The Analyst: Dzmitry Lipski’s investment insights

After doing nothing terribly exciting for the past four years, investors are looking east again for undervalued shares. ii’s head of funds research Dzmitry Lipski finds clues in the football.

9th July 2024 11:07

by Dzmitry Lipski from interactive investor

In this new series of blog content, Dzmitry Lipski seeks to provide actionable insights to help you navigate and better understand financial markets. It aims to help investors generate investment ideas designed to build robust, well-diversified, multi-asset portfolios and profit from market developments.

► Latest blog

ARE CHINESE SHARES THE REAL WINNER AT EURO 2024?

Chinese equities have underperformed global financial markets for more than three years now, but there are signs the macro outlook may be improving.

Along with football players showing off their skills, Chinese corporate brands have not gone unnoticed at the UEFA European Championship in Germany. Chinese companies account for more than one-third of the sponsors at the event, and top country names are frequently displayed to viewers at stadiums, billboards and TV ads along with other major event sponsors such Adidas, Booking.com and Coca-Cola.

The Chinese sponsors include television and home appliance manufacturer Hisense, global shopping platform AliExpress, financial technology giant Ant Group which owns Alipay (all three are part of Alibaba) smartphone maker Vivo, and electric vehicle manufacturer BYD.

Sponsoring the major football tournament in Europe shows Chinese companies’ ambition to expand and cooperate globally, demonstrating their technological innovation and competitiveness.

China finds itself at a different stage in the economic and monetary cycle to developed countries. Chinese corporates have been under pressure from slowing economic growth, regulatory crackdowns on real estate and technology sectors and ongoing geopolitical tensions with the US.

This macroeconomic tumult has been reflected in a declining Chinese stock market over the past three years, and a broad derating of shares, making Chinese companies look cheap versus developed and emerging market peers.

Nevertheless, looking past the negative noise in the markets, the economy appears to be at an inflection point, as it is refocusing towards consumer driven innovative industries such as internet technology, AI, industrial automation and electric vehicles. According to the Global Innovation Index, which ranks economies based on their innovation performance, China ranks 12th out of 132, being the only middle-income economy within the top 30.

From 15th to 18th July the Chinese government will hold the third plenary session, known as the “Third Plenum”. The meeting historically served as a forum for high level decisions and should provide further insight into the macro outlook for the economy. In the past the government showed that it is prepared to stimulate the economy, so more support is expected. With the US Federal Reserve set to start cutting rates soon, China might be in a better position to introduce stimulus and ease monetary policy without negatively impacting capital flows and the renminbi.

Despite the economic uncertainty, investors should consider having exposure to Chinese equities when building a balanced portfolio.

Fidelity China Special Situations Trust (LSE:FCSS) offers broad, diversified exposure to Chinese equities, including 'H' shares listed in Hong Kong and mainland-listed 'A' shares. It has been managed by Dale Nicholls since April 2014. He focuses on faster growing, consumer-orientated companies with robust cash flows and capable management teams.

KraneShares CSI China Internet ETF (LSE:KWBP) provides dedicated exposure to Chinese internet companies listed in both the United States and Hong Kong. Chinese internet companies that provide similar services as Google, Facebook, Twitter, eBay, Amazon, etc, benefitting from increasing domestic consumption by China's growing middle class. Ongoing charge is 0.75%.

Dzmitry Lipski is responsible for fund selection and portfolio construction at interactive investor.

► Blog entry: 21 June 2024

FIVE TIPS TO BE A BETTER INVESTOR AND SORT OUT YOUR PORTFOLIO

Ever looked at your investment portfolio and thought why on earth did I buy that fund? Or, perhaps scrolling through your list of holdings, you spot a share with a name that you recognise but you can’t remember what the company actually does?

Alternatively, there might be an investment trust sitting there that you once read good things about, but it’s been in the doldrums for some time.

These are scenarios that many long-term investors will recognise, as it can be all too easy to find your portfolio has turned into a bit of a jumble of holdings picked up over the years.

Giving your portfolio a regular tidy and making sure your investments are right for you is a vital part of being a DIY investor.

