Can investment trust dividend heroes extend winning streak?

We examine whether trusts that raise dividends every year can keep doing so indefinitely.

19th November 2019 09:54

by Fiona Hamilton from interactive investor

We examine whether trusts that raise dividends every year can keep doing so indefinitely.

The Association of Investment Companies (AIC) likes to trumpet the achievements of its dividend heroes, and rightly so.

It is no mean feat for trusts to have raised their dividends every year for at least the past 20 years, especially as the majority have raised them by more than the rate of inflation. This is great for investors who rely on dividends from their trust holdings to support their lifestyles; however, it begs the question as to how much longer these trusts can keep it up.

Has the growth in dividends come at the expense of growth in net asset value (NAV) per share or without dividends reinvested, as reinvested dividends are the assets which must generate future dividend growth?

Have the trusts done everything possible in structural terms to enhance their earnings per share, and will they now have to rely even more than before on securing higher dividends from their holdings?

Have they benefited from exceptionally helpful circumstances over the last decade, and could future developments be substantially less helpful? If so, have they used the good years to build their revenue reserves to levels which will allow them to keep on raising their dividends regardless of static or depleted earnings per share – as Scottish Investment Trust (LSE:SCIN) did in the noughties and F&C Investment Trust (LSE:FCIT) did in the first half of the last decade?

If markets suffer a steep setback and the only way to keep raising their dividends is to finance them at least partly from capital reserves, would it upset their supporters?

- Income hunters can find great funds on ii’s Super 60 recommended list of investments

- Get broad exposure to financial markets through this ii Super 60 recommended fund

For this article we have focused on the 16 trusts that have raised their dividends for at least the last 30 years, noting that the majority focus exclusively on quoted equities because these offer "the best opportunity to enjoy inflation-beating growth in income and capital over the long run", to quote the strategic report of Scottish American (LSE:SAIN).

Starting with growth in net asset value (NAV) per share, it is encouraging that in all but one case the average annual increase over the past decade has been at least double the average annual increase of 2.5% in UK consumer price inflation, and in the case of the global trusts it has been far higher.

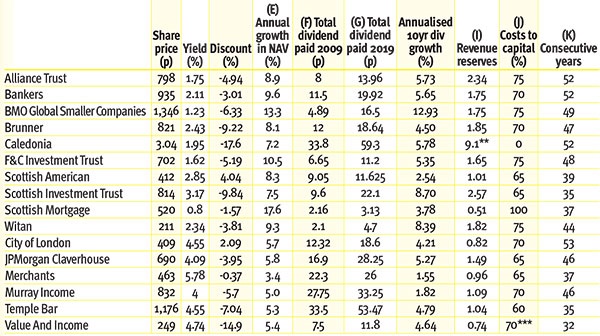

16 trusts that have raised their dividend for at least 30 years

Notes: Figures to end August 2019 provided by the AIC. ** Equating retained earnings to revenue reserves, on the advice of the company secretary. *** 70% of investment management fees, but 0% of interest costs. E annual average growth in NAV per share over 10 years, with no dividends reinvested. F and G dividends paid in the 12 months to end August. I number of times the current revenue reserves can cover the current financial year of dividends, including estimates and forecasts. J percentage of management fees and finance costs charged to capital. K number of consecutive increases in annual dividends. Source: AIC/Morningstar

Maintaining competitiveness

Nor has the need to pay out dividends rendered our heroes uncompetitive in terms of NAV total returns. On the contrary, Bankers (LSE:BNKR), F&C Investment Trust (LSE:FCIT), Scottish Mortgage (LSE:SMT), Witan (LSE:WTAN) and Scottish American all currently boast 10-year NAV total returns in excess of the MSCI AC World index. Similarly, all the UK equity income heroes have achieved 10-year NAV total returns comfortably in excess of the FTSE AllShare, and even further ahead of the FTSE High Yield index.

Turning to the measures they have taken to enhance their earnings per share: most of our heroes have managed to trim their costs by reducing their fees and/or controlling their running expenses, while some can spread their overheads more widely, having issued a lot more shares. Witan, for instance, has reduced its ongoing charges from around 1% a year up to 2015 to 0.83%; Scottish American has reduced them from 1.02% in 2009 to 0.76% last year; and Scottish Investment Trust has cut them from 0.79% in 2012 to around 0.5%.

City of London (LSE:CTY), which has raised its dividend in each of the last 53 years, has become exceptionally frugal. Although its ongoing charges have been impressively low for some time, it squeezed them down from 0.41% to 0.39% for the year to June 2019, and they are expected to be lower still this year as CTY gets a full year's benefit from the reduction in its fees to 0.325% of net assets from January 2019.

CTY has boosted its earnings per share by charging 70% of management and interest charges to capital for well over 10 years. So too has its globally oriented stablemate, Bankers, which has an equally long dividend growth record.

Murray Income (LSE:MUT) raised its allocation from 50% to 70% in July 2018, and other trusts which have been more reticent on this front could do likewise, or they could join Witan with a 75% allocation to capital, as Alliance Trust (LSE:ATST) did in 2018. However, Scottish Mortgage's decision to charge 100% to capital would be hard to emulate, as SMT justifies it by saying that although it expects to continue paying a small and growing dividend, shareholders should anticipate that returns will primarily come through long-term capital appreciation.

