Brexit vote latest: Stock market winners and losers

30th January 2019 12:58

by Graeme Evans from interactive investor

Last night's Brexit vote stirred markets into action Wednesday, but the impact on stocks varied greatly.

As we enter the Brexit endgame, today's near 1% rise for the FTSE 100 index appears to represent a step up in the London market's sensitivity to Deal or No Deal uncertainty.

While other leading European indices were treading water, the UK top flight was lifted by last night's sterling weakness and the benefits this has for stocks with overseas earnings.

The pound's latest lurch lower followed parliament's backing for Theresa May's high-stakes move to get Brussels to agree to amendments on the Ireland backstop.

In doing so, No Deal remains very much in view. Goldman Sachs nudged up its estimate of such an outcome from 10% to 15%, while the CBI employers' organisation said the upshot from last night's votes was that businesses would accelerate contingency planning ahead of March 29.

And for private investors, there's still no relief from the "Bretigue" that we highlighted in our recent Brexit flash poll. Almost half of investors told us earlier this month that they have an investment strategy in place and are going to stick to it, regardless of Brexit.

But as trading today has demonstrated, political developments and the resulting movement in the pound are having an increasingly strong bearing on stocks. On a day when other markets were on edge due to forthcoming US-China trade talks and Federal Reserve interest rate guidance, London-listed miners and other overseas-focused stocks were up as much as 3%.

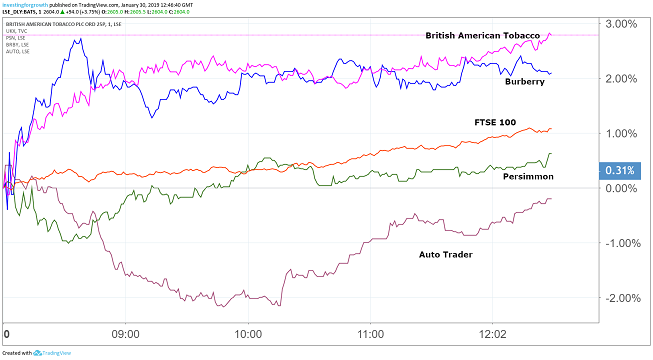

Some 70% of revenues generated by FTSE 100 companies come from outside the UK, making a weaker sterling usually beneficial for companies trading in US dollars. British American Tobacco (LSE:BATS), for example, jumped by 3% as it continues to consolidate after being the top flight's worst-performing stock in 2018.

Rival Imperial Brands (LSE:IMB) added 2% while Burberry Group (LSE:BRBY), which is heavily focused on Asian markets, rose 2.5% and packaging firm DS Smith (LSE:SMDS) charged ahead almost 3.5%.

In contrast, domestic-focused stocks struggled for momentum as Auto Trader (LSE:AUTO) slipped 1% and Marks & Spencer (LSE:MKS) also fell. Domestic banks including Lloyds Banking Group and Barclays (LSE:BARC), and housebuilders Persimmon (LSE:PSN) and Taylor Wimpey (LSE:TW.) were all lower at the opening bell, although have since attracted buying interest. The FTSE 250 index, which is much less driven by overseas earnings than its blue-chip counterpart, was barely changed.

Source: TradingView Past performance is not a guide to future performance

Our head of markets Richard Hunter notes that the FTSE 100 is now 2.5% ahead for the year-to-date, despite the wide berth that institutional investors continue to give London's top flight.

He said: "There are some signs that the traditional twin investment themes of "bottom up" and defensive positioning are coming through.

"Specific stock selection has seen the retailers and the housebuilders, such as Persimmon, enjoy a strong start to the year. Meanwhile, from a defensive perspective, the tobacco stocks in particular have had a positive couple of days.

"These combining factors illustrate that there is still value to be had within the index, even if overarching sentiment remains fragile."

This sentiment is reflected in the latest growth forecasts, with analysts at UBS now expecting the UK economy to expand by 1.5% in 2019, rather than the 1.8% previously forecast. It has also cut its estimate for 2020 from 1.3% to 1.2%.

They added: "For the time being we remain wary of taking directional views on sterling and UK assets.

"Although much seems like it has changed, the reality is that very little has. The options facing the UK are narrowing in on either accepting May's withdrawal agreement or delaying Article 50 to seek an alternative path.

"Within portfolios, exposure to sterling-denominated assets should be maintained at benchmark levels until more clarity emerges."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.