It’s important not to chop and change too often, but it’s wise to consider consolidating small holdings, switching out of shares, funds or investment trusts that don’t fit your appetite for risk anymore, and looking at where you might find better performance or lower costs.

Where should investors start to sort out their portfolio?

A good starting point is to consider how you want your investments to fit together, what you want them to do and how this matches your appetite for risk. This is a process known as asset allocation and is an important foundation for successful investing.

Investing is a long-term game, and long-term investors should construct a portfolio with a “core” comprised of equities and bonds, and any alternatives, such as commodities or property, for example, forming a “satellite” position in the portfolio.

There is no right or wrong mix, but you do want to settle on the best investment mix for your situation and needs, such as your goals, age and risk tolerance.

For example, if you are comfortable with more risk and you want as much growth as possible, you might have a portfolio that’s heavier in shares. If you are more cautious or looking for income, however, more exposure to bonds could be the way to go. And ultimately, by combining them you could get a bit of both: growth and income.

But always remember that market fluctuations can change the value of your investments and make your portfolio drift, and this can expose you to more risk or less growth than you originally planned.

By rebalancing your portfolio, you will avoid drift and align to your original asset mix.

With investing, diversification is absolutely vital. And this means diversification, not just of asset classes, but also regions and sectors.

How many funds or shares is too many?

Investors are regularly warned that they need to have a diversified portfolio and not put all their eggs in one basket. But they can also easily pick up a long list of shares, funds, investment trusts and ETFs that shifts them from diversification to something dubbed “diworsification”.

This is where multiple investments start overlapping and detracting from the job they should be doing - and duplicating holdings. There is a balancing act to be done between holding enough investments to diversify and not having too many.

If you’re making your first foray into the stock market and have £1,000 to invest, then one fund might make sense. You could, for example, buy a one-stop shop multi-asset fund to obtain instant diversification. This could be a fund that buys both shares and bonds.

For larger pot sizes, or if your portfolio is growing, you can create your own diversified portfolio by selecting funds from different asset classes, regions, company sizes, and investment styles (such as growth and value).

In this context, around 10 funds should be sufficient to have a well-diversified portfolio.

If you have more than 20 funds, it would be a good idea to review them and ensure each one is pulling its weight in terms of performance, and that they are sufficiently different from one another.

If you have funds that are less than 2% of your portfolio, then it is perhaps worth considering whether they add much value to the overall return.

How to think about winners and losers

Stock-picking investors are often advised to run their winning shares and cut their losers. That can be tough to do, as it is tempting to cash in big gains and hold on to big losses in the hope that a stock goes back up.

Investigate and think about what lies behind the outperformance or underperformance of a stock before you act. Ask if this is likely to continue and what could be the potential pitfalls lying ahead, or catalysts for improvement.

It’s worth considering using stop losses to protect individual share price gains.

For investment trust and fund investors, it’s necessary to look at the manager, the holdings and the strategy to weigh things up.

Some funds - especially actively managed ones - are often more concentrated in specific stocks or sectors than their benchmarks, meaning that some short-term underperformance should be expected.

The risk here is that some investors panic and sell during those short downturns and therefore miss out on a potential recovery and longer-term returns.

Instead - and going back to investing being a long-term game - consistent longer-term fund underperformance should be the key concern for investors and trigger a review of the fund.

Ideally, investors should assess a fund’s performance relative to its benchmark and peers over a market cycle. However, a focus on three to five-year returns could be sufficient to identify an issue.

A typical red flag is when a fund lagged its peers at a time when the market environment was favourable for that strategy. For example, if a large-cap growth fund underperforms when large-cap growth companies are in favour.

For more fund ideas check out our Super 60 and ACE 40 investment ideas, which cover a range of asset classes and geographies, to help you add some diversification to your portfolio or indeed to start building your own income portfolio.

Dzmitry Lipski is responsible for fund selection and portfolio construction at interactive investor.

► Blog entry: 7 May 2024

MARKET PUZZLE

With equity markets performing strongly and attractive bond yields on offer for the past two years, investor attention has shifted away from alternative assets and property, in particular.

Nevertheless, eventual interest rates cuts are expected to boost and attract more long-term investors towards the property sector.

