Is this year’s gold rush history?

The precious metal’s been caught in a ‘speculative frenzy’, with performance-chasers flocking to the commodity, argues one Kepler analyst, who shares his thoughts on the outlook for gold.

31st October 2025 14:06

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

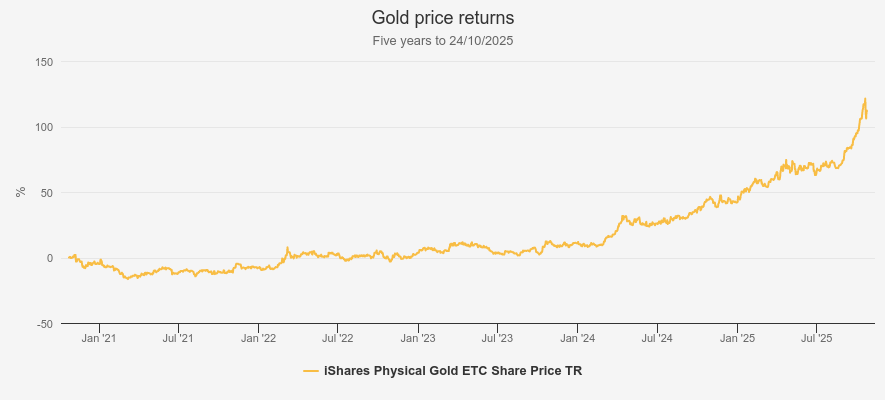

A dramatic fall in gold last week, with the metal down almost 6% in one day, raises the question whether it’s time to take profits.

Even after the recent fall, gold is up over 50% year to date, rocketing from around $2,600 an ounce at the start of January to c. $4,100 at the time of writing. Can this move really be justified by the fundamentals?

