10 Dividend Dogs with the highest forecast yields

Stockopedia’s Ben Hobson examines some companies that have cut dividends but may be on the up.

7th July 2021 16:59

by Ben Hobson from Stockopedia

Stockopedia’s Ben Hobson examines some companies that have cut dividends but may be on the up.

UK dividends have been in turmoil over the past 18 months, causing problems for investors who value the regular income streams that can be had from the market’s highest yielding stocks.

Indeed, payouts from UK shares fell by 26.7% to £12.7 billion in the first three months of the year alone.

While a huge swathe of expected dividend payments was cut during the Covid crisis, the latest figures suggest that the declines are slowing.

But what seems likely from here is that investors will need to pay closer attention than ever before to the dividend outlook for individual shares.

While some previously high yielding stocks have recovered well, others have struggled. Given that dividends are heavily dependent on solid earnings, confident management and a robust outlook, it’s important to tread carefully - there are likely to be dividend traps out there.

For investors in high-yield stocks, forecasts can play a useful role in all this. While company analysts aren’t always right, they are usually given a good steer by management - and are often well placed to predict earnings.

Their estimates can be a useful way of deciphering which firms are rebounding from economic uncertainty - and which dividend yields can be relied on.

One of the classic strategies for targeting these kinds of companies is known as Dogs of the Dow. It’s a strategy based on the work of Michael O’Higgins and John Downes in their book, Beating the Dow.

- Stockwatch: what to do with Morrisons shares after US bid approach

- Read more Stockopedia articles here

- Check out our award-winning stocks and shares ISA

The aim of the approach is to buy the 10 highest yielding stocks in a large-cap index such as the Dow Jones or the FTSE 100 - and you can use current yields or forecast yields. Part of the appeal of this method is that it really is a very straightforward set of rules.

In theory, the highest yielding stocks are usually out of favour for some reason, and their depressed share prices push the yields up further (hence why these are ‘Dogs’).

But the trade-off is that their size and financial muscle ought to mean they’ll recover and come back into favour over time.

Critics of the strategy point to the fact that, beyond the financial strength of large-caps, there aren’t many safety nets in the Dividend Dogs approach.

After all, blue chips aren’t immune from cutting dividends, and this approach does demand you consider companies that often have negative price momentum.

But the advantage of looking at the market with the ‘Forecast Dividend Dogs’ lens is that you can quickly get an idea about which companies have the highest expected yields - and that gives you somewhere to start in the search for solid payouts.

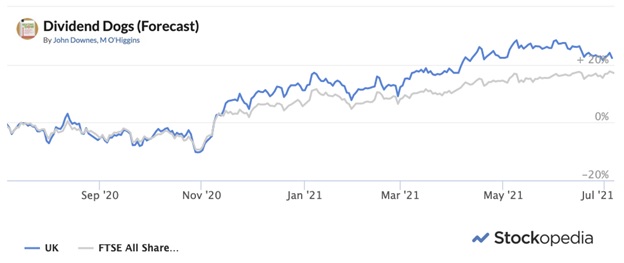

Source: Stockopedia Past performance is not a guide to future performance.

Tracking by Stockopedia of a model of this strategy has seen it generate a 25.2% return over the past year - before dividends. Here are the top 10 stocks in the FTSE 100 with the highest forecast yields for the year ahead.

Name | Mkt Cap £m | P/E Ratio | Forecast Yield % | Forecast Dividend Cover | Sector |

8,557 | 11.2 | 11.8 | 1.3 | Basic Materials | |

95,278 | 11.6 | 10.5 | 1.4 | Basic Materials | |

107,888 | 17.1 | 9.2 | 1.4 | Basic Materials | |

14,721 | 5.6 | 9.1 | 1.7 | Consumer Defensives | |

5,977 | 4.1 | 8.1 | 1.3 | Financials | |

64,318 | 8.6 | 8.0 | 1.5 | Consumer Defensives | |

9,678 | 13.8 | 7.9 | 1.1 | Consumer Cyclicals | |

7,518 | 9.7 | 7.6 | 1.5 | Basic Materials | |

15,611 | 13.1 | 7.2 | 1.7 | Financials | |

6,818 | 10.3 | 7.1 | 1.7 | Financials |

This simple screen looks for the highest forecast yields - with the median standing at 8.05%. Mining companies such as Evraz, Rio Tinto and BHP and Polymetal lead the list, but other sectors such as financials, consumer defensives, and even consumer cyclicals (with the house builder Persimmon) are represented.

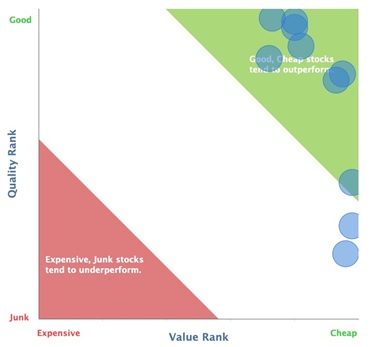

Analysis by Stockopedia of the exposure of these stocks to factors such as “value” and “quality” shows that several do classify as “good and cheap” shares.

- Discover how to be a better investor

- Subscribe to the ii YouTube channel and catch all our latest interviews and video content

A focus on forecasts

Overall, the outlook for dividends this year remains uncertain as the economy continues to recover from the disruption of Covid. It’s very likely that income investors will be keenly watching where dividends are being reinstated and where the strongest forecast yields can be found.

A focus on forecasts could help in that search and be a pointer to those companies where earnings are expected to support dividend payouts from here.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.