Ethical fund demand cools as performance comes under pressure

4th May 2022 12:27

by Kyle Caldwell from interactive investor

Kyle Caldwell considers whether ethical funds will retain investors if performance continues to suffer given the market rotation.

The first three months of 2022 saw the biggest quarterly slowdown for three years in the amount of money invested in ethical or sustainable funds on a global basis.

The findings, from data provider Morningstar, show that global sustainable funds attracted close to $97 billion (£77 billion) of net new money in the first quarter of 2022, representing a fall of almost 36% compared to the fourth quarter of 2021.

However, such funds held up notably better than the broader market, which saw inflows slump by 73% over the period; attracting $138 billion versus $517 billion for the fourth quarter of 2021.

The findings come at a time when ethical fund performance has come under pressure owing to the market rotation that’s played out on the back of high inflation levels and rising interest rates, which has benefited value shares at the expense of growth shares.

- Funds Fan: recession tips, funds vs trusts, and Japan fund interview

- Investors dump funds: here’s what they are selling

- Why investors are retreating to passive funds as markets fall

Value shares are seen as more attractive as they offer ‘jam today’ since their valuations are not based on producing high profits in the future. Among the winners are miners and oil firms, two sectors that many ethical funds tend to screen out. As well as the market rotation, companies in those sectors are also benefiting from the soaring oil price, which has been further elevated by Russia’s invasion of Ukraine.

Technology and other growth shares, however, have their more expensive valuations hinged on their future earnings potential. Such companies are negatively impacted by high inflation and increases in interest rates because both devalue their expected future earnings.

Ethical funds tend to favour technology stocks due to their lower carbon footprints and the social good they often provide, such as clean energy technology, access to education resources or medical breakthroughs.

The performance of interactive investor’s ACE 40 list shows how much of a tough period the first three months of the year were for ethical funds. Just three funds delivered a positive return: VT Gravis Clean Energy Income, the iShares Global Clean Energy ETF and FP Foresight Global Rl Infrastructure.

In a recent update, the fund managers of Montanaro Better World, the second-worst performer over the quarter in the ACE 40 with a loss of 17%, explained that: “It has been a painful quarter for quality growth managers like us. Our funds recorded one of the worst months ever in relative terms in January. The reason for this was a dramatic style rotation from growth to value, one of the fastest that we have witnessed in over 30 years of managing small and mid-cap portfolios.

“The swift change in sentiment was due to a burst of global inflation, which stoked fears of interest rate rises and disproportionately hurt long-duration assets, notably growth small and mid-cap equities.”

