The ‘E’ In ESG is most important factor for investment decisions, poll reveals

We share the findings of a new interactive investor survey ahead of the Climate Adaptation Summit.

20th January 2021 15:19

by Myron Jobson from interactive investor

We share the findings of a new interactive investor poll ahead of this month’s Climate Adaptation Summit.

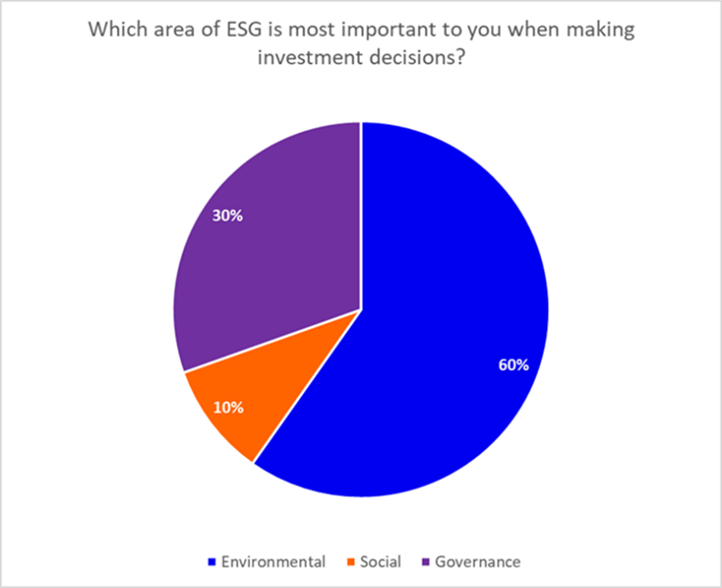

A new poll by interactive investor, ahead of the Climate Adaptation Summit due to take place on 25-26 January 2021, found that 60% of investors say the ‘E’ (for environmental) in ESG is most important to them when making investment decisions.

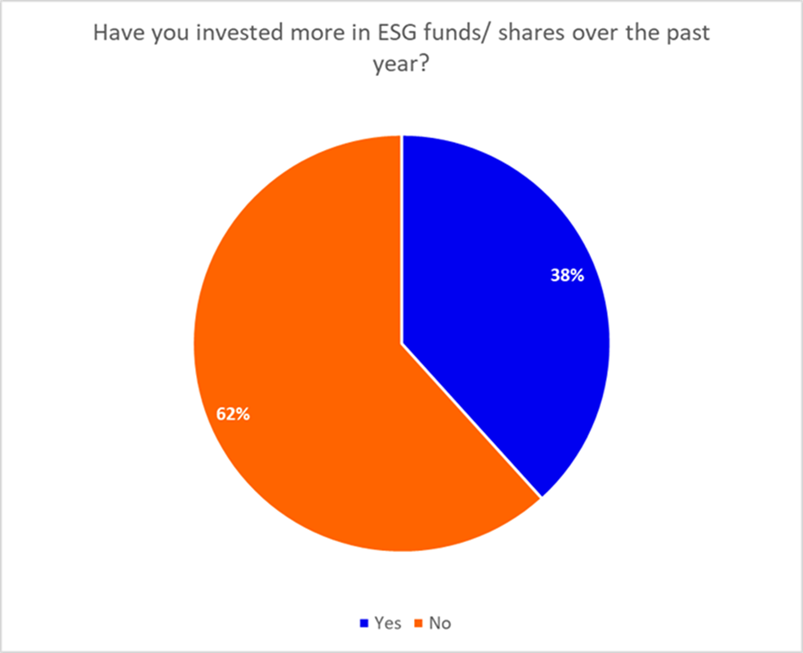

The poll of 2,347 interactive investor website visitors, between 7 and 11 January 2021, also found that almost two-fifths of investors (38%) actively invested more in ESG funds/shares over the past year.

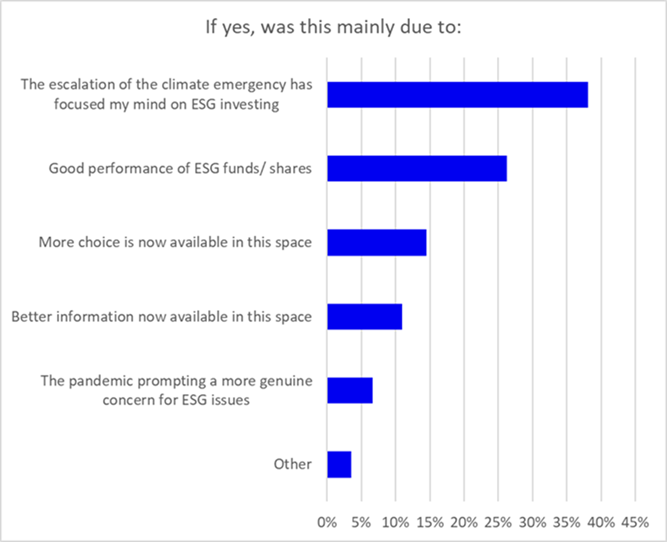

Of those who invested more in ESG investments over the past 12 months, the highest percentage of respondents (38%) admitted that the escalation of the climate emergency has focused their mind on ESG investing.