Structural changes within the sector have not gone unnoticed. Post-Covid changes to people’s lifestyles and work patterns, such as remote working and online shopping, have put pressure on office and retail space, while warehouses and industrial assets remain resilient.

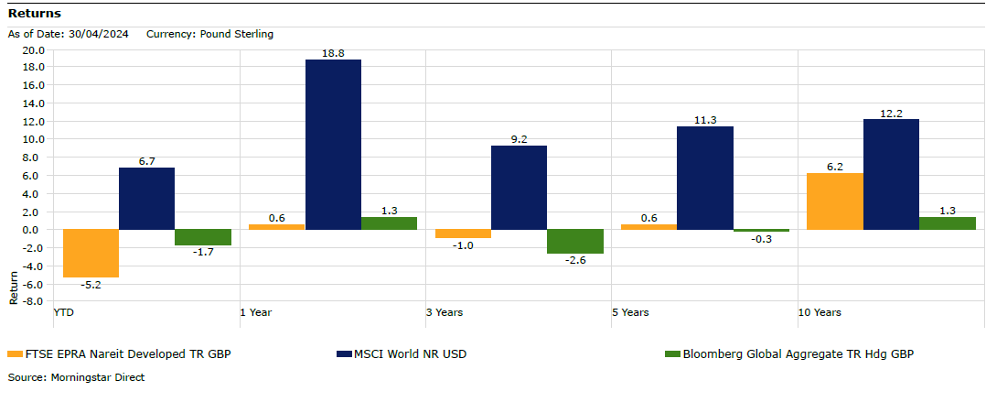

The chart below shows the performance of global real estate (FTSE EPRA Nareit UK index) against global developed market equities (MSCI World index) and bonds (Bloomberg Global Aggregate TR index hedged to GBP).

Past performance is not a guide to future performance.

Why consider property and how much to allocate

Looking at the bigger picture, the long-term fundamental case for property as an asset class remains intact, and history shows that real assets such as property outperform traditional asset classes amid high inflation environments. Yields and valuations look attractive relative to other asset classes, and property remains a solid option to generate income and diversity in investor portfolios.

UK investors are probably more biased towards property than most international investors due to the popularity of property ownership and wealth created over time for many UK residents.

While the opportunity to generate great returns from property is evident, investors aren’t always sure how much of their portfolio they should allocate to it.

Property allocation between 5% to 10% is a good rule of thumb as it is an alternative asset class. These numbers can change depending on the objective behind including property in a portfolio – either capital growth or stable income.

What about my home, you might ask. Your house is often not included as part of the overall portfolio, but it can appreciate in value and provide income in retirement.

How to gain exposure

As you would expect, investors have various choices in this space: open-ended or bricks and mortar funds, investment trusts, real estate investment trusts (REITs), exchange-traded funds (ETFs) and most recently hybrid (hybrid fund incorporating a higher level of REIT exposure alongside direct property) and long-term asset funds (LTAFs).

It’s worth mentioning that property may be sensitive to high-risk events. Several open-ended property funds were closed to redemptions after the Brexit referendum in July 2016 due to mass redemptions. It was the same during Covid.

While most funds provide daily dealing, some underlying holdings often take much longer to sell, so need to hold cash positions for liquidity reasons to meet redemptions or to manage large inflows. Uncertainty around the future of open-ended structures has also come under further question as the Financial Conduct Authority (FCA) seeks to align liquidity expectations with daily dealing.

A hybrid structure can also go some way to resolving direct property investment issues with daily liquidity, given the exposure to listed securities. But they won’t offer the same degree of diversification as a purely direct strategy given their public market exposure.

Overall, it seems the closed-end fund structure is the most appropriate for the retail investor. That is not to say that property trusts will be immune to any turbulence in the sector, as discounts are likely to widen in times of uncertainty, but at least existing investors should be able to access their money if they want to.

For some investors, commercial property may eventually become an attractive asset to buy as the recent volatility could provide a good entry point at attractive discounts. Current discounts in the property sector are the widest in the investment trust universe.

TR Property Ord (LSE:TRY)is an investment trust that invests mainly in the shares of property companies rather than physical property. This allows Marcus Phayre-Mudge, its manager since 2011, to adjust the portfolio more readily than if he were investing in direct properties, which can be hard to buy and take time to sell.

