The AIM share that just made investors an 8,500% profit

Read about one of the biggest investment success stories of all time, and over just a few short months.

9th April 2020 15:27

by Graeme Evans from interactive investor

Read about one of the biggest investment success stories of all time, and over just a few short months.

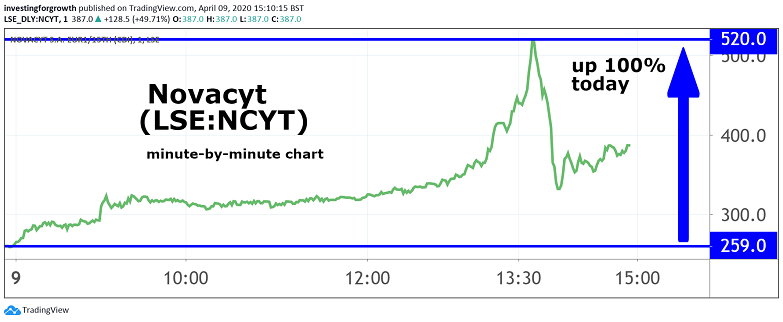

The stock market frenzy over AIM-listed Novacyt (LSE:NCYT) has reached new heights after more evidence that the biotech testing firm is now on the frontline in the fight against Covid-19.

The latest announcements from Novacyt, which include a collaboration with AstraZeneca (LSE:AZN) and GlaxoSmithKline (LSE:GSK) to support Covid-19 testing in the UK, mean the company's shares traded as high as 520p today - a whopping 8,500% higher than where they were in the autumn.

Source: TradingView Past performance is not a guide to future performance

The continued progress will have brought welcome cheer for many interactive investor customers, given that Novacyt has been a regular on our most-bought tables in recent weeks. Its shares had more than doubled today alone.

Only time will tell whether Novacyt is able to justify this investor excitement by turning surging global demand for its testing kits into meaningful earnings. Its annual results for 2019 are due soon, with investors hoping this will contain guidance on 2020 performance.

Source: TradingView Past performance is not a guide to future performance

The last time Novacyt posted results — for the six months to June 30 — revenues of 7.2 million euros (£6.3 million) led to a loss of 1.2 million euros (£1.05 million). Since then, it has sold and received orders for over £17.8 million of its CE-Mark and research-use only coronavirus tests.

This figure is up from more than a week ago, when the largest single order to date was £1.4 million from a new customer in India. It added then that it was selling its test to more than 80 countries, with the Middle East becoming the strongest selling region.

The biggest challenge for the company is keeping up with demand. With new production being lined up, Novacyt hopes it will be in a position to deliver four million tests per month after committing to purchasing additional raw materials for a total of 18 million Covid-19 tests.

- Coronavirus cures: Edmond Jackson says Novacyt is one to watch (4 Feb)

- Lee Wild analyses prospects for Novacyt (7 Feb)

- Like AIM and small-company shares? Check out ii’s Super 60 recommended funds

This week's bounce for shares comes after its test was listed as eligible for World Health Organisation (WHO) procurement under the emergency use process. Novacyt's CEO Graham Mullis said the move gave government agencies further confidence in the test's effectiveness.

He added that his company was also pleased to be working with Glaxo, Astra and the University of Cambridge to support the UK Government's drive to ramp up testing in this country.

As part of the collaboration, Novacyt will provide its Covid-19 test to generate results data at the university's Anne McLaren laboratory. The facility will be used for high throughput screening for Covid-19 testing and to explore the use of alternative chemical reagents for test kits in order to help overcome current supply shortages.

Novacyt’s own Covid-19 polymerase chain reaction test has been developed by its molecular diagnostics division, Primerdesign, based in Southampton.

Primerdesign was founded in 2005 by Dr Rob Powell as a spin-out from Southampton University and funded by a single £30,000 loan. The business became profitable in its first year and required no further investment funding until its sale to Novacyt in May 2016.

- Stocks that made you a fortune last tax year

- Two winning stocks in the race to cure Covid-19

- How this AIM stock returned 3,500% so quickly

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Novacyt, a French cell-based diagnostics business, was originally founded in 2006 by Dr Eric Peltier and subsequently listed on Euronext Growth Paris in October 2012. Novacyt previously merged with the Lab21 pharmaceutical testing business Mullis had run since 2008.

The Paris and Camberley-based group's 2017 listing on AIM at a price of 59.4p raised £7.1 million for the company, but was followed by a steady descent to as low as 6.1p in October last year. It has previously developed molecular tests for other major incidents, such as the outbreaks of Swine Flu, Ebola in 2014 and Zika in 2016.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.