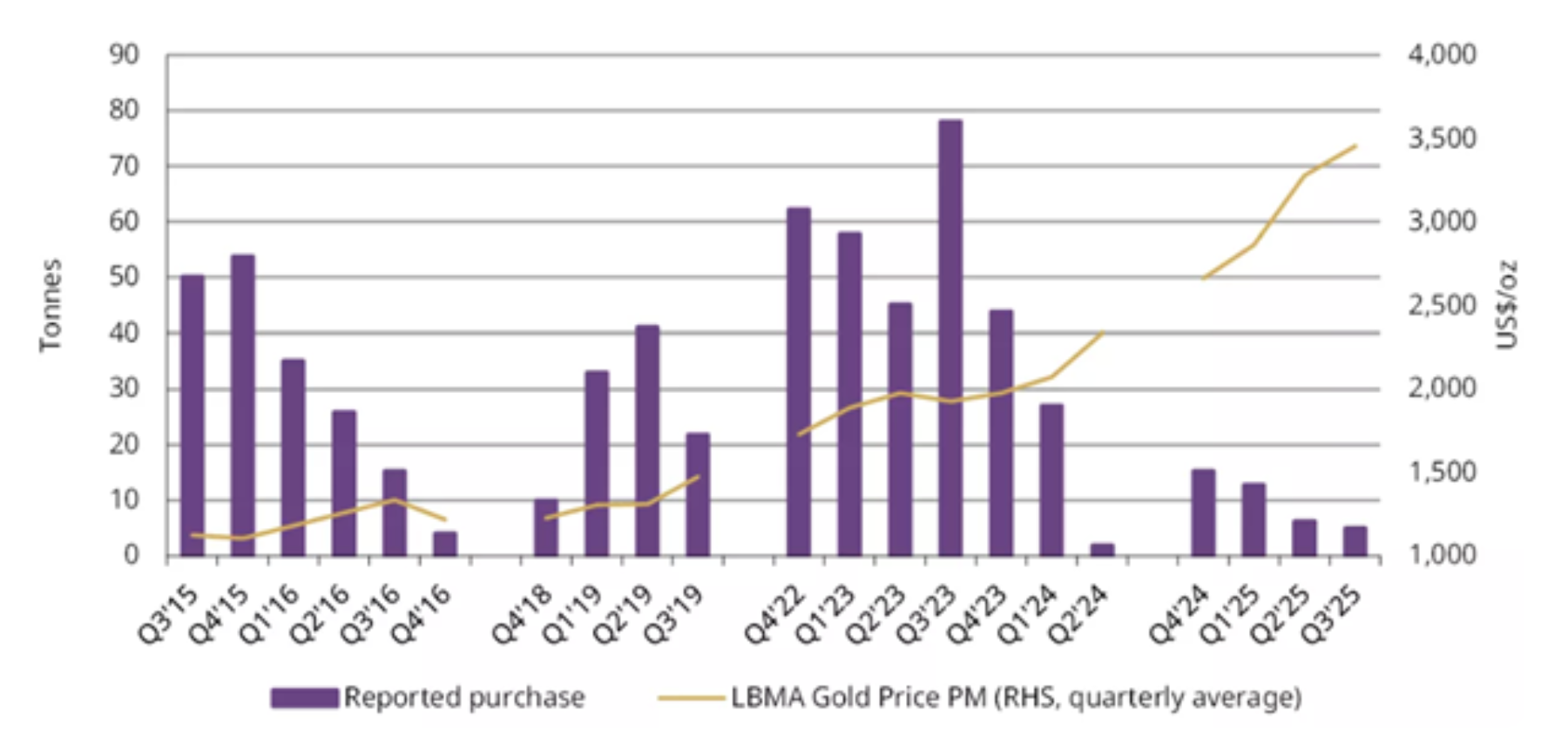

Gold has been in a clear uptrend since late 2022. One of the main supports for this has been buying by central banks, in particular China. Sanctions on Russian assets raised fears that US dollar assets, like Treasuries held by other countries, might come under threat in future, a particularly acute concern for China given the poor trading relations with the US that continue to this day and the ongoing stand-off over Taiwan.

PRICE OF GOLD IN USD/OZ

Source: Morningstar. Past performance is not a reliable indicator of future results

Gold’s move has accelerated over this period, with returns of 13.5% in 2023 and 27.2% in 2024, before the even more dramatic climb this year. Official gold purchases by the Chinese central bank have slowed over 2025, according to figures compiled by the World Gold Council, as the price has gone almost parabolic. This might suggest that China is wary of the recent run up, and is waiting to continue accumulating at better prices.

OFFICIAL CHINA CENTRAL BANK PURCHASES

Source: World Gold Council. Past performance is not a reliable indicator of future results

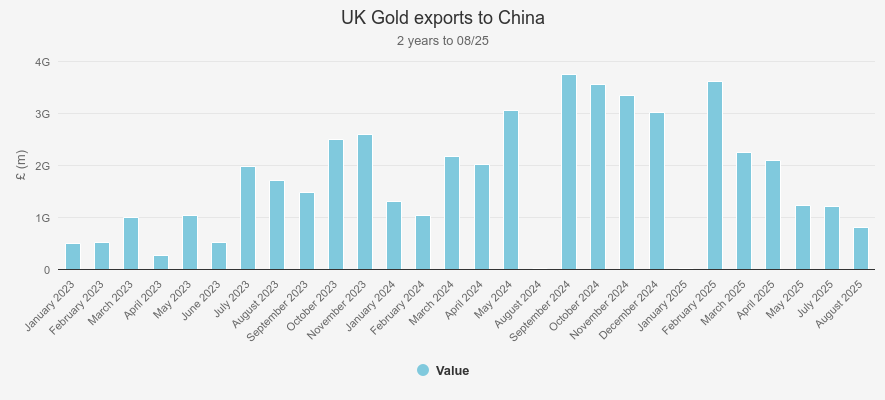

We have to be cautious about placing too much weight on this data, as analysts suspect that the officially reported purchases and holdings are a fraction of the true numbers. One data point considered to reflect below-the-radar central bank buying is UK gold exports to China. This has also slowed into the teeth of the recent rally, and indeed shows a rather similar pattern to the official purchases in the chart above.

UK GOLD EXPORTS TO CHINA

Source: HMRC

Meanwhile, shares outstanding in gold ETFs, which should reflect demand from Western investors, have soared. According to Bloomberg there has been 63% growth in the Goldman Sachs Physical Gold ETF Shares Outstanding Index this year, meaning a 63% rise in the number of shares outstanding, reflecting massive net inflows. In fact, the World Gold Council reports September’s inflows into ETFs were the highest ever. I suggest therefore that 2025’s rally in gold has been driven by Western investors and their concerns, and central bank buying has been less significant than it was last year.

There are a number of reasons Western investors might have been allocating heavily to gold, one of which is simply how well known the central bank buying argument has become. Investors may have been chasing momentum and looking to take advantage of this trend. This sort of source of demand is clearly going to be very sensitive to a sell-off and liable to reverse quickly.

Another reason is widespread concern about the fiscal health of key developed world economies. The UK’s problems will be well known by readers, while France is also struggling under high debt levels, low growth and political inability to reduce deficits. And the US, while it can boast a much better growth outlook, is also running huge deficits as a percentage of GDP and adding to a debt pile that is being shunned by one of its key investors, China, in favour of gold.

We can only speculate about the relative importance of these factors. However, I would argue that the sharp sell-off last week is itself one indication that pure momentum-seeking, trend-chasing speculation has played a role in 2025’s dramatic run up. If this is so, then it seems unlikely a rally of such violence will get going again after such a sharp correction. But this doesn’t necessarily mean that gold is vulnerable at its current price range.