When analysing potential investments, he and his team assess property assets, balance sheets and long-term records of managements using capital effectively to build asset valuation and earnings expectations for each company. Phayre-Mudge can invest internationally but most of his holdings are in Europe, including the UK. He can invest in physical property in the UK, although this will generally not account for more than 20% of the portfolio. The trust is managed on a total return basis and has historically outperformed the benchmark. Current yield is almost 5% and it is trading on a discount to NAV of 9%.

Dzmitry Lipski is responsible for fund selection and portfolio construction at interactive investor.

► Blog entry: 27 March 2024

IS THE MIDDLE EAST BECOMING THE ‘NEW EUROPE’?

Investing in global markets and beyond one’s own borders is a timeless strategy, but a region that is often overlooked by many is the Middle East. Recent events, such as the conflict in Gaza and Red Sea trade disruptions, as well as the infancy of Middle Eastern markets, add to investor hesitation.

Yet, for those looking to diversify their portfolios beyond the norm, the Middle East offers a wide range of countries with fast-growing economies, vast pools of wealth and attractive structural reforms that are under way.

Naturally, oil and gas has been critical for the main economies, especially the major oil-exporting Gulf Cooperation Council (GCC) states - Saudi Arabia, the United Arab Emirates (UAE), Qatar, Bahrain, Kuwait and Oman. Large concentrations of wealth in the region are dependent on oil, with higher prices continuing to support government fiscal budgets, boosting growth and public investments.

However, more recently, foreign interest is simultaneously both attracted by and contributing to the transformative change happening in the region. Economic diversification is driven by a shift from over-reliance on oil exports, to booming tourism, technology and infrastructure sectors, including the ramping up of renewable energy projects. Investor and business-friendly reforms are also fostering increased investment opportunities, with the region home to numerous economic hotspots, investment corridors and highly active IPO markets.

Consequently, the GCC countries have been growing fast, with the UAE, Kuwait, Saudi Arabia and Qatar boasting one of the largest sovereign wealth funds globally. Assets across the Abu Dhabi Investment Authority alone are nearing $1 trillion. These states are prepared to spend this wealth not only in the region but also globally.

In most recent deals, last year Saudi Arabia's Public Investment Fund (PIF) purchased a 10% stake in London's Heathrow airport. In addition, in 2012 Qatar's sovereign wealth fund bought 20% of BAA in a move that adds the British airport operator to a portfolio of UK interests including Harrods and stakes in Barclays and J Sainsbury.

‘The new Europe’

Saudi Crown Prince Mohammed bin Salman once said “The new Europe is the Middle East” recognising the region’s thriving economies, ambitious reforms and investor-friendly environments that are attracting talent and vast influxes of capital.

As part of Saudi Arabia’s Vision 2030 economic transformation plan, the government has announced its intention to invest over $2 trillion in the domestic economy. The country has also been chosen to host the Asian Winter Games in 2029 in the mountains near the $500 billion futuristic city project Neom.

Saudi Arabia has the highest GDP in the Middle East, accounting for roughly 30% of the region's economy and is expected to grow 2.7% this year and 5.5% in 2025.

The economic growth in the region remains stable with the International Monetary Fund (IMF) predicting an almost 3% increase in GDP and a healthy inflation rate of just over 2%. The Middle East displayed an exceptional recovery from the Covid-19 pandemic and, while other regions have contended with economic uncertainties, this region has seen remarkable and stable growth. Such resilience and continued adaptability offer adventurous investors potentially vast and promising opportunities.

Investment opportunities

No surprise, Middle Eastern equities are highly volatile and are not for the risk-averse, but the region still presents attractive opportunities for long-term investors looking to capture strong growth and the benefits of structural changes.

Markets have delivered gains over the last years, as shown below. But valuations still look attractive, especially relative to developed market equities.

