Alliance Trust churns portfolio by one-third as it narrowly beats benchmark

28th July 2022 11:30

by Sam Benstead from interactive investor

Six-month results for the multi-manager trust reveal big portfolio changes and compromise on ESG.

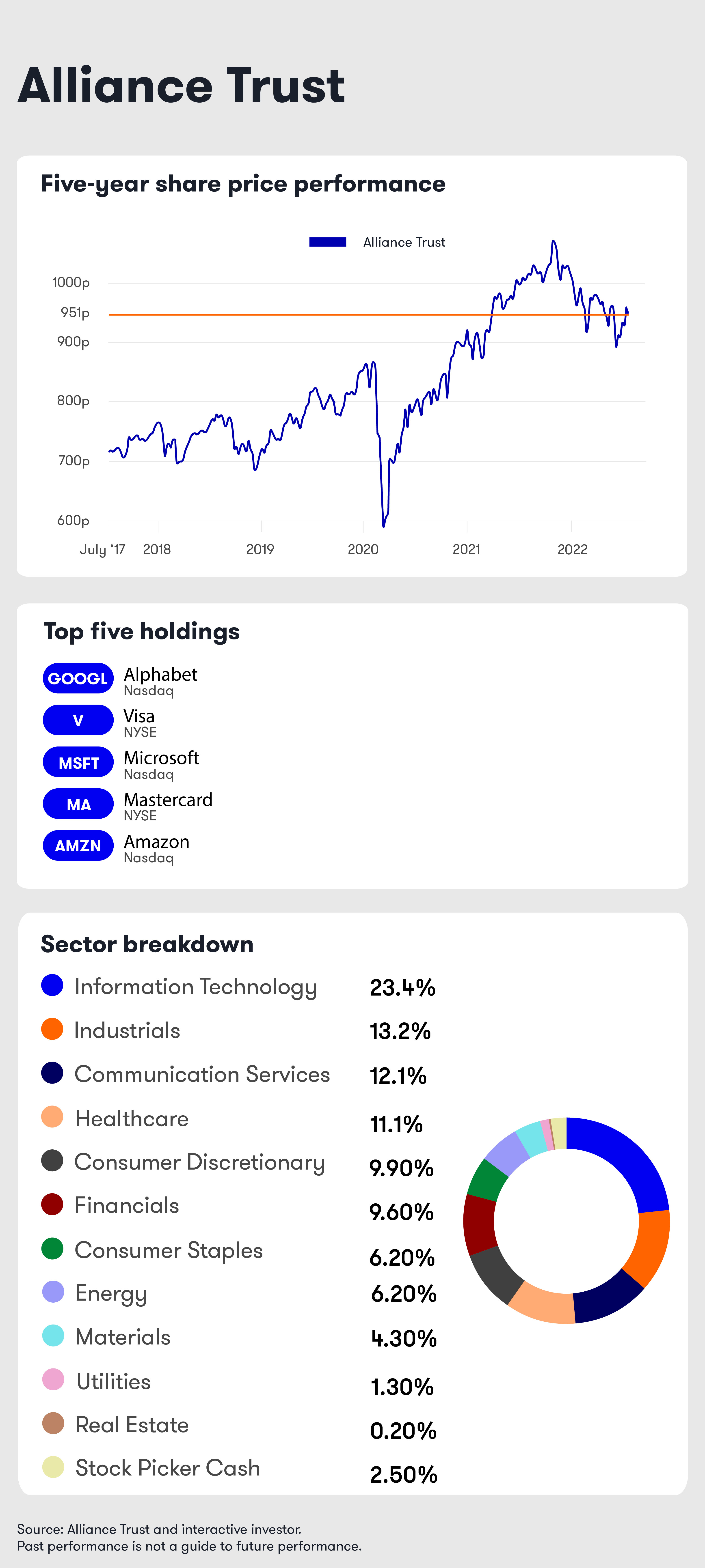

Global investment trust Alliance Trust just pipped its benchmark in the first half of year, delivering a net asset value (NAV) return of -10.5% compared with a -11% drop for the MSCI All-Country World Index.

