Wild’s Winter Portfolios 2021: it never rains but it pours

8th April 2022 13:21

by Lee Wild from interactive investor

It’s been one shock after another this winter, and now two reliable stocks have turned south.

War in Ukraine caused a sharp decline across global stock markets in February which spilled over into March. But buyers returned in droves after just one week of the new month, driving many international indices back up to pre-conflict levels.

However, there’s no escaping the fact that this has not been a great year for growth stocks that dominate the winter portfolios. And it’s not just Russia’s invasion of Ukraine that’s damaged investor sentiment.

Growth stocks do best when interest rates are low, so they don’t like the dramatic surge in inflation which raises the very real prospect of sharply higher borrowing costs. Rates haven’t risen much yet, but the expectation is for several more increases in 2022 both here and in the US.

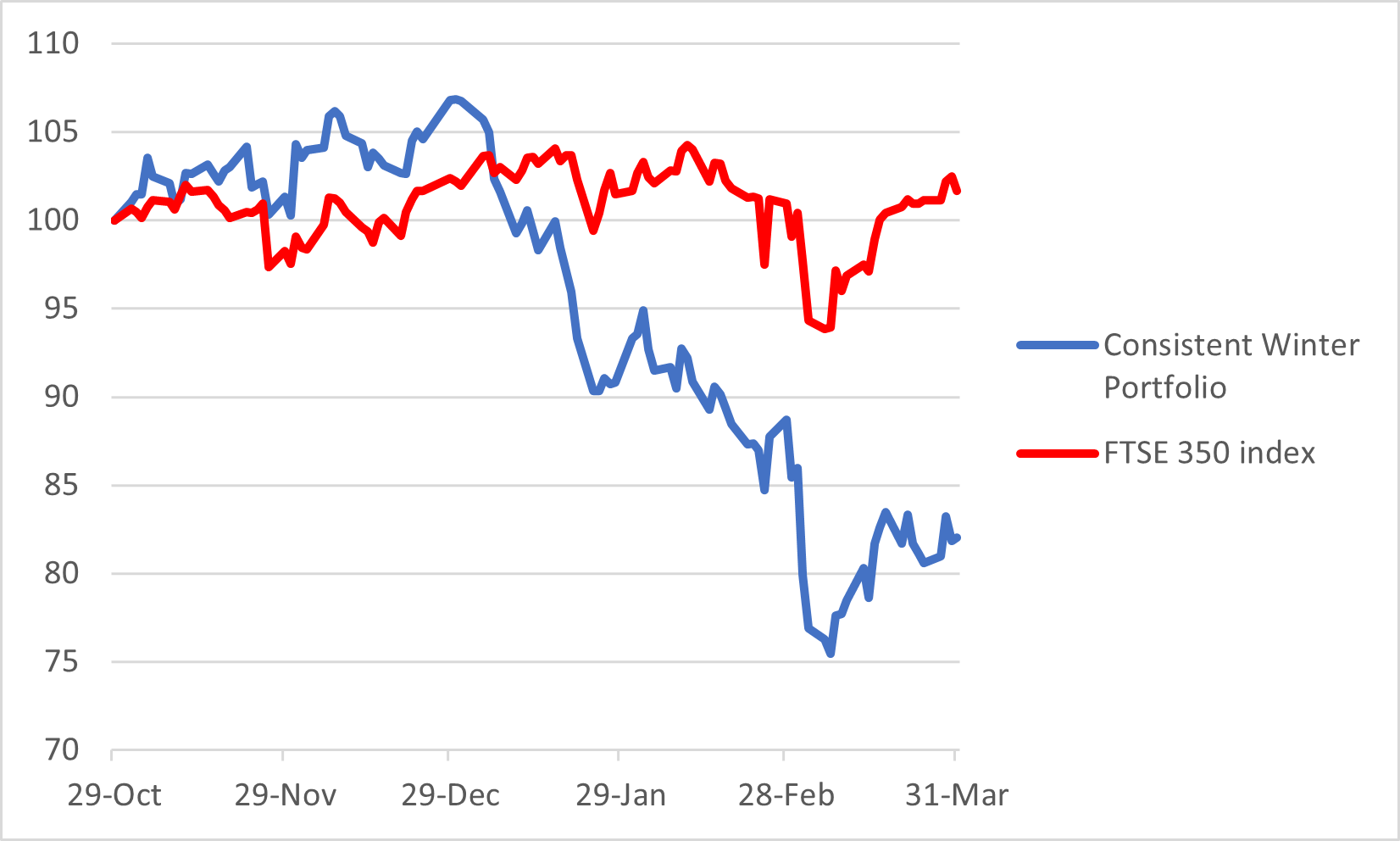

While the FTSE 350 benchmark index edged up 0.7% in March, the Consistent Winter Portfolio fell 7.5%. A pair of previously solid performers clearly felt lonely, so played catch-up with other constituents that had already suffered sharp declines. That extends the portfolio’s loss for the first five months of the seasonal strategy to 18%.