Index/Fund | Return: year-to-date (%) | Return: 1 Year | Return: 3 Years | Return: 5 Years | Return: 10 Years | Forward price/earnings | Forward price/book |

MSCI Emerging Market index | 0.7 | 4.1 | -3.1 | 2.9 | 5.9 | 12.4 | 1.5 |

MSCI World index | 6.3 | 19.6 | 12.3 | 12.8 | 12.2 | 18.5 | 2.9 |

S&P GCC Composite index | 4.8 | 12.2 | 15.7 | 10.9 | 8.5 | 14.9 | 1.8 |

Gulf Investment Fund | 6.4 | 34.6 | 27.9 | 20.9 | 12.5 | 15.1 | 1.6 |

JPM Middle East, Africa & Emerging Europe Opps Fund | 3.2 | 12.2 | — | — | — | 9.7 | 1.5 |

Source: Morningstar as at 29 February 2024. Total returns in GBP. Past performance is not a guide to future performance.

The market is often overlooked and under-researched compared to the developed market, which explains the lack of options and higher fees for retail investors. Investors should be very cautious and selective as the asset class consists of a diverse collection of countries and companies, so an actively managed approach is preferred.

Investors could consider a broader emerging markets funds that can adjust exposure to the Middle East as a more appropriate way to invest in the region.

JPMorgan Middle East, Africa & Emerging Europe Opportunitiesfundis among the largest in the sector and invests in companies of the Middle East, Africa and emerging markets of Europe. The largest allocation in the portfolio is to Saudi Arabia (30%) and the United Arab Emirates (15%). At sector level, financials and energy account for 60%. The fund has an ongoing charge of 0.95%.

Gulf Investment Fund Ord (LSE:GIF)(closed-ended vehicle) invests specifically in companies of the Gulf Cooperation Council (GCC) region with the aim to capture the growth opportunities offered by the GCC economies.Their actively managed strategy has consistently outperformed its benchmark and peers over time. The trust has an ongoing charge of 1.5%.

These funds tend to exhibit significant volatility due to their specialist nature, so are more appropriate for higher-risk investors or as part of a diversified portfolio.

Dzmitry Lipski is responsible for fund selection and portfolio construction at interactive investor.

► Blog entry: 8 March 2024

DON’T UNDERESTIMATE THE ‘ART OF DOING NOTHING’ WITH YOUR INVESTMENTS

“If investing is entertaining, if you're having fun, you're probably not making any money. Good investing is boring.” George Soros

As we approach the tax year end, private investors are bombarded with a wealth of investment ideas, portfolio strategies and fund picks all claiming to have the best potential for the coming tax year, or to even make you an ISA millionaire.

As a result, investors can feel obliged or at least tempted to tweak their portfolios, or perhaps try and time the market and add new ideas, all to profit from the latest opportunities picked by experts.

Encouraged by the idea that they can do no worse than the average professional trader or hedge fund manager, investors can become caught up in the infinite investment opportunities presented to them. However, many will be unsure about which strategies are best for their individual financial circumstances and what these changes would mean for their portfolio.

While adding more and more complexity can seem like the “sophisticated” approach to money management, the opposite is often true.

History tells us that emotions and acting on impulse often lead to bad decisions. We are susceptible to believing that trends will last forever on the positive and negative side, so we exaggerate the potential for gains and losses. By following short-term trends and acting out of the fear of missing out – FOMO – then we end up paying too much for assets and selling them when the price has already fallen.

You have a better chance at generating long-term returns over different market cycles by setting clear investment goals, constructing very simple and well-diversified portfolios, and taking the long view.

Technological advances have democratised the investment industry by improving access to a wide range of assets, all delivered through a smartphone app. However, private investors must remember the long-term benefits of staying put and should avoid checking their portfolio too often. Such easy access to trading at the tap of a button and information overload may tempt you to tinker with your portfolio unnecessarily, something you may regret in the future. Counterintuitively, investors are often better rewarded for being inactive.

For fund ideas use iiSuper 60andACE 40, but only keep as many funds in your portfolio as you’re comfortable monitoring. While it’s important to make sure your portfolio is properly diversified, it can be hard to keep track of too many investments and act when necessary.

In addition, Morningstar’s Portfolio X-Ray tool, which ii customers can find a link to when they view investments in each of their portfolios, can help understand how your whole portfolio will work together to achieve your investment goals.

It can also instantly provide an overview of the main characteristics like asset allocation, exposure to different investment styles, geographic regions and sectors.

As always, learning about investments and staying up to date on the markets and the economy can help investors make informed and rational investment decisions when the time is right.