While structural factors might be taking a back seat, they continue to be supportive. Tensions between the US and China remain high, and while the current dispute over tariffs may be resolved, which could lead to some downward pressure on gold in the short term, I think the strategic confrontation will remain, whoever is in the White House. Meanwhile, the loss of confidence in dollar assets post-Ukraine sanctions isn’t something that will reverse. And shifting reserves from dollars into gold is an offensive move as much as a defensive move, presenting a challenge to the US’s continued appetite for borrowing, and has to be appealing to China for this reason. As such, I would expect Chinese central bank buying to continue, with other emerging market central banks following suit.

Additionally, the fiscal pressures referred to above aren’t going to be relieved anytime soon. Both British and French analysts have raised the possibility of IMF bailouts due to the countries’ dreadful outlook. Meanwhile, the US could be more vulnerable than it first seems. It has been AI spend that has kept its economy motoring and its stock market rising, and should this tail off then US growth would fall and attention could quickly turn to its absurd deficit of 6% of GDP. Gold would be an obvious hedge for private or professional investors against currency debasement as a way out of debt traps, and the chaos that could be seen if a major Western country looks like it might default.

Conclusion: why do you own gold?

A lot of professional investors like to own gold as a hedge against tail risks. The concept of a hedge implies the asset won’t usually perform very well, but will provide returns or safety when equities and/or bonds fall. Recently, however, gold has been caught up in what looks like a speculative frenzy, potentially attracting the same investors who have been chasing performance in NVIDIA Corp (NASDAQ:NVDA) or other tech names. I’m not getting sniffy here, the name of the game is making money. However, if this is right, then it might be due a pause and consolidation, and if enough ETF flows are from short-term performance chasers, we could see further falls.

But there are two reasons I think it still pays to have exposure to gold. The first is its quality as a hedge. In times of geopolitical risk and when the viability of government finances are being called into question, I think it makes sense to have exposure to gold. Investors are likely to turn to it in a crisis, even more so when debt sustainability is one of the potential sources of that crisis and when US Treasuries are considered less palatable than they once were by many investors round the world.

The second reason is that precisely these geopolitical dynamics mean a secular bull market may continue for many years to come, with ups and downs on the way. If we are seeing a decoupling of the US’s rivals from the dollar system, there is a lot of gold or alternatives that needs to be accumulated to whittle away at the relative size of US dollar assets on overseas balance sheets. This would be a multi-year trend, and while central banks may be less price-sensitive than some buyers, they can also easily step aside when the market gets frothy only to step back in when prices fall, which may be what we have seen over 2025.

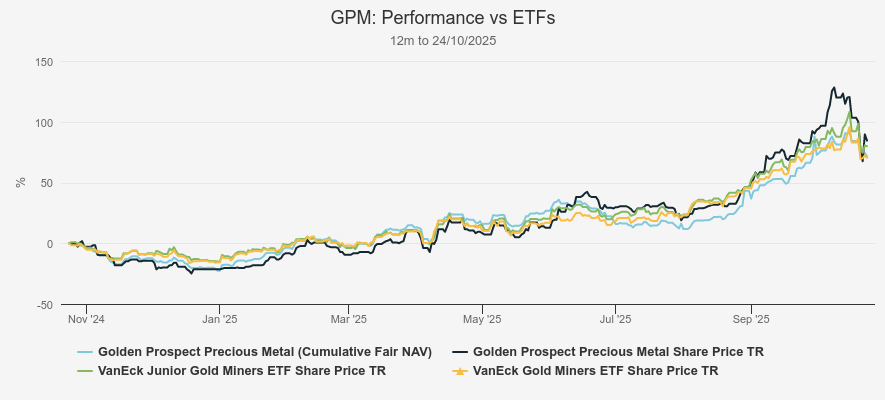

A physically backed ETF therefore still looks like an attractive asset to own in a diversified portfolio, in my view. Additionally, investors might like to consider owning the miners, instead of or alongside the metal. Gold miners have outperformed gold this year, finally catching up from depressed valuations.

However, Keith Watson, manager of Golden Prospect Precious Metal Ord (LSE:GPM) points out that the ETFs have actually seen outflows over the year, in sharp contrast to the physical gold ETFs. Miners continue to attract very little attention despite their exceptional performance and the fact valuations remain reasonable, if not cheap. Keith estimates the industry is trading at around 1× the net present value of its assets, assuming a constant gold price out into the future, which is low by historic standards.

Miners could be a cheaper way to keep exposure to gold, although given the equity beta and other factors influencing performance, they will likely have a different performance profile and may not be as pure a hedge. Gold and gold equities remain attractive, in my view, even if they may not see the same strong performance of the first nine months of 2025 in the next nine months.

PERFORMANCE OF GPM AND INDICES OVER 12m

Source: Morningstar. Past performance is not a reliable indicator of future results

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.