The fund that just hit an all-time high

22nd May 2023 14:36

by Douglas Chadwick from interactive investor

Saltydog is reaping the rewards of investing in Europe funds at the beginning of the year.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

For most of this year Saltydog's portfolios have mainly been invested in funds from the Money Market sectors or in cash.

The main reason is that although there have been quite a few sectors that have performed well from time to time, they have not been consistent.

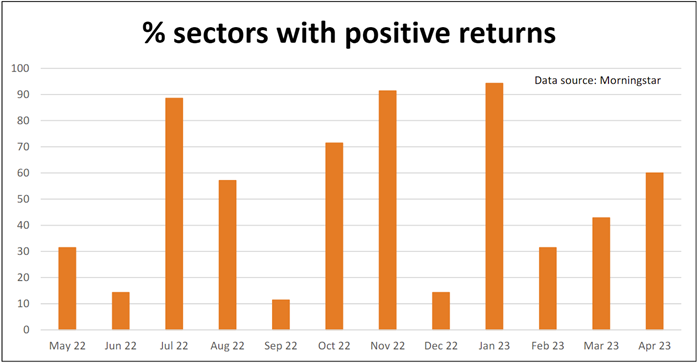

The graph below shows how many sectors have made gains in each of the last 12 months.

Invest with ii: Money Markets| Bond Yields| Tax Rules for Bonds & Gilts

You can see that last year did not finish well. In December only five of the sectors that we track (14%) rose in value: Standard Money Market, Short Term Money Market, European Smaller Companies, Asia Pacific including Japan, and China Greater China.

In January, there was a dramatic improvement with over 90% of the sectors going up, but the number dropped significantly in February. Since then, it has been rising steadily.

However, because it has been different sectors that have been doing well each month, there are only three sectors that made gains in February, March and April: Standard Money Markets, Short Term Money Markets, and Europe including UK.

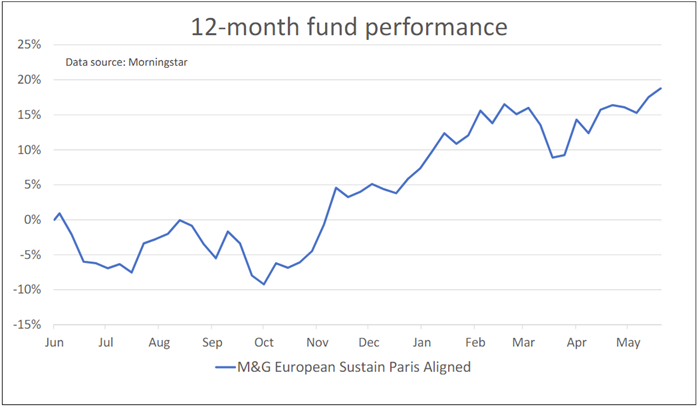

We invested in a fund from the Europe including UK sector at the beginning of this year and its one of our top performers. The M&G European Sustain Paris Aligned fund, which was launched in 1989, currently has a portfolio value of around €350 million (£304 million). As well as aiming to beat its benchmark over any five-year period, it is also committed to investing in companies that contribute towards the Paris Agreement climate change goals.

Last week it ended at an all-time high. The fund is currently showing a gain of 8.6% since we went into it on 5 January. This is how it has performed over the last year.

As you can see, it has not been totally plain sailing, but the fund has made healthy progress since the lows of last September. It fell at the beginning of March, following the collapse of several US banks and fear of contagion in Europe, but it has subsequently recovered.

Although the banking crisis did expose some problems at Credit Suisse, which was taken over by UBS, it looks as though the banking sector appears stronger in Europe than it does in the US. This could be one of Europe’s current attractions.

Another key factor is that the large European companies are still relatively cheap to own. For example, the price-to-earnings (PE) ratio of American stocks (based on the S&P 500) is around 50% higher than the European large cap stocks.

Inflation in the Eurozone is still a problem, but it is heading in the right direction. Its CPI peaked at 10.6% last October and is currently down to 7%. Not as good as in the US, but better than in the UK. However, it has not raised its interest rate as much. In Europe it is currently 3.75%, compared with 4.5% in the UK and 5%-5.25% in the US.

- Where we hold our cash to earn 4% returns

- The global funds delivering the best and most consistent returns

The problem is still the war in Ukraine. There is no sign of it ending soon which causes uncertainty, and means that European governments will have to continue providing support, using resources that could otherwise be used to boost their economies.

The European sectors did not perform very well last year. Europe including UK fell 8.2%, Europe excluding UK lost 8.9%, and European Smaller Companies fell by 21.9%. However, they have had a strong start to this year, which we hope continues.

As well as holding the M&G European Sustain Paris Aligned fund, from the Europe including UK sector, we are also invested in the Man GLG Continental European Growth fund, from the Europe excluding UK sector. We bought it in November and since then it has risen 14%.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.