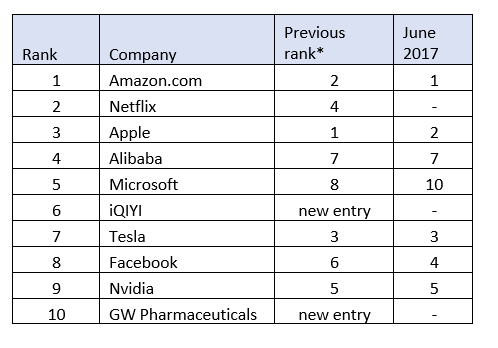

10 most-bought US stocks in June 2018

17th July 2018 11:56

by Lee Wild from interactive investor

America's Nasdaq index has been making record highs for fun over the past few years, and blips have been quickly overcome. Lee Wild reveals the hottest US stocks in June.

US earnings season is well underway and buying activity on the interactive investor trading platform suggests position-taking in the hot tech stocks ahead of quarterly results.

Amazon.com regained top spot in last month's most popular, ahead of second-quarter results on 26 July. And investors have been right to chase shares in the online retailer higher.

A rise of 4%-plus in June has been extended into July, with the stock now up almost 90% since last October. It's easily outperformed the Nasdaq Composite index – by 7% over the past three months, and more than 50% since this time last year.

Movie and TV streaming business Netflix has had a phenomenal time, even better than Amazon, and buyers late to the party will still have made handsome profits. Up from fourth place in our most-bought rankings in May to second place last month, Netflix shares jumped more than 10% in June and have still doubled since October, even after last night's sell-off in reaction to disappointing results.

These stats put former investor favourite Apple in the shade. The stock is up over a fifth in the past eight months, but down a couple of dollars in June. There were certainly fewer buyers in our list last month, hence its slip to third place in the popularity stakes.

As a volatility play, electric car giant Tesla fits the bill. It's tripled in value over the past five years, but direction these past 12 months has been less consistent. They're little changed versus this time last year but have been down as much as 20% and up by the same amount.

Their popularity among investors waned last month, too, slipping from third to seventh in our most-bought list.

Tesla's Model 3 has just been made available to all car buyers in North America, and it's this vehicle that will determine the company's financial success, at least in the near-term. There's a long reservation list, but founder Elon Musk is rarely far from controversy and Tesla faces stiff competition from rival carmakers.

*May 2018

Source: interactive investor. Shows most bought US stocks by interactive investor's customers in June 2018.

There were two new entries in June's Top 10.

First, iQIYI, the company dubbed 'China's Netflix' made it sixth spot three months after its IPO on Nasdaq. The streaming video provider flopped on its debut in March, when it raised $2.3 billion, but things are looking up, and they're now worth almost double the $18 float price.

The stock remains highly volatile amid escalating tensions as Donald Trump and the Chinese take turns in ramping up the trade war rhetoric. Indeed, iQiyi shares were up as much as 75% for the month mid-June at over $46, but have come back since.

Finally, and a name that will be familiar to many UK investors, is GW Pharmaceuticals, the developer of cannabinoid-based medicines.

The former AIM company is now exclusively traded on Nasdaq where its shares have thrived since making the move in 2016. They are off a bit in recent weeks, but remain within striking distance of this year's record high.

Cannabis stocks have been all the rage recently following legalisation both in some US states and in Canada. GW produces the drug for medical purposes, and already sells Sativex, a treatment for multiple sclerosis-related spasticity.

There's currently excitement around Epidiolex, the first plant-based cannabinoid drug to win approval from US regulators. Optimists believe it could generate annual sales of as much as $1 billion. In the six months to 31 March 2018, GW made sales of just $11.4 million and lost $154 million.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.