduction in demand for medical gloves during the pandemic and also from the DIY sector, plus integration risk of the cyclical Eastman Adhesive Resins business. We’ll find out who’s right in the months ahead.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.