Balancing our investment portfolios for uncertain times

Political events are causing sleepless nights for many investors, but not for the Saltydog analyst.

30th September 2019 13:04

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Political events are causing sleepless nights for many investors, but not for the Saltydog analyst.

On the whole I try to avoid talking or writing about politics, there are plenty of other people doing that. However, the decisions that politicians make can have a profound effect on our lives and our financial welfare. Investors don't like political uncertainty and that's what we've got at the moment.

In the United States the House of Representatives is holding an impeachment inquiry into President Trump over his request that a foreign power investigate a domestic political rival. If he's impeached, it will lead to a trial and, if they find him guilty, he'll be out of a job.

While still in power, Trump's 'chest beating' continues to stoke the trade war between the USA and China, reducing the growth of world trade. In a similar vein, there does not seem to be any end to the Iranian and American 'head to head' confrontation.

Back in the UK we've just seen the Supreme Court rule that our Prime Minister unlawfully prorogued parliament. He hasn't got a working majority and yet the opposition won't support an early election – it's a shambles. I'm still not sure if, or when, we'll leave the European Union and whether anything will have taken place by the 31st October.

As DIY investors it's hard to know how to position our portfolios.

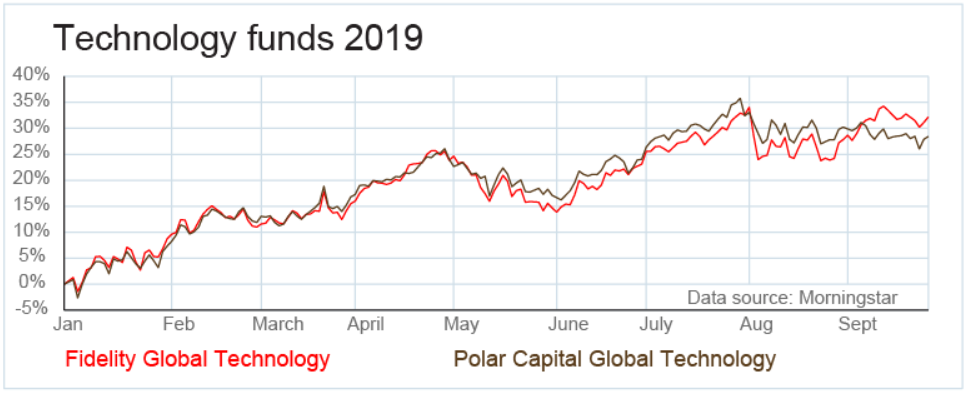

We are still holding on to a couple of 'tech' funds that we went into in January - Fidelity Global Technology and Polar Capital Global Technology.

They've performed well but have levelled off over the last couple of months. If the tensions between China and America ease, then these funds could benefit as global growth recovers.

They could get a further boost if Brexit takes place without a so-called deal and we leave under World Trade Organisation (WTO) rules. There will be an initial fall in the value of sterling which will increase the value of any funds investing overseas.We are also keeping our gold funds.

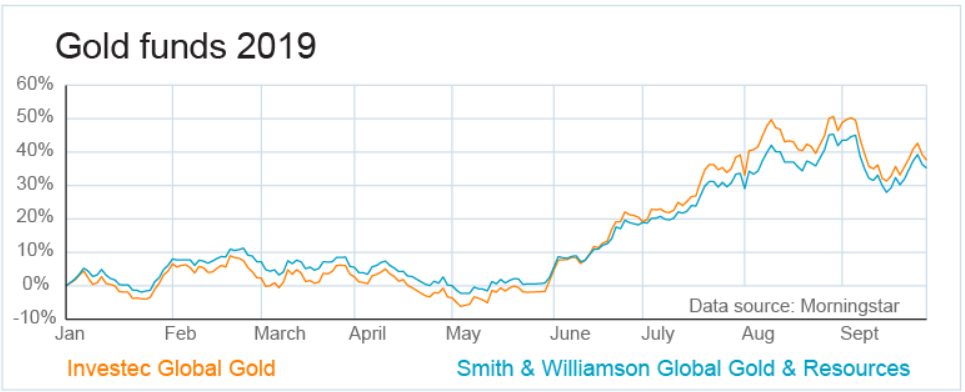

We first went into the Investec Global Gold fund in June, with the Smith & Williamson Global Gold & Resources fund added more recently. These funds both made significant gains between the beginning of June and the end of August, but fell sharply in the first couple of weeks of September. They have recovered a bit and would also benefit if the pound weakened. They could also do well if we see central banks reduce interest rates and increase quantitative easing, which seems likely.

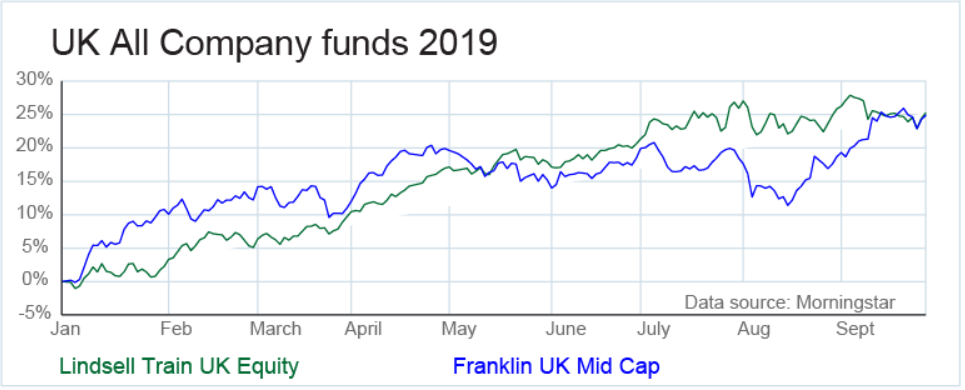

In the last few weeks we've added a couple of funds from the UK All Companies sector - LF Lindsell Train UK Equity and Franklin UK Mid Cap.

If the remainers win the day, and there is no exit from the EU, then sterling will probably strengthen, dollar invested funds will fall in value, but funds invested in the UK should do well.

In addition to these funds we still have relatively high levels of cash in our portfolios, along with less volatile funds from the Mixed Investment 40-85% shares sector.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.