Are boardrooms ready for investor activism?

Social media gives us all more of a voice. Will this mean a surge in investor activism in the boardroom?

21st February 2020 14:44

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Social media gives us all more of a voice. Will this mean a surge in investor activism in the boardroom?

The return of the activist... but not as we know it

Why the ‘20s will go down as the decade of the corporate activist...

William Heathcoat Amory, Founder, Kepler Trust Intelligence.

The advent of social media has led to an increase in activism of all types, the like of which has not been seen since the penny press changed the course of American history in the 1800s. From #MAGA to the Arab Spring, platforms such as Facebook have had a profound effect on politics and society.

Everywhere, we are invited to support campaigns on social media. Where once it would have taken a petition (which requires a pen, frayed paper, and someone to hand it around at the very least), it is now as easy as “liking” at the touch of a button any cause on Facebook to lend your support. As a result, individuals in society are ever more expected to engage on topics and issues that affect them (and even those that do not).

In a further extension of democracy, rather than have our elected representatives debate and decide issues on our behalf, technology enables us to engage ourselves in the argument and help contribute to the decision-making process.

And having tasted the forbidden fruit, it seems unlikely that things will ever be the same again. We are all becoming activists in one way or another. Absolutely, we may not have the same passion for a subject that the leader of a campaign might have. But we are increasingly happy (or indeed desirous) to have our views sought, and vote taken.

In the same way, leaders of organisations are having to adapt. No-longer can they make decisions and feel insulated from the people who gave them the mandate. There is now a much wider grey area they have to navigate, and woe betide them if they alienate their electorate!

Populism in the boardroom

The same trends and pressures are absolutely being felt in the corporate boardroom. Shareholder democracy is a hot topic – not least because in the US passively managed investment funds now represent around half of the assets in US equity funds.

It is now a “norm” in the fund management industry that investment professionals have a responsibility to vote at company AGMs as stewards of their clients’ capital.

Part of this surely stems from a desire that we should rid ourselves of the excesses of the past (companies should be run for shareholders, and not executives). But in terms of sentiment, it must also be being driven by the same forces that are driving the current fashion for all things ESG (the acronym for corporate policies concerned with Environmental, Social and Governance issues).

The desire to have our thoughts on what is right and what is wrong transmitted to those in power is a crucial part of today’s technology enabled global citizen. To some extent (although by no means exclusively) this is being reflected in the huge rise in flows into ESG funds.

Many investment managers are still getting to grips with how they plan to fulfil their ESG commitments. However, a recurring theme we continually hear is that henceforth, fund managers plan to engage with investee management teams more actively, and record the “effect” they have had in driving change.

As a result, a critical change is being felt in the investing world, with pressure for investors and stewards of capital to sit up and take notice of what the management and boards of their investee companies are doing. And where they don’t like what is happening, to vote accordingly. At its basic – this is activism.

Activist investors traditionally focus purely on profit. Although with ESG inspired activism on the rise, there is a meeting of the minds: ESG proponents believe that their ambitions are not about reducing profitability, but de-risking business models and putting companies on a more sustainable trajectory.

However, with an increasing cadre of managers (ESG and non) now agitating corporates for change (on behalf of ‘woke’ shareholders?), it is a recognisable fact that more and more managers are becoming activists.

An epoch of activism

With the confluence of these ideas now coming to the fore, we believe it might be fair to say that the twenties will come to be seen as the decade of the investment activist (with a small a). Many investment trust (and London listed funds) managers we meet, regularly engage actively with the management and boards of investee companies, although most of these meetings are carried out behind closed doors.

Managers such as Aberforth Partners (Aberforth Smaller Companies (LSE:ASL), Aberforth Split Level Income (LSE:ASIT)) have consistently engaged with investee companies over the years, trying to guide management down paths that will enhance shareholder value. Aberforth can take significant stakes in companies should they choose to, and are well practised at holding management to account and encouraging positive change operationally and on other matters.

Aberforth note that they have frequently owned the stocks in their universe more than once over a number of years, and the managers may have more experience of a business than incumbent management teams. Currently 34% of the portfolio is invested in companies in which Aberforth funds own more than 10% of the equity. At any one time Aberforth are 'engaged' in a constructive manner, behind closed doors, with the boards of a number of them.

Aberforth’s model is as a “quiet activist”. Other styles of activism can often involve a more confrontational stance. In some cases, if an activist’s target is not willing to engage, publicity can help apply pressure to engage.

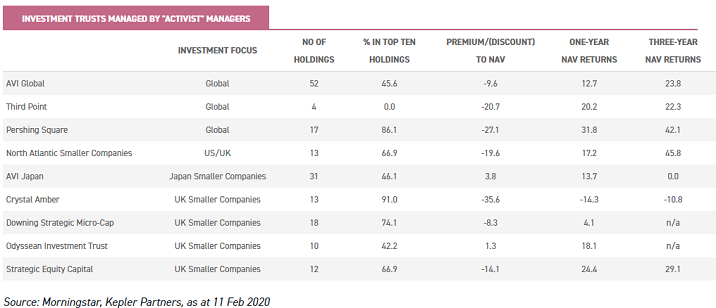

Asset Value Investors (managers of AVI Global and AVI Japan) are increasingly using their weight and position to apply pressure for change – both privately, and where necessary publicly.

