A crazy world: Elementis up 200% today, Dart Group down 52%. Why?

Reaction to updates from these popular stocks demonstrates the unpredictability of markets now.

19th March 2020 13:16

by Graeme Evans from interactive investor

Reaction to updates from these popular stocks demonstrates the unpredictability of markets now.

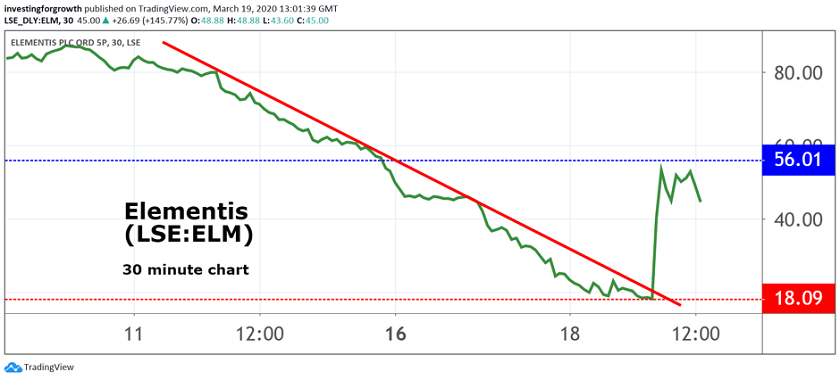

A 207% jump for shares in speciality chemicals company Elementis (LSE:ELM) provided a case study today on the near impossible task for investors seeking to put a value on Covid-19 disruption.

The spectacular rise, which came as Elementis said the pandemic was only having a “limited impact” on production and demand, put its shares back to near where they were at the start of another brutal week for global stock markets.

The highly-regarded FTSE 250 index stock, which makes ingredients for the industrial and consumer markets, is still 60% down since the start of the market sell-off on February 20.

Source: TradingView Past performance is not a guide to future performance

The performance demonstrates the current extreme levels of volatility caused by the unquantifiable impact of Covid-19, as well as how in bear markets stocks tend to get overbought on the upside and oversold on any negative news or sentiment.

In the case of companies on the front-line, such as retailer Superdry (LSE:SDRY) or Jet2 owner Dart Group (LSE:DTG), the sell-off is clear-cut when shops have been closed or flights grounded. For others the full impact of Covid-19 has yet to kick in, leaving guidance open to the interpretation of investors.

But what's clear is that all companies are battening down the hatches, with more dividends and share buy-backs being cancelled and efforts redoubled to secure additional financial headroom.

Elementis is among several stocks announcing today they will sacrifice their dividend. Despite the group boasting an average cash conversion rate of 90% over the last three years, it said the move to axe the previously announced full-year dividend would free up US$33 million.

Future pay-outs are also on hold until conditions normalise. Meanwhile, the company has secured a relaxation of its banking covenants from 3.25x to 3.75x net debt/EBITDA for the next two testing periods in June and December.

Analysts at UBS said the moves should mean that an equity issuance in order to reduce debt can be avoided in the near term, although they add that more needs to be done to reassure investors around the visibility of future cash flows.

Among the more than 40 companies providing updates on the impact of Covid-19 today, south of England developer Crest Nicholson (LSE:CRST) said it would cancel the 21.8p a share dividend it planned to pay on April 9. In addition to its dividend, gambling technology stock Playtech (LSE:PTEC) is also pausing its share repurchase programme in order to prevent over 65 million euros of cash outflows.

Insurance company Direct Line (LSE:DLG), meanwhile, has put on hold the £150 million buyback it announced alongside full-year results until the situation around Covid-19 is clearer. It had so far purchased £29 million of stock.

National Express (LSE:NEX) also warned that the 11.19p a share dividend it announced last month was at risk following a significant decline in passenger numbers. Despite this unprecedented slump, cash flows are still expected to be positive over the next three months.

Along with borrowing headroom of £500 million, the update helped to reassure investors. Shares in the coach operator rallied 11% to 100p, having fallen to as low as 70p on Wednesday from 438p in mid-February.

Dart Group finds itself in a similar position to National Express, although there was no respite for the tour operator's shares following its update made after the stock market closed last night.

Source: TradingView Past performance is not a guide to future performance

Travel restrictions have forced the company to suspend its Jet2.com flying programme until at least 1 May, with the recent focus being on a repatriation programme to bring customers home. Other uncertainties include the deposits placed to secure hotel rooms for the summer season.

AIM-listed Dart has a “strong and prudent” balance sheet with £1.5 billion of cash as of last night, along with long-term structured debt in relation to aircraft financing.

Given the escalating situation, however, it said it would accelerate actions to “underpin the stability of our business and improve cash flows”. With Dart also unable to provide guidance on the March 2020 and 2021 financial years, shares fell as much as 52% to 182.50p. They’d bounced back as high as 345p by lunchtime, but that compares with 1,890p prior to the market slump.

Source: TradingView Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.