FTSE for Friday: will the week end on a sour note?

21st January 2022 07:34

by Alistair Strang from Trends and Targets

Analyst Alistair Strang has some gloomy thoughts about Wall Street and shares his view on potential for the FTSE 100.

Just as we’d started to feel the markets were growing immune to politics, the current US President managed to spend Thursday destabilising them with his comments on Ukraine.

Until now, we’d felt the Ukraine thing was ‘just’ an excuse to ensure Russia earned higher income from gas sales during winter. Now, we’re less confident and the futures markets appear to share our fears.

At time of writing, Wall Street futures are trading around 34,686, having achieved an after-hours low of 34,525. What bothers us with this behaviour is fairly simple.

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- Why reading charts can help you become a better investor

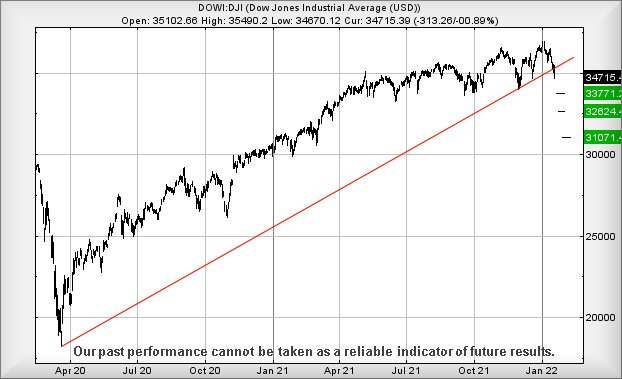

The Dow Jones had experienced a pretty solid uptrend since the pandemic low in 2020. That uptrend has now broken pretty conclusively, creating a situation where traffic continuing below 34,525 risks marching down to 33,771 next with secondary, if broken, at 32,624 eventually, hopefully with a proper bounce. Wall Street requires to exceed 35,285 points (Red on the chart below) to make a nonsense of these reversal potentials.

Source: Trends and Targets. Past performance is not a guide to future performance

As for the FTSE for Friday, a peculiar calculation demands the UK index exceed 7,634 points to extract itself from a zone where some reversal is probable.

This week has proven quite strange, the FTSE 100 ‘wanting’ to go up but clearly being restrained by external events.

Friday should prove interesting, especially as the FTSE has (so far) been relatively immune to the stock market drama’s being enacted in Europe and the USA. However, with FTSE Futures presently trading around 7,515 points, a massive 65 points below the level (7,580) at which the market closed Thursday, common sense alone suggests the UK faces a bit of a hammering on Friday.

- Shares for the future: how I’ll find great cheap shares in 2022

- Watch our new year share tips here and subscribe to the ii YouTube channel for free

We shall not be aghast if the FTSE is gapped down in the opening second, perhaps to around 7,526 points. Things risk becoming quite fragrant with any movement below such as we can calculate an initial tame sounding ambition at 7,503 points. Below 7,503 risks knocking on the gates of trouble as we can calculate a secondary and hopeful bounce level at 7,421 points.

Source: Trends and Targets. Past performance is not a guide to future performance

We shall not embrace our inner optimist unless the UK somehow scrambles above 7,588 points. In theory, this should trigger gains to 7,609 with secondary, if exceeded at 7,628 points.

We suspect we wasted our time, running these recovery calculations. Some solace can be taken from the detail that no immediate calculations are presenting the threat of reversals below Blue (7,370) on the chart. From a FTSE perspective, returning below this longer term downtrend would be “a bad thing”.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.