Market rotation a headwind for ESG funds

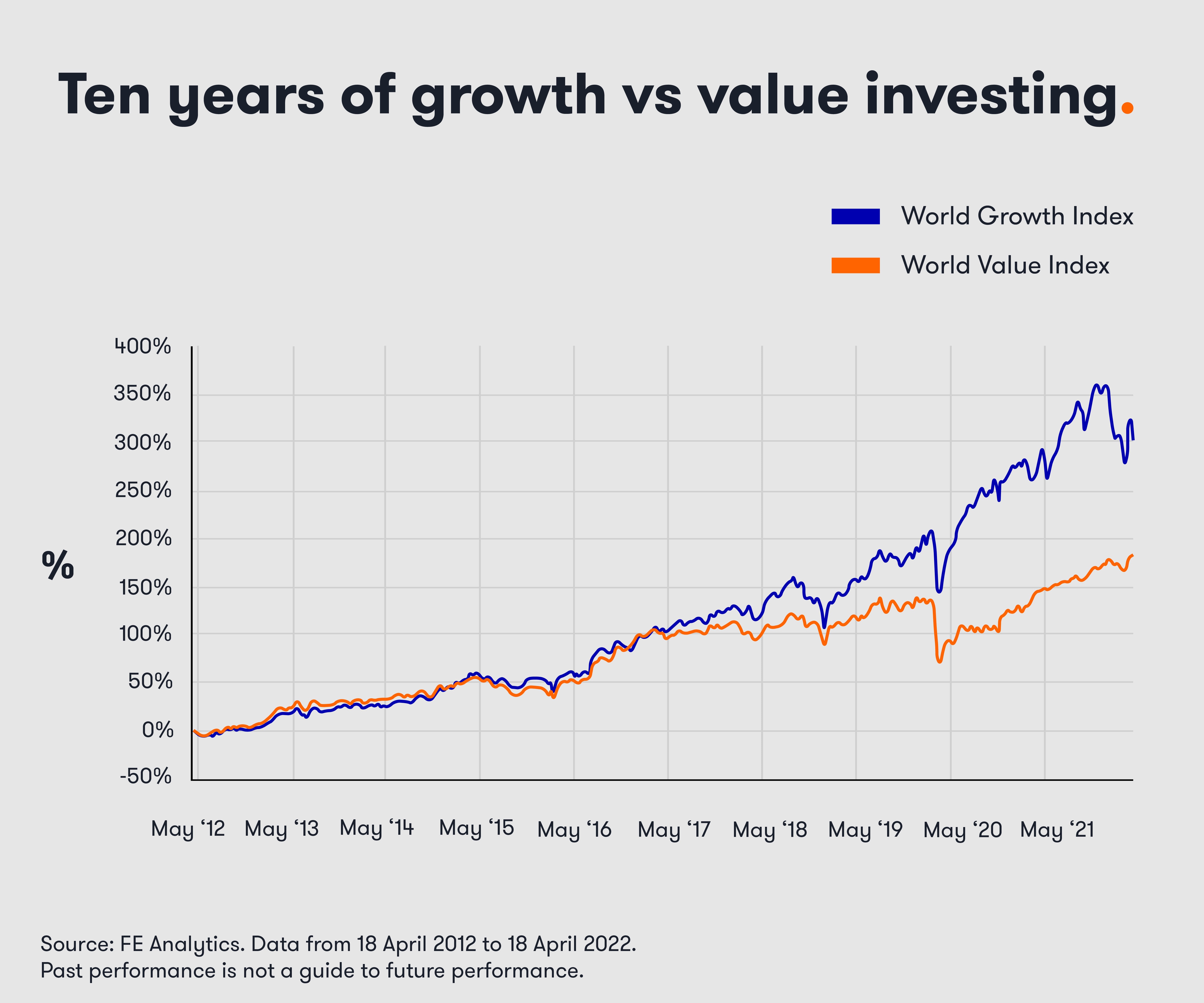

There’s been various predictions over the years of when the value style of investment would make a comeback, having been notably beaten by growth shares over the past decade, as the chart below shows.

Monetary policy is now tightening as central bankers attempt to cool inflation.

Ian Lance, co-fund manager of Temple Bar (LSE:TMPL) investment trust, which invests in value shares, argues that this backdrop will prove to be a headwind for funds that place great emphasis on environmental, social and governance (ESG) factors.

He said: “ESG funds are a proxy for growth with almost perfect correlation. Often the top 10 of growth funds and ESG funds are nearly identical, for example, Microsoft (NASDAQ:MSFT), Tesla (NASDAQ:TSLA), etc.

“We think that a change in the macro backdrop from low inflation and low interest rates to high inflation and higher interest rates will cause a regime change from growth to value and, hence, ESG funds are likely to do poorly from that point of view.”

- Our jargon buster runs through all you need to know about ethical investing

- ii Top 10…ways to avoid greenwashing with funds

Simon Holman, a partner at Castlefield Investment Partners, an investment management and financial planning business that specialises in responsible ESG investing, acknowledges that the market rotation has “undeniably been a headwind”.

He added: “Our perception is that it will be a short-term headwind that over the long term (five to 10 years) will come out in the wash.

“Our view is that if you are doing ESG properly, you should not invest in oil and gas companies. While shares in the sector have been performing well of late, it was not long ago that it was seen as a benefit to not being invested in the sector when the oil price crashed.”

Will investors keep their money in or pull it out?

As the Morningstar stats show, globally ESG fund demand has been holding up better than the wider market.

In the UK, funds classed by the Investment Association (IA) as ‘responsible investment funds’ received inflows of £670 million in February. This bucked the wider trend, as overall £2.5 billion was withdrawn from funds, with most sales being bond funds.

Holman makes the point that investors in ESG funds are in it for the long term. He adds: “If the market rotation goes on a bit longer, I would like to be confident that the majority of investors would keep their money invested. There will always be some investors trying to catch waves of whatever is doing well, but I do think that ESG investors are committed investors who have more of a longer-term outlook.”

Patrick Thomas, head of ESG portfolio management at Canaccord Genuity Wealth, agrees that ESG fund money is sticky. “Such funds invest very differently from an index – in part due to what they don’t own – so it is only natural that there will be short-term periods when performance lags.”

And finally, Hortense Bioy, global director of sustainability research at Morningstar, says:“Sustainable funds currently face macroeconomic headwinds and while this is a decline in net new investments, continued investor appetite remains as inflows into sustainable funds were more resilient than those into their conventional peers.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.