Joe Bauernfreund took over as lead manager of British Empire Trust (as was, now AVI Global (AVG)) in September 2015, and quickly focussed the portfolio into higher conviction ideas as a precursor to getting more actively engaged with the underlying management of his holdings.

With AVI Global Trust (LSE:AGT), each underlying investment tends to own high-quality assets, but trades at a significant discount to what AVI believes is intrinsic value. Their engagement with management, boards and other shareholders seeks to develop and enact policies which will help to reduce this discount.

In recent years AGT has been finding rich opportunities in cash-rich Japanese operating companies, which has since spawned a separate £127 million investment trust – AVI Japan Opportunity (LSE:AJOT). This trust focuses on investment in a portfolio of Japanese companies which hold significant levels of net cash and investment securities on their balance sheets (at present equating to c.82% of their market cap on a weighted basis).

AVI believe the ongoing changes in the corporate governance regime in Japan, driven by government pressure as part of the ‘third arrow’ of Abenomics, offers the opportunity to buy companies with drastically overcapitalised balance sheets, which are in the process of improving balance sheet efficiency and returning capital to shareholders. AVI are active in engaging with company management and have noted evidence of trends in improved corporate behaviour towards minority shareholders.

Japan is something of a ‘target rich environment’ for those wishing to enact corporate reform, with 27% of the AVI Global portfolio invested in the country. Alongside the ‘Special Situations’ bucket (to which AJOT offers exposure), AVG also owns other investments here.

One of the largest is Sony (5.6% of NAV as at 31 Dec 2019). AVI recognize that Sony (NYSE:SNE) operates a multitude of businesses within its umbrella, though there are four core businesses (Gaming, Music, Pictures and Semiconductors) which drive its profitability. Misconceptions about these businesses, in AVI’s view, explain why the stock trades at a c.34% discount to their sum-of-the-parts NAV.

AVI is engaged alongside other activist investors in Sony, notably Third Point (Third Point Offshore being a holding in AGT). Third Point Offshore (LSE:TPOU) have invested $1.5 billion in Sony “because they believe it is one of the most undervalued large cap businesses in the world today”. They make their case for change at https://www.astrongersony.com/, believing there are several avenues for management to better realise Sony’s value, including selling listed stakes in Sony Financial, M3 and Spotify (NYSE:SPOT).

Other options they are pushing for management to explore include spinning-off Sony’s semiconductor business, and applying a moderate amount of gearing to increase the rate of buybacks. Sony’s management rejected the suggestion that the semiconductor business should be disposed of, but there are suggestions they may not be averse to revisiting the idea in the future.

We caught up with Third Point recently on a call in which Daniel Loeb (portfolio manager and leader of the 35 strong investment team) reported that they expect to be adding to their Activist (or “Constructivist”) portfolio. Currently, around 17% of the portfolio is in Activist positions (including Sony), which they expect to increase over time. Dan noted that this was a reflection of their 25 year track record in adding alpha through 22 activist campaign “repetitions”, but also of the opportunity set.

He stated that activism shouldn’t be viewed as a strategy per se, but a tool that makes good investments even better through engagement. Currently we understand that 8 out of the top 15 positions held by Third Point Offshore (the listed feeder fund into Third Point’s Master Fund) are activist positions.

Dan has noticed that other long-only investors’ traditional suspicion of activist investors is giving way to a broader recognition that activism can result in a win-win situation for all. As a result, Dan believes that successful activism no longer requires an activist to own a very large percentage of the shares of a company to influence change.

At the other end of the market capitalisation spectrum, in the UK Smaller Companies sector, there are a number of activist managers working with investee companies with the aim of generating superior returns for shareholders. Strategic Equity Capital (LSE:SEC), Odyssean Investment Trust (LSE:OIT) and Downing Strategic Micro-Cap (LSE:DSM) all occupy this space, with concentrated portfolios and managers who are more than used to rolling their sleeves up and proactively driving change in investee companies.

Downing Strategic Micro-Cap Trust is managed by Judith MacKenzie and her team aiming to own between 12-18 investments at any one time, engaging on both operational and board matters, ensuring management teams interests are aligned with those of shareholders.

The trust launched in May 2017, and suffered something of a hard time in 2018 (in common with many micro-cap funds and trusts). Judith and her team invest at the very smallest end of the market cap spectrum, and expect to get fully involved in the nitty gritty of sorting out a company’s problems.

They are value investors and aim to generate returns of 15% per annum from their investments by taking a private equity approach to public market investments. Of their current portfolio of 12 companies, we understand Judith has been instrumental in making 18 management changes within them.

When we met up with Judith recently, she seemed positive on the outlook for her investee companies, that with the necessary changes having been made, she is looking forward to the underlying businesses driving earnings growth which should see re-ratings in their share prices and the DSM’s NAV being driven forward.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.