More than a quarter (26%) cited the strong performance of ESG-related funds and shares, while 15% said it was mainly down to greater choice and 11% said better information in the ESG space. Only 7% cited the Covid-19 pandemic prompting more genuine concern for ESG issues.

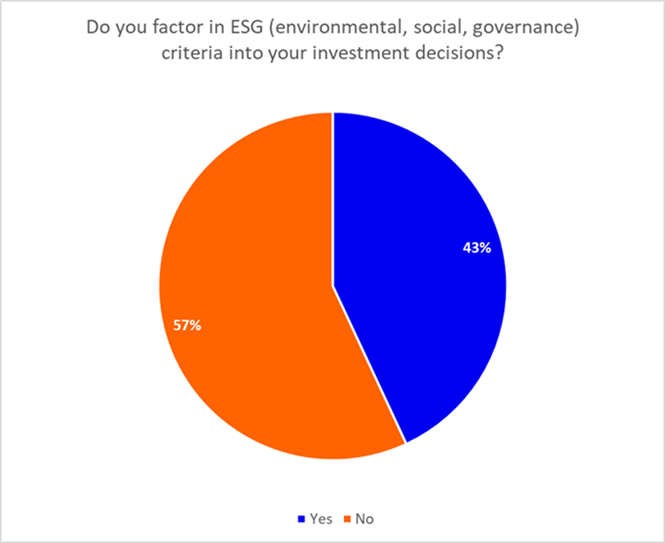

In all, 43% of respondents said they factor in ESG criteria in their investment decisions.

Myron Jobson, Personal Finance Campaigner, interactive investor, says: “Everyone has their own approach to ESG investing and for many, it’s nothing new. Many DIY investors have long done their own screening by avoiding certain stocks they find unpalatable, but there is no question that ethical investing has become more mainstream.

“The climate emergency is finally high on the political agenda, and Joe Biden has outlined an ambitious plan. It is clearly high on investors’ minds too: six out of 10 of the most-held ESG-related collective investments on the interactive investor platform are environmentally focused. The Renewables Infrastructure Group (LSE:TRIG), an investment company, is in third place, followed by iShares Global Clean Energy ETF (LSE:INRG) in fourth place, and Greencoat UK Wind (LSE:UKW) (an investment company) in fifth place. Impax Environmental Markets (LSE:IEM) investment trust is in sixth place, with Bluefield Solar Income (LSE:BSIF) and Gore Street Energy (LSE:GSF), both investment companies, are in nine and 10th place.”

ESG picks

Dzmitry Lipski, Head of Fund Research, interactive investor, says: “We like the Impax Environmental Markets investment trust, which is the UK’s largest environmental investment trust. The trust targets long-term capital growth by investing in companies offering solutions to environmental challenges, with a particular focus on alternative energy and energy efficiency, water treatment and pollution control, and waste technology and resource management (which includes sustainable food, agriculture and forestry).

“Companies involved in significant controversies that it considers violates ‘global norms’ related to human rights, labour, environment and corruption don’t make the cut.

“The trust’s investment team actively engages with companies in the portfolio to improve practice and disclosure across their governance and sustainability activities and views proxy voting as a key activity as part of this process.

“Having launched in 2002, the trust has an 18-year track record but has seen its performance go from strength to strength since 2016, when investors began to take a closer interest in ESG factors.”

Royal London Sustainable Diversified Trust

“We like the Royal London Sustainable Diversified Trust. Constituents of the ethical multi-asset fund are picked because they are deemed by the fund’s investment team to have a net positive benefit on society, either through the products and services they offer, or in the way they conduct their business.

“Sectors considered more favourably for the fund include healthcare and technology. Common ethical investing no-nos, including tobacco, armaments and animal testing are stripped out the fund’s investment universe entirely.

“The strategy is managed by Mike Fox on the equity side and Richard Nelson on the fixed income side. They have been managers since launch in July 2009. The managers have built a respectable track record, ranking in its top quartile since inception.”

interactive investor published a long list of more than 140 socially responsible and environmental funds, investment trusts and ETFs available on the platform in 2019, broken down into three interactive investor ACE investment styles: Avoids, Considers and Embraces, to help investors navigate the list.

ii also offers an ethical rated list, recently renamed ACE 40, to reflect the growth in the number of ethical collective funds it rates.

In addition, ii also launched its ethical ready-made growth portfolio a year ago.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.