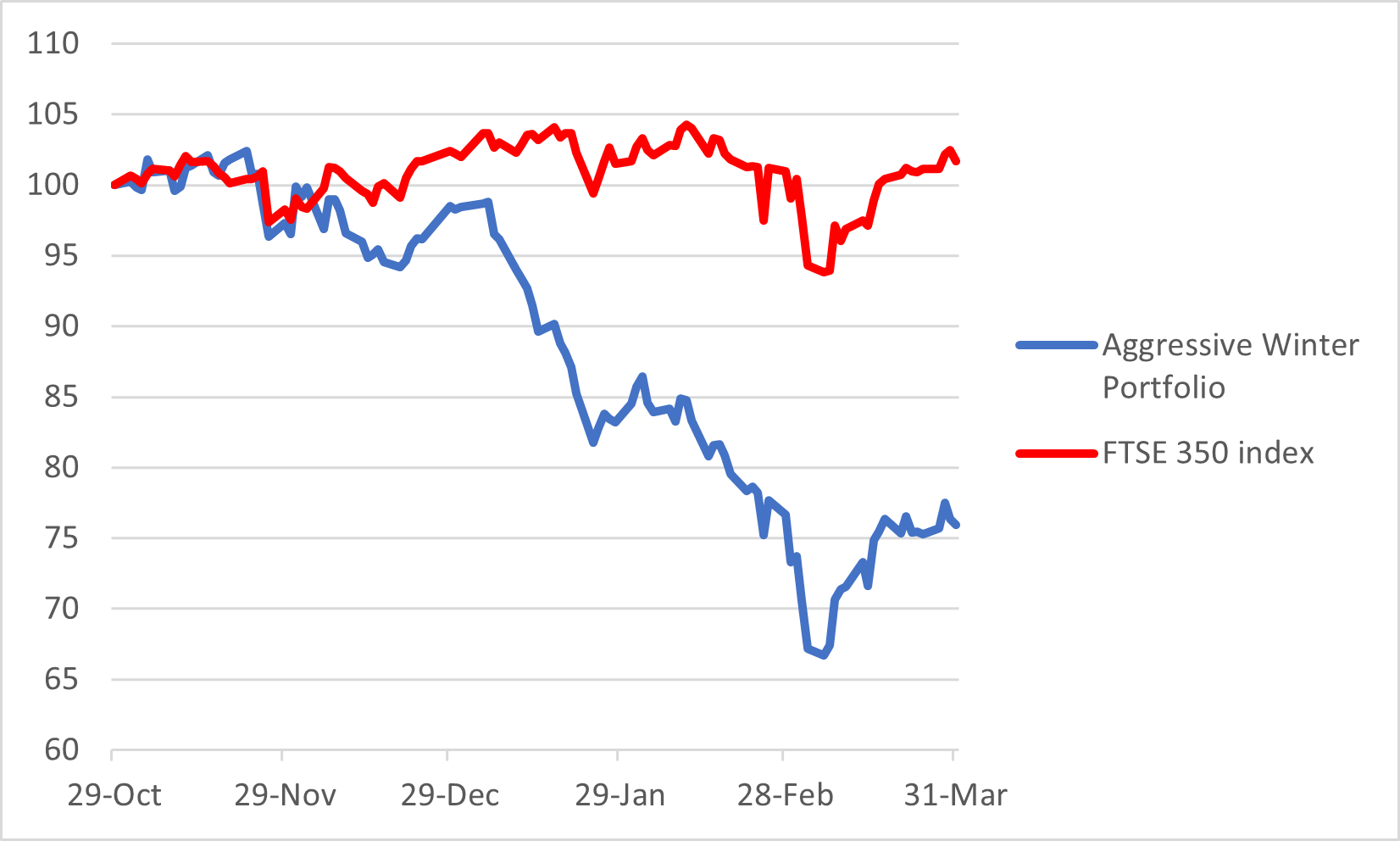

There’s extra risk in the Aggressive Winter Portfolio in return for potentially higher rewards, and this month it traded more or less in line with the market, ending the month with only a 1% deficit.

It is reassuring that the constituents still demonstrate an ability to recover from setbacks, given that the portfolio was down 13% in March after just one week of the month, when selling was at its most ferocious. However, with the portfolio down 24.1% this winter, there is clearly much more work to be done in the final few weeks of this strategy which is very much a damage limitation exercise.

Consistent Winter Portfolio 2021-22

Source: interactive investor using Morningstar data. Past performance is not a guide to future performance.

Let’s start on a positive note. Two ‘consistent’ stocks generated positive returns in March. Self-storage firm Safestore Holdings Ordinary Shares (LSE:SAFE) added 5.3%, taking its five-month gain to 11.5% and the shares very near a record high. Technology conglomerate Halma (LSE:HLMA) also regained some ground, a rise of 4.1% reducing the seasonal deficit to 15%.

But that’s as good as it gets. Liontrust Asset Management (LSE:LIO) had another bad month as investors continued to rotate out of highly-rated investments focused on environmental, social and corporate governance (ESG) issues – an area in which Liontrust specialises - into oil and mining companies.

A loss of 15.9% in March takes the decline this winter to over 41%. Many analysts believe Liontrust shares have been significantly oversold, but it’s unclear how much of the damage can be repaired in the remaining weeks of this seasonal portfolio.

It was also disappointing to see one of the portfolio’s best performers – Admiral Group (LSE:ADM) – and one of its most promising constituents - XP Power Ltd (LSE:XPP) – take a significant hit in March. The insurer warned that higher second-hand car values were behind an increase in claims inflation, driven by higher accidental damage claims. It also warned that profits would be lower in 2022.