Dzmitry Lipski is responsible for fund selection and portfolio construction at interactive investor.

► Blog entry: 20 February 2024

SHOULD INVESTORS FEAR A CORRECTION AS S&P 500 HITS ALL-TIME HIGH?

“Be fearful when others are greedy and greedy when others are fearful” - Warren Buffett

Over the past few weeks, the S&P 500 index has reached new highs and breached the 5,000 level for the first time, demonstrating strength in the US economy. Unemployment is low, inflation is under control and the Federal Reserve (Fed) central bank is set to cut interest rates, adding to improved investor sentiment.

But despite the optimism, there is a growing sense of caution that the market rally may meet some resistance, and that we might see some correction in the short term (a correction is typically seen as a decline of 10% or more).

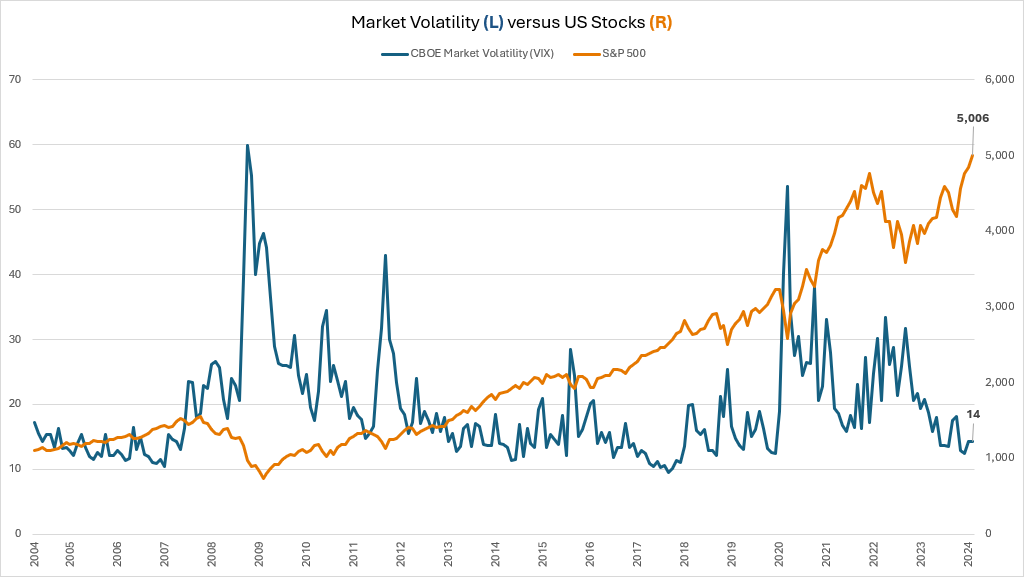

Interestingly, the VIX index - a measure of stock market volatility, risk and investor sentiment used to gauge investor fear - is trading at relatively low levels, below both its three- and five-year averages. This indicates complacency among investors as stock prices hit record highs.

The ‘fear index’

The VIX index gauges expected volatility of the S&P 500 over a 30-day period by aggregating pricing of call and put options on the index itself. It is considered a leading indicator for both the S&P 500 and the wider stock market.

A lower VIX reading - typically lower than 20 - indicates less fear in the market, whereas a higher VIX - above 20 - usually shows greater volatility. As such it can be used as a contrarian indicator.

The VIX generally tends to have an inverse correlation with the S&P 500 - as one index rises, the other falls. So when spikes in the VIX coincide with sharp drops in the S&P 500, 0history tells us it’s time to go bargain hunting. Similarly, when the VIX reaches a low point and investor complacency is high, a cautious approach should be taken.

The chart below shows that the opposite trend between S&P 500 & VIX has reached extreme levels: 5,006 for the S&P versus 14 for the VIX.

Source: Morningstar Direct. S&P 500 PR and CBOE Market Volatility (VIX) VIX/S&P as at end of each month from 30/04/2004 to 16/02/2024.

Do not fear new highs – stay invested

While investors can monitor the VIX, it is almost impossible for investors to accurately determine the top or bottom of the market. And there remains the risk of buying at extended levels when you should actually be selling, or selling after a market fall when you really should be buying.

