Do you know how much your pension provider is charging you?

Find out how we compare to other pension providers whose charges can eat away at your retirement pot.

Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

Why pension charges matter

Did you know that pension providers take money straight out of your pension to pay their charges?

These charges can vary a lot depending upon your provider and the size of your pension, charges often increase as the value of your pension grows.

Some older pensions can have higher and more complex charges than the pension products available today.

It’s very important to check how much you pay in charges for your current and older pensions, over time charges can have a large impact on your pension pot and could even mean a re-think of when you retire and how you live in retirement.

It is important to understand that depending upon the value of your pension and the number of fund buys / sells or switches the ii SIPP could be more expensive for you.

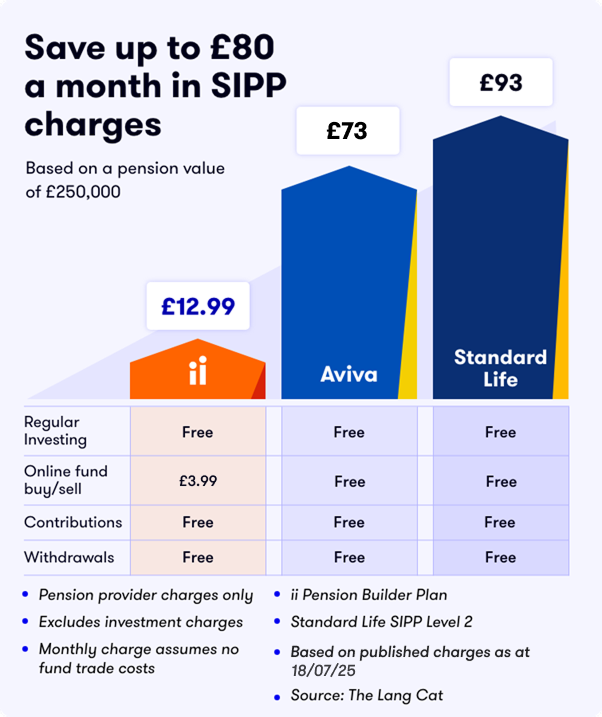

See how we compare to some of the largest pension providers

Already an ii customer on our Investor plan? See how your charges compare >

Thousands are already benefitting from the ii SIPP

Thousands of people, building their pension or already taking an income, have already moved billions of pounds from large traditional pension providers to the ii SIPP and are now benefitting from our low flat fee pension charge.

Transferring your pensions to ii also means you can:

- Access and manage a single pension online

- Access a range of investments chosen by our experts

- Pay no additional fees when you start to withdraw an income

Can't see your pension provider?

Many traditional pension providers, that were once household names, no longer exist and moved their pensions to larger providers who continue to operate them today.

Check on our Provider checklist to see who your current provider could be:

Pension charges comparison

It’s not always easy to compare pension charges from different providers. To ensure we made a meaningful comparison we took two of the largest pension providers in the UK and compared their monthly charges to ii.

| Pension pot value | ii SIPP | Aviva SIPP | Standard Life SIPP |

|---|---|---|---|

| £50,000 | £5.99 | £14.58 | £25 |

| £100,000 | £14.99 | £29.17 | £45 |

| £250,000 | £14.99 | £72.92 | £93 |

| £500,000 | £14.99 | £145.83 | £166 |

| Regular investing | Free | Free | Free |

| Online fund Buy/Sell | From £2.99 per trade | Free | Free |

| Contributions | Free | Free | Free |

| Withdrawals | Free | Free | Free |

We were careful to compare products that are all SIPPs and products that even made available some of the same investment funds, with the same fund investment charge. It was also important we highlighted to buy or sell a fund with AVIVA & Standard Life there is no charge and with ii there is a charge when the free regular investing service is not being used. Read more about our analysis.

How to check your pension charges?

Finding out exactly what you're paying in charges is not always easy, especially for some older pensions, that's why we've put together a simple guide designed to help:

Read the guide: How to check your pension charges

We promote transfers to the ii SIPP on a regular basis. It is important that you take enough time to decide whether transferring your pensions is right for you. If you need more time and wish to qualify for an offer, please wait until the next offer period.

Things to consider before you transfer

Please check that you won’t lose any safeguarded benefits if you transfer. This could include guaranteed annuity rates or lower protected pension age than the Normal Minimum Pension Age (rising from 55 to 57 in 2028).

Please also check any transfer-out fees your current pension provider may charge.

Please note that if you plan to hold both drawdown and non-drawdown pots in your ii SIPP, you cannot allocate specific investments to each pot separately. This means that the value of each pot will change in line with the overall performance of all the investments held in your SIPP.

Before transferring, we recommend seeking advice from a suitably qualified financial advisor or free, impartial pension guidance from MoneyHelper or (if you are 50 or over) Pension Wise.