A lot of dividend heroes use gearing to enhance their yields, and the decline in UK interest rates over the last decade has allowed them to do so on much more attractive terms. The resultant boost to earnings per share and total returns has been particularly significant for trusts such as Brunner (LSE:BUT), F&C Investment Trust and Merchants Trust (LSE:MRCH), which have been able to replace expensive long-term debentures with much lower-cost borrowing.

For instance, Witan's 2016 redemption of its £44 million 8.5% debenture helped cut its average borrowing costs from 7% to 4.6%, and subsequent borrowing on ever tighter terms has lowered them to 3.8%. City of London, Bankers, JPMorgan Claverhouse (LSE:JCH), Scottish American and Merchants all have expensive debt due to be redeemed over the next four years.

All look vulnerable to strengthening sterling

While some dividend heroes have scope for more self-help on the above fronts, all of them look vulnerable to a strengthening in the pound. Sterling has fallen by over 20% against the dollar in the past 10 years, with particularly weak runs in 2016/17 and again this year.

This has boosted the sterling-converted NAVs and income streams of the global trusts, and also of UK equity income trusts with significant exposure to overseas companies or substantial holdings in UK multinationals.

If a resolution of the Brexit saga leads to a bounce in sterling, it will negatively impact the NAVs and earnings streams of all these heroes.

Another worry is the potential slowdown in global growth. It has been relatively robust over the last decade, helping companies to make more money.

Their distributable earnings have been further enhanced by cuts in corporation tax, notably in the US; dividends have increased even faster as payout ratios have risen from 30% to 40% in the important US market, and are also much higher than they used to be in Europe, Japan and the UK.

With companies in many regions worrying about the US/China confrontation and Europe struggling to avoid recession, both earnings and payout ratios could be under pressure, making the current deceleration in US earnings per share growth to around 1.5% an unwelcome harbinger of tough times to come.

Happily, most of our heroes are reasonably well-placed to keep their dividends rising through several lean years, as they have used recent fat years to enhance their revenue reserves per share. This has been hardest for trusts which have issued a lot of new shares, as it means their revenue reserves per share are diluted.

Issued capital could be an issue for some trusts

City of London, for instance, has grown its issued capital by over 80% over the last nine years, which helps explain why its revenue reserves per share are relatively modest, at 0.82 times last year's payout. However, manager Job Curtis considers this "ample", especially as he believes "low to mid single-digit percentage dividend growth is a realistic medium-term estimate."

In contrast, extensive buybacks by F&C IT have shrunk its issued capital by around 20% over the last 10 years, allowing the remaining shares to qualify for a larger share of its revenue reserves. In addition, its earnings per share – and therefore its dividend cover – have been usefully enhanced by the December 2014 replacement of its £110 million 11.25% debenture with much cheaper short-dated debt, by raising the percentage of management fees and interest charges allocated to capital from 50% to 75% in January 2015, and by whittling its ongoing charges down from 0.87% to 0.65%.

Just as importantly, FCIT's earnings per share have been bolstered by shifts in its portfolio, notably the 2013 launch of a global income portfolio, which manager Paul Niven says has provided "a useful yield pickup", and a gradual reduction in the trust's double-digit exposure to private equity, which had performed well in capital terms but had no yield.

Interestingly, Niven is currently reversing both changes, running down the global income portfolio and restoring private equity exposure to around 10%. In explanation, he says FCIT is not a high-yield trust, and although income is important the main emphasis is on total return. With earnings cover in reasonable shape and substantial revenue reserves, he no longer feels the need to chase income.

Looking ahead, he says: "Markets have had a very strong run, and there is a lot of uncertainty on the macroeconomic front which could impact earnings in the short term, but we can use revenue reserves if need be. The trust has come through a number of big events in the last 146 years, some of which have led to a marked fall in the revenue account, but it has paid a dividend every single year since launch, and raised it in each of the last 48 years, and I am confident it will continue to do so."

If the next bear market proves more ferocious and sustained than either Curtis or Niven seem to expect, and our heroes start to run out of revenue reserves, they could in theory maintain their income growth records by dipping into their capital reserves. After all, the market has welcomed the decision by trusts such as BMO Private Equity Trust (LSE:BPET), Invesco Perpetual UK Smaller Companies (LSE:IPU) and JPMorgan Global Growth & Income (LSE:JPGI) to boost their dividends in this way.

However, there have been worries that while paying these "enhanced dividends" may not be damaging in normal market conditions, it could result in a dangerous depletion of assets in the type of extreme setback under discussion, so hopefully it will not occur.

Scottish Mortgage has already exhausted its revenue reserves and is dipping into its capital reserves to pay its dividends, but as in so many things it is the exception which proves the rule. Notably, SMT's yield is far lower than that of any of our other heroes, so the impact on its capital reserves is, to quote its chairman Fiona McBain, "relatively immaterial".

In addition, the following quote from SMT's latest report and accounts hints that it may not be sustained indefinitely:

"The board will continue to keep the dividend policy and use of the realised capital reserves under review."

Revenue reserves

Investment companies are uniquely well-placed to achieve a sustained run of dividend increases, because they do not have to distribute more than 85% of their earnings per share each year. The balance can be transferred to their revenue reserves, and drawn down in years when earnings per share fall short of the trust's dividend target. Other forms of pooled funds are not allowed to hold back part of their revenue in this way, so their distributions are more erratic and less consistent.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.