Check out five of China’s top stocks

Emerging from coronavirus crisis stronger than most, investors risk missing out if they ignore it.

22nd July 2020 09:34

by Rodney Hobson from interactive investor

The world’s second largest economy is emerging from the coronavirus crisis stronger than most countries and investors risk missing out if they ignore it, believes our overseas investing expert.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Attacked from all sides, China looks to be a dubious place to invest. It remains under the control of an authoritarian regime that puts political stability above openness and transparency. Yet the world’s second largest economy is emerging from the coronavirus crisis stronger than most countries and investors risk missing out if they ignore it.

It has to be said that China is not for the squeamish. Its record on human rights, particularly in Tibet and currently among the Uighur minority in the West, has brought much opprobrium. It is all very well for the Chinese authorities to protest about foreign interference in the country’s internal affairs, but if you seek to take your place on the world stage you will be subject to international standards.

China is upsetting its Asia neighbours with territorial claims involving distant islands such as the Spratleys that are of little value in themselves, but greatly expand China’s territorial waters and offshore oil exploration rights.

- Invest with ii: Buy International Shares| Free Regular Investing | Super 60 Investment Ideas

Although trade tensions with the United States have faded somewhat into the background, the issue of whether telecoms company Huawei is using its technology to spy on Western countries has become more vocal.

The blocking of the company in the US and the UK is potentially a serious setback to China’s trading position with the developed world. For the first time, the West has dared to stand up to the Eastern superpower.

- Polar Capital Technology Trust: the best tech company I’ve ever owned

- Global small cap investment trusts: which one is best?

- Scottish Mortgage investment trust on Tesla, Amazon and Zoom

For British investors, perhaps the biggest obstacle lies in the former colony of Hong Kong, where Beijing has tightened its grip after months of protests and rioting. The prosperity of the entire country is not so heavily dependent on maintaining contact through Hong Kong, but the tiny enclave is still important as a financial centre.

Although there has been some evidence of a second wave, China went into the Covid-19 crisis first, got on top of the outbreak first and is among the first countries getting back to normal.

China had been posting annual economic growth of around 6% before the lockdown that affected large parts of the country. The fall of 6.8% in the first quarter of 2020, while the rest of the world was still growing, was disappointing but, in the event, turns out to be not too bad. Western nations including the US and UK have subsequently been affected more severely.

Now, China has bounced back 3.2% in the second quarter, pretty good going in the circumstances, even if it is weak by past standards. That growth depended heavily on stimulation from Chinese Government special measures, but factories are reopening, a positive sign. Negative factors are a continuing fall in retail sales and the potential impact of a global slowdown on China’s export-led economy.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Be first to watch our interviews with top fund managers by clicking here

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

There is some suspicion that China fiddles its economic figures, so any independent confirmation of improvement is welcome. One of the world’s largest mining groups Rio Tinto (LSE:RIO) gives an independent view. It says sales of iron to China rose by 1.5%, with the economy there improving through the second quarter and apparently stabilizing.

Although China has its own stock exchange in Shanghai, investors should prefer to invest through the better regulated Hong Kong Stock Exchange, or by buying American Depository Shares (ADRs), a form of proxy shares, in New York.

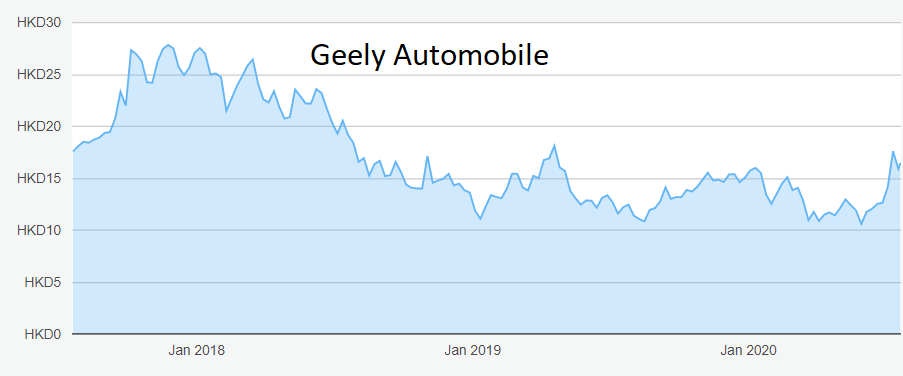

Hobson’s choice: Possibles to consider include Geely Automobile Holdings (SEHK:175) is a Hong Kong-based company that makes and sells vehicles in China and various other countries. I suggested buying at HK$17.70 in April last year and, despite the upheaval since, they are down only to HK$16.50. Buy up to my previous buy level.

