FTSE for Friday: UK market slightly less optimistic than the US

5th August 2022 09:44

by Alistair Strang from Trends and Targets

Despite the Bank of England's predictions, the markets don’t seem to be embracing the concept of a recession, observes independent analyst Alistair Strang.

There's something distinctly strange going on, as evinced by the Bank of England on Thursday. By announcing a long recession, along with the deepest plunge in living standards ever, the organisation gave a subtle hint that things may not be rosy for the next 18 months or so.

The “strange” element of all this gloom is that the markets don’t currently seem to be embracing the concept of a recession, perhaps quite the opposite. It may be the case that the current boost in corporate profits, due to price gouging, will face payback.

With the service sector announcing its worst month since the pandemic lockdown started, maybe we are seeing the opening salvo of what is to come. It’s also quite curious, with crude oil prices now flirting with a reversal cycle (ie, Brent crude to $77 looks possible), we can entertain a faint hope of a reduction in fuel costs.

- Read about how to: Open a Trading Account | How to start Trading Stocks | Top UK shares

Unfortunately, for this to become a reality, it will require oil refineries to revisit a pricing structure based on greed. Fuel prices will not experience “proper” reversal until such time that the cost of cooking a barrel of oil returns to sane levels. The current increase, from pre-pandemic $9 to between $39 and $50 to refine a barrel, may prove difficult to sustain in the face of reduced demand, due to the forecast recession.

From an immediate perspective, Wall St (the Dow Jones Industrial Average) is trading around 32,726 at time of writing. This index needs exceed just 32,914 points to suggest coming movement to an initial 33,137 points, a fairly tame increase, which simply matches the highs of June. Should such a level be exceeded, our secondary is at 33,758 points, along with a challenge against the blue downtrend for 2022. It's interesting, closure above such a level is liable to be game-changing, allowing a future cycle towards 36,875 points!

Should everything plan to go pear-shaped on Wall St, the index needs below 30,500 points (red on the chart) to risk a reversal cycle that permits a future 25,600 as a hopeful bottom. Amusingly, should such a level break, an ultimate bottom calculates around 16,000 points, undoing all the gains experienced since Donald Trump became president...

Past performance is not a guide to future performance.

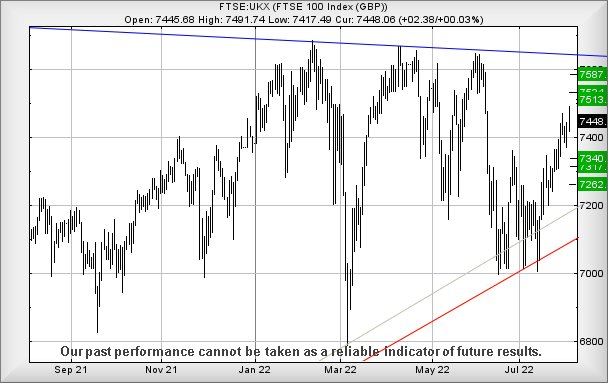

As for the FTSE for Friday, the UK market is proving slightly less optimistic than the US. As usual, there's a plethora of probable causes, the Conservative contest, Brexit, the Bank of England, August holiday time, or even the weather but, the FTSE has not been holding any lasting upwards momentum recently.

This week has been as concise in direction as a bluebottle, all calculations suggesting the market should be heading up, the market refusing to co-operate. The immediate situation is pitiful, working out with movement above 7,492 presenting a useless challenge of attaining 7,513 points next.

Even our secondary, should such a level be exceeded, is pretty dismal and works out at 7,531 points. About the only hope possible is our theoretical third target level of 7,587, but in a week where only initial targets were being attained, we are not inclined to any great hope for this ambition.

In addition, there's now a tiny little problem at 7,410 points. Should this level break, a reversal cycle to 7,340 looks possible as our initial target. If broken, our secondary calculates at 7,317 points. In this instance, a surprisingly tight stop loss level looks possible around 7,450 points.

Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.