10 cheap small-caps the pros may have mispriced

Ben Hobson reveals a strategy targeting small, high quality firms that are under-researched.

25th November 2020 14:32

by Ben Hobson from Stockopedia

Stockopedia’s Ben Hobson reveals a strategy targeting small, high quality firms that are under-researched.

Analyst research can play an important role in helping investors understand the mechanics of how businesses work and guide them on which stocks to own - but it has flaws. One problem is that larger companies often get more research coverage than lesser-known firms. This imbalance can mean that some stocks simply aren’t as well-known as they should be - but this can actually create investment opportunities.

In the UK, company size is very influential in deciding how much research a firm gets. Sell-side analysts – which provide research for clients - tend to prefer doing large-cap company research because it offers a better prospect of lucrative brokerage and corporate deal-making fees. So it makes sense for them to cover those companies.

As a result, smaller firms generally have far fewer analysts covering them. Some don’t have any at all, while others only have their house broker to rely on. With scant research and few, if any, earnings forecasts, investors face a much more difficult task understanding them.

Yet this lack of research is actually a key reason why investors - including institutional fund managers - make the case for investing in this part of the market. They claim the price inefficiencies caused by fewer investors knowing the value of smaller stocks is a major reason for spending time doing your homework on them.

In his book One Up on Wall Street, the legendary American investor Peter Lynch, wrote:

“If you find a stock with little or no institutional ownership, you’ve found a potential winner. Find a company that no analyst has ever visited, or that no analyst would admit to knowing about, and you’ve got a double winner. When I talk to a company that tells me the last analyst showed up three years ago, I can hardly contain my enthusiasm.”

Lynch’s point was that out-of-favour stocks that are overlooked by the City can be a source of great returns for investors prepared to get to grips with them.

The ‘neglected firms’ effect

Academic research into the ‘neglected firm effect’ has found evidence that this kind of inaccurate pricing can be profitable for investors prepared to do the research themselves. Some argue that the anomaly is really about these companies being ‘small’ rather than being particularly neglected. But either way, the evidence points to pricing errors turning up in smaller and less well researched stocks.

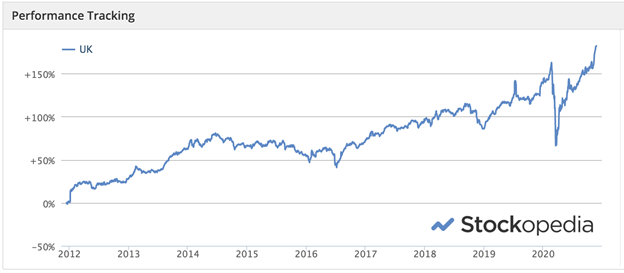

At Stockopedia, we track a Neglected Firms strategy, which has produced an impressive 25.1% return over the past year, despite market volatility. It’s been particularly strong recently, with a 14.5% return over the past three months. This suggests that smaller, less-understood shares might be benefitting from investors taking much more care about what they are putting their money into. In a stock-pickers market, under-researched firms seem to be flourishing.

Past performance is not a guide to future performance.

The strategy itself is a “quality-plus-value” approach that focuses on companies with two brokers or fewer. It looks for below average valuations using price-to-earnings and price-to-book. And it also looks for above average earnings growth, net margins and return on equity. The idea is to target small, higher quality firms that the market has mispriced. Here’s a list of some of the shares that currently pass those rules:

| Name | Mkt Cap £m | # Brokers | EPS Gwth % | PE Ratio | ROE % 5y Avg | Industry Grp |

|---|---|---|---|---|---|---|

| Hargreaves Services (LSE:HSP) | 76.5 | 2 | 708 | 17.2 | -0.93 | Coal |

| Venture Life (LSE:VLG) | 77.3 | 2 | 511.5 | 27.1 | -4.09 | Pharmaceuticals |

| PureTech Health (LSE:PRTC) | 817.2 | 1 | 507.1 | 5.84 | 5.8 | Biotechnology |

| Sylvania Platinum (LSE:SLP) | 204.4 | 1 | 167.5 | 6.01 | 12.7 | Metals & Mining |

| RA International (LSE:RAI) | 75.5 | - | 157.9 | 6.34 | 35.7 | Professional Services |

| Brickability (LSE:BRCK) | 127.3 | 1 | 49.6 | 13.3 | 12.9 | Construction Materials |

| Solid State (LSE:SOLI) | 51.7 | 1 | 26.3 | 15.6 | 14.7 | Machinery, Equipment |

| Anglo Asian Mining (LSE:AAZ) | 138.4 | 2 | 18.8 | 8.69 | 7.08 | Metals & Mining |

| Cambria Automobiles (LSE:CAMB) | 56.5 | 1 | 6.15 | 5.45 | 18.7 | Specialty Retailers |

| Inland Homes (LSE:INL) | 149.5 | 1 | - | 11.4 | 21.5 | Real Estate |

As is always the case with smaller companies - particularly those with patchy research coverage - care is needed. This is very much a strategy for finding ideas in potentially good quality but mispriced shares, which is exactly the type of territory that analysts are likely to overlook. Here you find names ranging from miners like Sylvania Platinum (LSE:SLP) and Anglo Asian (LSE:AAZ), to pharma firms like Venture Life (LSE:VLG) and PureTech Health (LSE:PRTC), along with a diverse set of small-caps like Hargreaves Services (LSE:HSP), RA International (LSE:RAI) and Brickability (LSE:BRCK).

An advantage over the analysts

Small cap fund managers have long stressed that the lack of analyst research in parts of the market gives them an edge in hunting for ideas that others have missed. The information vacuum around smaller companies can be an advantage for brave investors. Investing in firms this small is risky, and this type of screening tactic is just a starting point. Without analyst research, it needs strong confidence that the companies really are misunderstood by the rest of the market. Yet the evidence suggests that patchy research can cause pricing errors that can be very profitable for those investors prepared to take a closer look.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.