Tesla: stock of the future or better prospects elsewhere?

Despite a recovery from tariff crash lows, there are still doubts about the long-term future of Elon Musk’s electric car company. Analyst Rodney Hobson reveals what he thinks.

4th June 2025 07:57

by Rodney Hobson from interactive investor

Shares in Tesla Inc (NASDAQ:TSLA) bounced off the bottom after founder Elon Musk started to distance himself from US President Donald Trump. Investors must decide whether Musk’s doubtful decision to align himself with a trade-war president will have a long-term effect or prove to be a passing setback.

While Trump is seen as a saint among his American worshippers, he has seemed determined to present himself as a devil in international circles. Musk has learnt the hard way that doing deals with the devil is a sure-fire route to damnation.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Every week there seems to be news about a sharp fall in sales of Tesla cars, once seen as the pioneers of all-electric motoring and ultimately driver-free vehicles. Pioneers often cop for all the expense and anguish but none of the ultimate rewards, and so it may well prove with Tesla.

Sales of Teslas in Europe in April were less than half the level of the same month in 2024, following a trend that had already been established earlier this year and one that seems to be gathering momentum. This is despite a continuing surge in electric cars on the Continent. China, the main but far from only target of Trump’s tariff barriers, was the big beneficiary, but Volkswagen AG (XETRA:VOW), Bayerische Motoren Werke AG (XETRA:BMW) and Renault SA (EURONEXT:RNO) have also overtaken Tesla in their European home base.

Rivals have done this mainly with traditional fuel vehicles but ominously they have launched hybrid and electric ranges to challenge Tesla further.

Tesla reported revenue in the first quarter of 2025 down 9% year on year to $19.3 billion, even lower than pessimistic analysts were expecting. Operating profits slumped 66% to $399 million.

Sales worldwide fell 13% despite some discounting on prices. This was partly, but only partly, due to production as the company upgraded its Model Y standard-bearer. However, this highlighted another problem. Tesla’s range, which once led the world, is now seen as falling behind.

- Buffett, Wall Street and heroic retail investors: who’s right?

- Can Mag 7 tech rally continue after best month in two years?

Chinese rival BYD is outselling Tesla in Europe for the first time. It has just launched a new electric saloon similar to Tesla’s Model 3 but at little more than half the price. Even if Europe and other countries follow Trump’s lead in erecting tariff barriers against Chinese manufacturers, BYD’s model will probably still be cheaper.

Musk has now stepped back from his job wielding a chainsaw to American government bureaucracy and has even voiced some hints of disillusion over Trump’s policies. But there are serious doubts about whether he can recover quickly from an association that saw his premises firebombed and his cars scratched with keys.

He has a struggle on his hands. Tesla is expected to continue to offer discounts, with the average sales price slipping from $39,720 to $38,300 by this time next year. At the same time, he needs to tackle supply chain problems at Tesla’s energy business, which is dependent on China. Switching to suppliers in other countries subjected to lower tariffs will take time.

The immediate focus is to abandon the plan to grow volumes and to concentrate instead on maintaining a strong balance sheet. At least Tesla is back to generating cash.

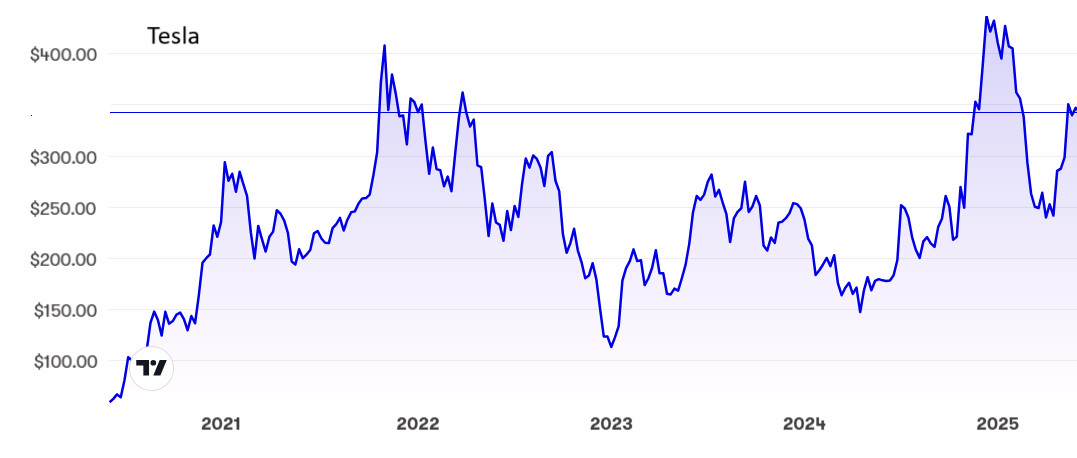

Source: interactive investor. Past performance is not a guide to future performance.

- Tech funds top the performance charts once again

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Tesla shares peaked at $480 in December but were already falling before the Trump administration took office. They bumped along the bottom just above $220 in March and April, but news that Musk was to concentrate on the business once more prompted a recovery to $363.

However, the stock may already be giving way to reality. It is falling again at $344, where the shares are still on a fantastic rating of nearly 200 times earnings.

Hobson’s choice: Tesla will continue to delight short-term traders as the stock swings wildly under the conflicting influences of optimists and realists, but there are just too many potential problems to justify buying for the long term. Sell. There are better prospects elsewhere.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.