Yields of 6%-plus: The attraction of renewable energy trusts

We look at the popular infrastructure sector, and review the latest additions to two burgeoning fields.

21st June 2019 12:40

by Fiona Hamilton from interactive investor

We look at the popular infrastructure sector, and review the latest additions to two burgeoning fields.

Fans of infrastructure funds, attracted by their steadily rising yields and low NAV volatility, have an increasingly diverse choice thanks to the launch of six new investment trusts over the past two years.

Most of the launches have been based either on energy storage systems involving batteries, or on renewable energy generation in countries other than the UK. Funds specialising in the former aim to help system operators maintain stable grid frequency and manage local peak demand as the share of inherently volatile renewables in the energy mix within the UK and Europe steadily increases. The non-UK renewable energy trusts offer renewable energy enthusiasts the chance to diversify their portfolios with exposure to different climates,technologies and political regimes – with Labour's latest threat to nationalise the UK's energy providers flagging up the risks of remaining too UK-focused.

Energy storage

Launched in May 2018 and November 2018 respectively, Gore Street Energy Storage Fund and Gresham House Energy Storage Fund both invest primarily in UK-based utility-scale energy storage projects, though Gore Street's pipeline also encompasses projects in Belgium, Germany and Ireland.

Gore Street Energy Storage (LSE:GSF) is targeting an ambitious internal rate of return (IRR) of 10-12% a year, and a dividend of 4p in 2019, rising to 7p in 2020 and paid quarterly. It hopes for an element of capital growth through the reinvestment of net cash generated in excess of the target dividend, and says its initial investments are generating strong positive cash flows. However, it is taking time to deploy the rather meagre £30.6 million it raised at launch. Unusually for the renewables sector, it has a performance fee as well as a 1% base fee.

Gresham House Energy Storage (LSE:GRID) aims for a net asset value total return of 8% plus when fully invested, with leverage potentially raising that to 15%, and a dividend of at least 4.5p this year rising to 7p in 2020, paid quarterly. The fund had gross assets of £100 million at launch, 60% of which was already invested in a seed portfolio of operational storage systems; some of these deploy generators as well as batteries and are expected to be net exporters of power. With a strong pipeline of projects, a number of which are expected to be commissioned later this year, the fund has been looking to raise more funds and to introduce some gearing to enhance returns.

No subsidies required

GRID's manager states that its return is not correlated to the absolute level of wholesale power prices and is not dependent on any subsidies. It also says that despite the removal of subsidies to onshore wind and solar in the UK, the development of offshore wind (which is still subsidised) is set to take renewable energy generation to over 50% of UK capacity within two years, thereby "generating an even more volatile supply of electricity and power prices, which underpins the opportunity for energy storage schemes".

These are early days for the energy storage sector, and the managers of these two funds must not only navigate developments in battery technology but also juggle the attractions of a variety of revenue-generating options, one of which has already been disrupted by a 'standstill' order from the European Court of Justice. So despite the potentially large market for energy storage, cautious investors may want to let the funds bed down before dipping a toe into the water.

The non-UK renewable energy trusts deploy much better-established technologies. Launched in July 2017, Greencoat Renewables (LSE:GRP) was the first explicitly non-UK renewable fund to make its debut. It is Aim-quoted and euro-denominated, and like its well-established and highly rated sister fund, Greencoat UK Wind (LSE:UKW), it invests exclusively in operating wind farms with good track records.

To date it has restricted itself to onshore wind farms in Ireland, where they benefit from a 15-year inflation-linked floor price under the Refit (Regulatory Fitness and Performance) regime, plus the ability to capture prices above the floor. The downside of GRP's purely Irish exposure is that it is heavily dependent on a much smaller geographic area than UKW, and suffered even more from unexpectedly low wind speeds in 2018. Investors might therefore be relieved if the directors start to capitalise on their option to invest up to 40% of assets in operational wind energy or solar assets in northern Europe.

GRP targets of 7-8% a year and a progressive fully covered dividend. Like UKW, it recently enhanced its NAV by extending the assumed life of its wind farms from 25 to 30 years, a move which several other funds have broadly followed.

US Solar Fund (LSE:USF) raised $200 million at its April 2019 launch, and its shares are dollar denominated. It targets a total return of 7-8%, and an annual dividend of 5.5% growing by 1.5 to 2% each year when it is fully invested and geared. Managed by New Energy Solar Manager, an experienced solar investor which is a division of Australian company Evans Dixon, it started life with a pipeline of more than 60 solar power projects located across 13 US states; but up to 15% of gross assets can be invested in solar power projects in other OECD countries in the Americas.

USF's solar power assets are expected to have power purchase agreements (PPAs), capacity contracts or similar revenue contracts of at least 10 years' duration with predominantly investment grade private or public sector bodies (known as offtakers); if assets generate electricity in addition to the volume required under a PPA, this can be sold into the wholesale market or to another offtaker.

More diversified

Aquila European Renewables Income Fund (LSE:AERI), which has been looking to raise €300 million (£260 million), is arguably the most interesting of the non-UK renewable trusts because it expects to be much more diversified in several respects. It hopes to be fully invested within 12 months of IPO, with a portfolio mix of around 40% each in onshore wind and solar, plus 20% in hydro.

Its assets are expected to be located across western and northern Europe in the areas best suited to the technology concerned. Thus, hydro will be mostly in Norway, with a lot of solar in Spain and southern France. And initially around half its revenues are expected to be based on government subsidies, with the other half from PPAs.