However, shareholders in the multi-manager trust, which outsources stock picking to nine stock pickers (who in most cases invest in 20 shares), were left with a -11.3% return as the discount widened to an average of 6.3%, above the 5.9% average in the first half of 2021. Performance was better than rival global investment trusts, which returned -18.6% on average.

It was a busy period for the trust, with turnover greater than normal at 32.7% of the portfolio. This was due to dropping UK investment firm River & Mercantile, and removing the 0.5% of the portfolio that was in invested in Russia. Alliance Trust aims for manager turnover to be 10% to 15% per year.

The Russian stocks, which were held by American investor GQG, were sold by 1 March 2022. Other key changes included Jupiter Asset Management buying Kyndryl, the newly renamed IT services company spun out of IBM, and SGA selling its holdings in PayPal and Walt Disney to cheaper growth firms Recruit Holdings and Danaher.

- Battle of the big three multi-manager trusts: who comes out on top?

- The fund firms investors are turning to during market turmoil

- Reasons why the bear market is far from over

Key to beating its benchmark were investments in energy and materials stocks. GQG’s investments in large oil and gas companies, Petroleo Brasileiro (Petrobras) and ExxonMobil Corporation, were the first and third biggest contributors to performance, up 43% and 59% respectively, in the first half of 2022.

Their shares have climbed on the back of higher oil prices. GQG shifted from some of its more expensive growth and technology investments in 2021 towards energy, where it said strong growth potential and resilient free cash flow generation was key to the investment case, as well as favourable supply and demand dynamics.

Alliance Trust has an environmental, social and governance (ESG) mandate, seeking to manage the portfolio so that it is aligned with the Paris Climate Agreement goals of net-zero by 2050 and limiting global warming to below two degrees.

However, Alliance Trust fund manager Willis Towers Watson said the increased allocation to carbon emitters set back their plans of reducing carbon emissions in the portfolio.

It said the portfolio’s allocation to energy and materials increased its carbon footprint, but was not at odds with what the trust is trying to achieve with regards to sustainable investing.

- Top investors spot opportunity in ‘cheap’ tech

- Investors are so bearish it is time to be bullish

- F&C IT switches to defensive mode amid volatile markets

Willis Towers Watson said: “Our stock pickers are recognising that the valuations placed on these companies by the market appeared too cheap, even after factoring in the financially material ESG risks posed by the energy transition.

“Some of the investors took advantage of the opportunity, and while the companies are held in the portfolio, we seek to vote and engage with them on these issues to ensure they move towards alignment with the Paris Agreement pathways to net zero.

“Changes in stock holdings can have a very significant impact on the carbon footprint and are more significant in a concentrated portfolio. More than 60% of the portfolio’s emissions come from just three stocks, Petrobras, NRG Energy, and HeidelbergCement.”

Dividend growth

Alliance Trust announced a second interim dividend for 2022 of 6.0p, up on 2021's 3.702p. The total of the first two interim dividends paid for 2022 is 12p, representing an increase of 62% on the same payments for 2021.

The dividend yield as at 30 June 2022 was 2.4%. This level of dividend is well supported by the company as it can dip into its £3.3 billion in assets available for shareholder payouts.

The dividend increases means that Alliance Trust is on track to maintain its “dividend hero” status this year. It has been able to increase its total dividend for 55 consecutive years.

“This is a record of which the board continues to be proud and expects to extend,” said Willis Towers Watson.

Longer-term performance

Since April 2017, Alliance Trust has adopted a multi-manager approach, overseen by Willis Towers Watson. Since its appointment in 2017, figures from Numis show the company’s NAV total return of 55.2% against 61.3% for the benchmark – the MSCI All Country World Index. The trust aims to outperform the index by 2% a year over rolling three-year periods.

Numis points out that while “the concept of investing in the top 20 stock picks from a range of leading managers via a low-cost vehicle is appealing...the manager is yet to deliver the consistent outperformance that its approach was expected to deliver”.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.