Meanwhile, XP, which maker power adapters, said a US jury had ruled against it in a case brought by Swiss rival Comet.

As our columnist Richard Beddard reports: “Comet says the verdict proves XP Power stole trade secrets and used them to develop its next generation Radio Frequency power products, a relatively new part of XP Power’s product portfolio.”

Aggressive Winter Portfolio 2021-22

Source: interactive investor using Morningstar data. Past performance is not a guide to future performance.

With Liontrust and Safestore appearing in both portfolios, there are just three companies left to review, two of which delivered market-beating gains.

Hill & Smith Holdings (LSE:HILS), the manufacturer of motorway crash barriers and other roadside infrastructure, added 4.4% in March, reducing the winter deficit to 19.7%. A recovery from the stock market low on 7 March continued after the company published its annual results a few days later in which it reported a big increase in profit and operating margin.

Synthomer (LSE:SYNT), supplier of chemicals used to make paint and latex gloves, had a better month, up 6.6% in March, perhaps to celebrate completion of the $1 billion acquisition of Eastman’s adhesive resins business. It had also flagged a big increase in annual profit, although demand for nitrile latex for medical gloves remains “subdued” because of high inventory levels and reduced demand as the pandemic eases. The shares are still down over 39% this winter.

It's been pretty bleak at precision instrumentation expert Spectris (LSE:SXS) too. Its share price fell 7.4% last month and is now down 39% over the past five months despite calling off its £1.8 billion takeover bid for Oxford Instruments because of the war in Ukraine.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.