Currently, the market may see further uncertainty and volatility, and it is important to remember that the best investment outcomes are often achieved through time in the market, not timing the market.

In addition to conventional defensive assets such as bonds, gold and healthcare stocks, investors looking to lessen the impact of volatility can consider minimum volatility strategies. Over time, low volatility stocks have shown higher average returns than high-volatility stocks.

A good option is iShares Edge S&P 500 Minimum Volatility ETF USD Acc (LSE:SPMV), which tracks the performance of an index composed of selected companies from the S&P 500. These companies collectively exhibit lower volatility than the broad stock market, while maintaining characteristics such as sector and factor exposure similar to the S&P 500. The ongoing charges figure (OCF) is 0.20%

Other iShares exchange-traded funds which employ a similar strategy include iShares Edge MSCI World Minimum Volatility ETF $ Acc (LSE:MVOL), iShares Edge MSCI Europe Minimum Volatility ETF €Acc (LSE:MVEU)andiShares Edge MSCI EM Minimum Volatility ETF $ Acc (LSE:EMMV)F.

Dzmitry Lipski is responsible for fund selection and portfolio construction at interactive investor.

► Blog entry: 7 February 2024

GOLD, SILVER OR BOTH?

In the past, gold has performed well relative to equities and other risk assets during periods of extreme economic turbulence, market volatility and high inflation. As such, it’s widely considered a safe-haven asset. Recent heightened geopolitical risk and dovish outlooks from major central banks have both supported the prices of the yellow metal. Subsequently, the price of gold has risen almost 15% in the last year to over $2,000 per ounce.

Similar to gold, silver is also considered a good hedge against inflation and a reliable store of value during economic and geopolitical uncertainty. It also has more industrial application than gold and is used extensively in energy-efficient industries such as solar and electric vehicles. This means that including silver in investment portfolio offers the potential for higher returns than a pure gold allocation.

Historically, silver and gold have a close relationship, with a correlation coefficient of 65% over the past 10 years. As such, silver prices tend to move in tandem with gold and typically increases in value faster than gold when precious metal prices are rising.

The outlook for gold and silver, and commodities more generally, is more favourable given the possibility that interest rates in developed counties have peaked and will likely be cut this year. Lower rates and expectations for a weaker US dollar should increase the appeal of both gold and silver as they are priced in dollars. Growing demand for “clean” energy metals should also support silver prices.

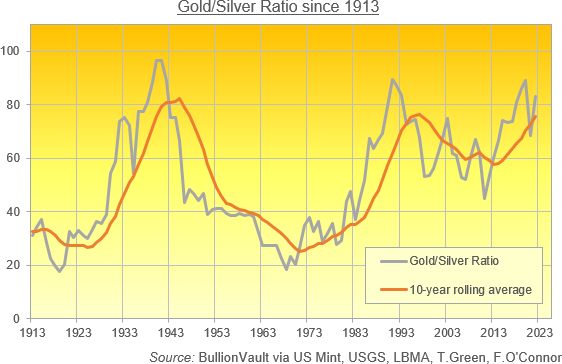

A popular indicator to time your trade

For experienced investors, look at the gold-to-silver ratio as an indicator of when to invest in which of the metals. The ratio is the amount of silver needed to purchase one ounce of gold.

The chart below shows the fluctuations of the ratio since 1913. A popular rule of thumb is the “80/50” rule, which suggests switching to silver when the ratio value rises above 80 ounces of silver per one ounce of gold, and switching to gold when its value drops below 50 ounces per ounce. The current ratio is around 90 to 1, which indicates that gold is looking expensive relative to silver.

Although the gold-to-silver ratio offers a simple and useful guide for precious metal investors, there are many more variables to consider when assessing the value of gold and silver. As always, it’s important to do your own research, and fully understand how the investment fits your strategy.

In addition to generating extra return, maintaining a certain percentage of a portfolio in gold and silver can increase diversification and reduce the risk of the overall portfolio.

Investors can gain passive exposure to precious metals via simple, low-cost exchange-traded funds (ETFs) such as iShares Physical Gold ETC (LSE:IGLN)and iShares Physical Silver ETC (LSE:ISLN).

