11 small-cap winners for 2016

8th January 2016 13:59

by Harriet Mann from interactive investor

With the experiencing its worst start to the year since 2000, it's fair to say the mood among investors is pretty glum. Slowing global growth, battered commodity markets and tensions in the Middle East will certainly make it hard for equities to outperform in 2016, although opportunities can be found among smaller companies.

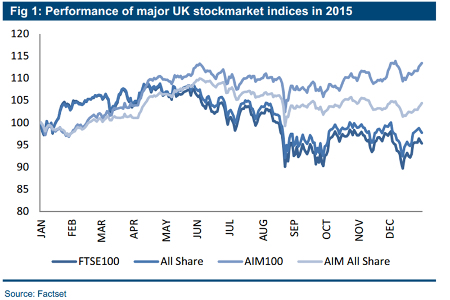

It's not unusual to begin the year with concerns: last year it was economic growth, especially in China, and the prospect of rising interest rates. Equities struggled against this backdrop and the FTSE 100 slid 5% over the year.

But with growth of 13% on the AIM 100 index, smaller companies outperformed their larger counterparts. Even the index, which is jam-packed with resources companies, rose 4% compared to the main market 2% fall.

(Click to enlarge)

Construction and Materials led the AIM pack with growth of 41% in 2015, according to broker finnCap, followed by Food & Beverage up 39% and Healthcare 23%. Unsurprisingly, Oil & Gas plummeted 45%, tailed by Telecoms and Mining, down 34% and 31% respectively.

was the star of 2015, up 690%,and finnCap's head of research Raymond Greaves believes smaller companies are in for another year of outperformance.

"I think the small companies space is a good place to be again because small companies aren't necessarily driven by the macro-economics around them. They can thrive even in difficult underlying economic environments," he explains.

But, as ever, it's all down to stock-picking. Greaves and his team of analysts have pulled together 11 of the companies they think will deliver strong returns in 2016.

Constellation Healthcare

provides medical billing services in the US, which is a defensive $37 billion (£25 billion) market and growing at 7%. Complementing this momentum, the group's buy-and-build model works well in such a fragmented market, while its back-office operations are outsourced to India.

"This strategy is bearing fruit - we have upgraded forecasts by 44% since IPO in December 2014 - and we believe strong organic growth and cheap valuation leave scope for strong performance in 2016," says Greaves.

With a target price of 310p, the bullish broker reckons the shares have 84% upside. This target price represents an enterprise value/cash earnings multiple of 9.6 times, which is still a 31% discount to peers.

Hayward Tyler

2016 should be a good year for , which makes and services pumps for the energy sector, as early talks turn into contract wins and its recent Peter Brotherhood acquisition paves the way for a profitable turnaround.

finnCap's David Buxton doesn't see these changes reflected in the share price, and reckons delivery of its strategy will trigger a rerating away from its current discount to the sector. Reflecting 22% upside, the analyst believes the shares are worth 113p.

"The shares trade at a discount to their peers yet do not suffer the same negative issues as many pump/valve makers. We see upside scope to forecasts as well as several potential catalysts for a rerating," he explains.

IS Solutions

Using home-grown analytics and Big Data for business intelligence, acquisition of Celebrus in 2014 should lead to success.

With a strong management team behind it, an exciting pipeline of opportunities in a rapidly growing market and solid financial results expected, analyst Lorne Daniel reckons the shares have 25% upside to his 130p target price.

"The market has yet to fully appreciate the change in the market focus, and the business model since the acquisition. We forecast an impressive 6.3p final dividend-adjusted earnings per share (EPS) in Y/E March 2016," he explains.

LiDCO

makes the devices hospitals use to monitor patients in surgery. A tricky 2015 has left the shares undervalued, but finnCap reckons this is about to change.

Product approval in China, return to growth in the UK and its new royalty stream are the potential catalysts offering the group 73% upside with a target price of 13p.

"The shares have underperformed recently and trade on an enterprise value divided by earnings before interest, tax, depreciation and amortisation (EV/EBITDA) of 9.1x and a price/earnings (PE) multiple of 12.1x our FY 2017 forecasts, implying 17.0% and 35.0% discount to the medical device sector," says analyst Michal Cabadaj.

LSL Property Services

Surveying and estate agent also has a sizeable mortgage and lettings business arm and a 2.6% stake in property portal . Clearly, it's got presence in the market.

But the driver for growth isn't going to be increasing transaction volumes, it's going to be higher branch margins as a result of self-help measures.

"The sum-of-the-parts of all of the individual revenue streams when benchmarked against peers suggest the shares are materially undervalued," explains Duncan Hall. The analyst has slapped a 430p target price on the stock, representing 50% upside.

Petra Diamonds

With projects in Tanzania and Botswana and South Africa, it's the redevelopment of three mines in the latter that's most promising for . Even with conservative diamond prices, these mines are expected to increase gross margins by 1,300 basis points.

Of course, this all costs money, and concerns over financing have suffocated the share price. This, according to finnCap, provides a buying opportunity. A target price of 127p represents jaw-dropping 125% upside.

Proactis

Providing spend control software and services contracts, visibility from recurring revenue provides "high-quality earnings at sub-industry multiples", says finnCap.

Acquisitions have complemented organic growth and the group now has over 500 customers, with around 200 being UK local authorities. The group's already proving itself and finnCap reckons the shares are worth a fifth more at 150p.

redT Energy

Everyone loves a transformational period, none more so than . Formerly Camco, the group is now a commercial and utility-scale energy storage business with a properly developed product. The shares could rocket 84% to 14.5p.

"We continue to believe that the commercial/utility-scale energy storage market is set to become the fastest-growing area of the power technology industry, hence we believe that the next few years will be exciting for redT," says Greaves.

ScS

The flooring and furniture retailer is sitting on a number of catalysts that could drive the top-line this year; namely growth in space, leverage from third-party brands, momentum in online sales and its House of Fraser concession.

already has an impressive 8% dividend yield, but a free cash yield of over 13% provides opportunity for further capital return. There's potential upside of 24% to finnCap's fair value estimate of 206p.

Utilitywise

Forecast downgrades and concern over its rising accrued income balance weakened share price in 2015, but finnCap is confident a re-rating is on the cards after a shift back to customer acquisition priority and improving commercial terms for contract extensions.

"The stock has undergone a c30% de-rating during 2015 but is still forecast to deliver growth in adjusted profit before tax (PBT) of 44% in the two years to July 2017," says Mark Paddon.

"A valuation comparison against its direct quoted peer, , reveals a Utilitywise discount of 42% on an EV/EBITDA basis, 36% on a PE basis and a yield premium of 62%."

Instead, he reckons the shares are worth 54% more at 173p.

Wentworth Resources

Focused in East Africa, current 80 million cubic feet per day (mmcfd) gas production should jump to 130mmcfd by the end of 2016.

With limited risks across its assets, finnCap reckons the company will swing into profitability this year, driving a 114% re-rating to 63p.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.