The trust's target NAV total returns are only 6-7.5%. Also , on the downside up to 30% can be invested in assets under development/ construction, which adds to the upside potential but creates some uncertainty.

The trust is managed by Aquila Capital, a German company with €4 billion under management in renewables across Europe; and fundraising, reporting and investor distributions will all be euro-denominated.

The trust could diversify into activities such as stored energy over time, but is expected to consider stored hydro before batteries. It is also avoiding offshore wind, as projects in that sector are usually so large that the manager would need to take minority stakes and it prefers to be a majority owner.

Dividends will be paid quarterly and the target is 1.5% for the second half of 2019, at least 4% in 2020 and 5% in 2021, growing progressively thereafter. The average life of the Aquila trust's assets is expected to be around 30 years, with wind limited to around 25 years as that is as long as Aquila believe it is sensible to make assumptions, but longer for solar and much longer for hydro.

The sixth newcomer is SDCL Energy Efficiency Income Trust (SEIT), which invests in projects delivering "lower cost, cleaner and more reliable energy solutions" to users ranging from hospitals and car parks to data centres and poultry farms.

Launched in December 2018, its initial portfolio includes LED lighting projects, biomass boilers and combined cooling, heating and power projects, and is mostly UK-based; but it is expected to become more international over time. SEIT is targeting a total return of 7-8% per annum, pus a growing dividend, and its ambitions look closely attuned to the zeitgeist.

What about the older alternatives?

The six older renewable energy infrastructure funds initially invested almost entirely in operational UK onshore wind and/ or solar generation projects. These projects are liable to expire worthless after 25 to 30 years, so the funds offer relatively little in terms of sustainable NAV growth, and have to keep raising new money in order to extend their lives.

However, they have been hugely popular with investors thanks to their relatively high dividends, which have grown slowly but steadily since launch.

Historically the revenue financing these dividends was substantially supported by UK government-backed index-linked subsidies, which investors found reassuring.

But new UK onshore wind and solar projects no longer attract subsidies, and there is stiff competition for any subsidised projects on offer in the secondary market.

As a result the funds are being forced to diversify into UK projects other than onshore wind and solar, or those deriving most of their income from power purchase agreements and therefore vulnerable to changes in UK power prices; or to invest overseas, where some new onshore wind and solar generation is still subsidised but there is a foreign exchange risk.

Despite this shift in risk profile, the six older funds have all recently been trading on substantial premiums. Most seem likely to want to reduce their borrowings before long, by raising new funds at a lower premium. So most brokers suggest new investors wait for such opportunities to buy.

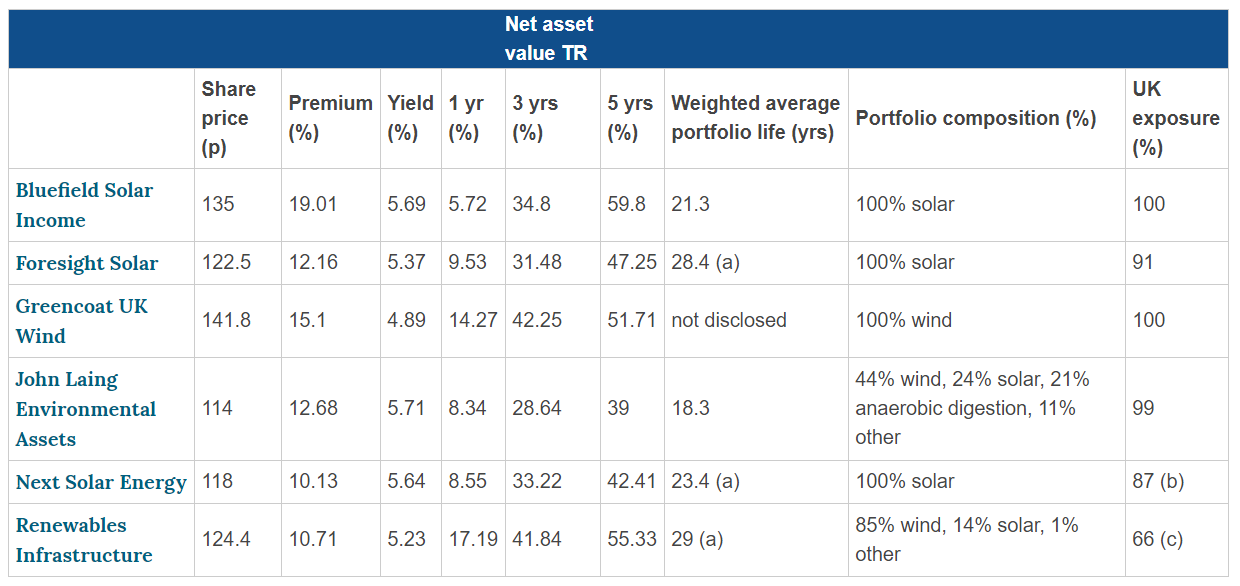

How are longer-established renewables trusts faring?

Notes: Columns 2 to 6 derived from data to 30/4/2019 supplied by the AIC. Other columns derived from data supplied by Canaccord Genuity. a) Recently extended by incorporating longer life assumptions into their valuations b) 13% Italy c) 21% Sweden 9% France, 4% Australia.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.