Alternatively, investors could also consider actively managed Jupiter Gold & Silverfund. It invests in both physical gold and silver bullion, as well as gold and silver mining companies, and can adjust exposures depending on the prevailing market conditions.

Dzmitry Lipski is responsible for fund selection and portfolio construction at interactive investor.

► Blog entry: 23 January 2024

US EARNINGS SEASON – TRADE IT OR FADE IT!

As American companies publish quarterly results, major stock market indices are hitting record highs. ii’s Head of Funds Research shares his thoughts on some new analysis of stock market performance and forecasts for 2024.

Last week the S&P 500 index hit a record high for the first time in two years, topping the 4,800 level, but I believe more upside is only possible if company earnings beat already optimistic expectations.

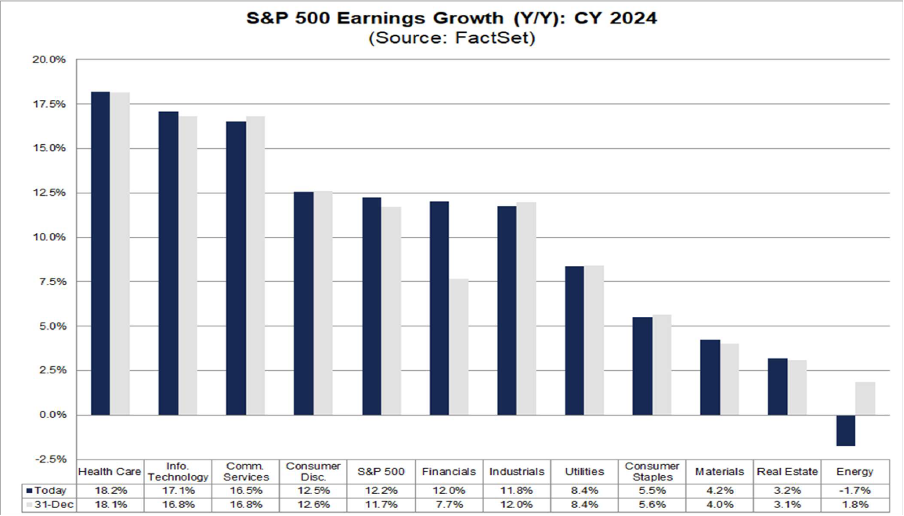

According to the latest report from data provider Factset, the projected earnings growth rate for the S&P 500 in 2024 is 12.2%, which is pretty punchy and way above the 10-year average earnings growth rate of 8.4%.

At sector level, all but one of the 11 sectors (Energy) are predicted to report earnings growth in 2024. Six of these are projected to report double-digit growth, led by the Healthcare, Communication Services, and Information Technology.

Past performance is not a guide to future performance.

The S&P 500 also looks expensive on a forward price/earnings ratio of 19.5, which is above both the five-year and 10-year averages at 18.9 and 17.6 respectively.

The bottom-up target price for the S&P 500 is 5,233.85. At the sector level, Energy (+25.7%) is expected to see the largest price increase, and Information Technology (+6.2%) is expected to see the smallest price increase.

Just because stocks look expensive, it doesn’t necessarily make them a sell; not all of them anyway. There are some big themes at play which explain the excitement, most obvious being artificial intelligence (AI). It’s only just started to play out and clearly has a long way to run. It’s been a case of FOMO in the past months – everyone wants a piece of the action. But stock prices never go up in a straight line. This is a trend for the long term that you either buy and tuck away, or trade on the way up if you prefer that approach.

And, of course, from a big picture perspective there’s the current “will they, won’t they?” debate about interest rates. Expectations of a first cut in May have been baked into share prices, so any deviation from that consensus will have negative consequences for equity markets. We saw what happens when this occurred at the start of the year. Central bank policymakers have rarely been so powerful.

Given ongoing concerns about slower growth and the threat of recession, investors should tread cautiously and maintain a well-diversified portfolio.

Whatever your view on markets, a well-diversified portfolio makes it easier to successfully navigate economic uncertainty and market volatility. It also gives the best chance of generating a positive outcome whatever the market throws at you.

Dzmitry Lipski is responsible for fund selection and portfolio construction at interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.