Source: interactive investor. Past performance is not a guide to future performance.

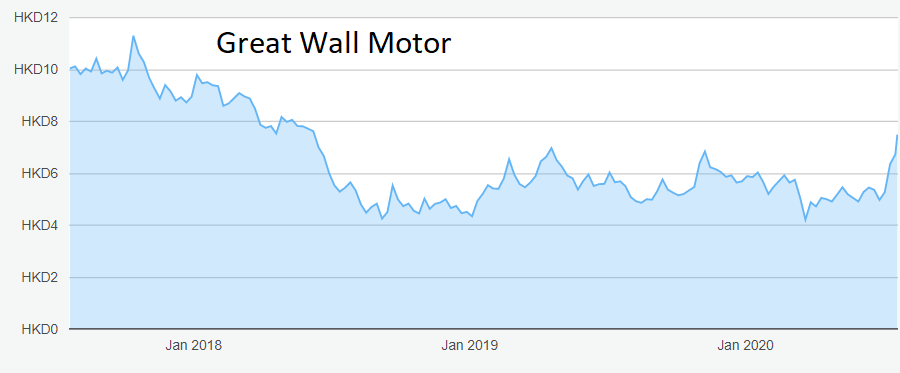

Great Wall Motor (SEHK:2333) is an alternative. It makes SUVs, sedans and pick-up trucks plus vehicle parts and components. It was available 15 months ago at HK$7, which I suggest was preferable to Geely, and so it proved. Still a buy at the current HK$7.50.

Source: interactive investor. Past performance is not a guide to future performance.

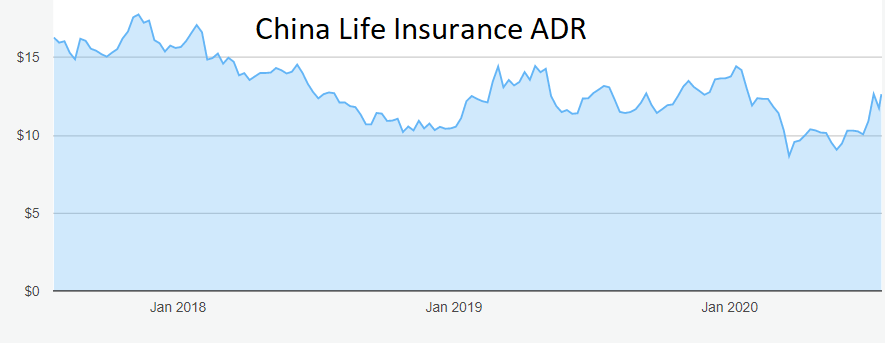

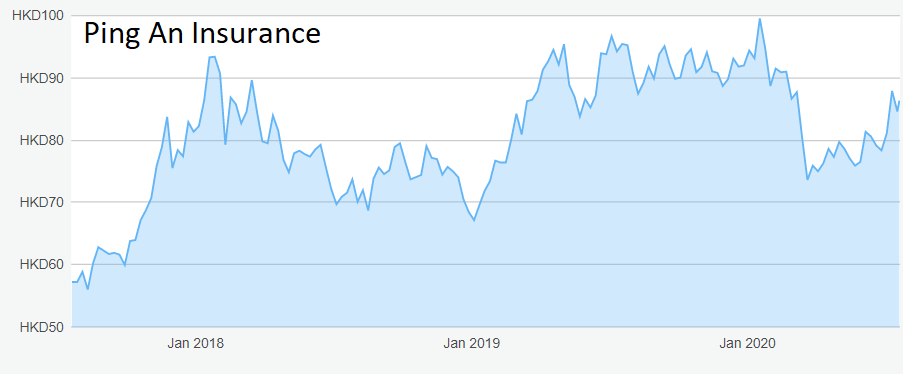

China Life Insurance (NYSE:LFC) is available in ADR form at $12.59, which looks good value with a 4% yield, while Ping An Insurance (SEHK:2318), which I rated less compelling in April last year, is down from HK$93.35 to a more attractive HK$86.35.

Source: interactive investor. Past performance is not a guide to future performance.

Source: interactive investor. Past performance is not a guide to future performance.

China Resources Pharmaceutical (SEHK:3320), one of the largest drug distributors to hospitals in China, has had a disastrous couple of years, falling from HK$12 to HK$4.63. The fall has been overdone. Buy below HK$5 for recovery.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.