Fund spotlight: North American Income Trust

interactive investor's analysts give an update and view on the North American Income Trust.

3rd April 2020 14:44

by Teodor Dilov from interactive investor

interactive investor's analysts give an update and view on the North American Income Trust.

The fund

Fran Radano, who has managed the North American Income Trust (LSE:NAIT) since 2015, aims to provide investors with an above average and progressive dividend income and capital appreciation over the long-term. The strategy has a value tilt and puts a strong focus on downside protection without comprising performance.

The mandate allows the manager to take a relatively flexible approach and, although the trust is comprised of predominantly S&P 500 constituents, he could also go into areas such as US mid- and small-cap stocks, Canadian stocks, fixed income and derivatives.

The investment selection process is well-defined, based on valuations and the quality of the business. Although the portfolio turnover is relatively low and the manager rarely changes his holdings, he is actively navigating the weight of his positions according to current valuations.

The team has a preference for stocks that usually yield 2-4%, but most importantly they are looking to invest in companies that exhibit predictable dividend yields. Meeting the management is a must and the trust does not consider building a position before engaging with company executives.

What’s in it?

Since Fran took over the management of the trust, he has been gradually reducing its fixed income exposure which is now lower than 3% of the overall portfolio and totals £334 million. As at end of February 2020 the trust had 46 holdings including 38 equity and eight fixed income positions, where the top 20 positions account for over half of the entire portfolio. Individual holdings are capped at 5% of the portfolio, although the manager has the right to go slightly over this number if necessary. New additions usually enter the portfolio with around 1.5% weighting.

Fran’s team use a variety of tools to eliminate any sector, theme or geography bias. However, due to the nature of the mandate and process, the trust is underweight in sectors that do not yield sufficient income such as Technology.

Currently, the largest sector exposures are Financials (24%), Healthcare (17%) and Consumer staples (10%), where the top three holdings include the American multinational bank Citigroup (NYSE:C) and cigarette and tobacco manufacturer Philip Morris (NYSE:PM) with 5% weight each, plus telecoms conglomerate Verizon (NYSE:VZ) with 4%.

Other holdings within the top 10 include the dividend aristocrats (US companies that have increased dividends for 25 consecutive years) AbbVie (NYSE:ABBV) (biotech), Chevron (NYSE:CVX) (Oil & gas) and Coca-Cola (NYSE:KO) (Non-alcoholic beverages). Cash available for investment is around 3.5%.

How does it perform?

| 5-year discrete performance (%) | 21/03/2019 - 20/03/2020 | 21/03/2018 - 20/03/2019 | 21/03/2017 - 20/03/2018 | 21/03/2016 - 20/03/2017 | 21/03/2015 - 20/03/2016 |

|---|---|---|---|---|---|

| North American Income Trust | -22.81 | 10.52 | -1.39 | 42.29 | 6.75 |

| Russell 1000 Value | -16.85 | 9.93 | -4.52 | 40.77 | -0.31 |

Source: Morningstar as at 21 March 2020. Total Returns in GBP

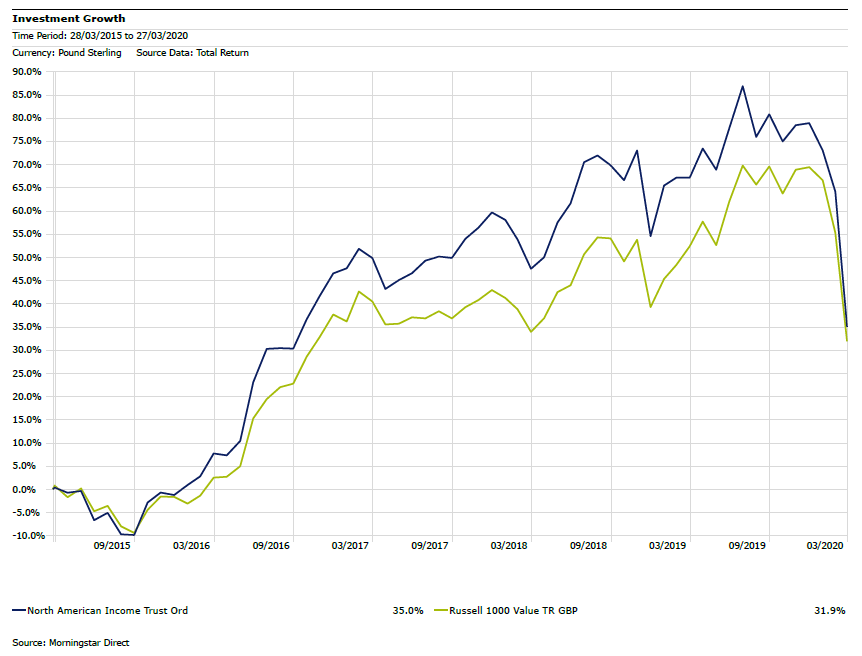

The trust has demonstrated strong returns and outperformed its Russell 1000 Value Index benchmark by 3% over a five-year period (see chart below).

The dividend yield also stands at over 4% and, although not a formal objective, the trust has been increasing its annual dividend every year since the adoption of the income mandate in 2012.

Currently, the manager does not employ gearing and the trust is trading at a 3% discount to its Net Asset Value (NAV), which might be an attractive entry point to gain exposure to quality assets. In addition, the trust has high active share (around 90%), which shows that the manager is very active in his allocation style and does not rely on benchmark weightings

The ii view

The North American Income Trust features on interactive investor’s Super 60 rated list of investments as a US Equity Income option. It is unique in its proposition to offer income sourced from North American companies and packaged in a closed-ended structure.

Dividends are distributed quarterly and, along with its risk and performance features, the trust is competitively priced in a tiered management fee structure - 0.75% of net assets up to £350 million; 0.6% of net assets between £350 million and £500 million, and 0.5% of net assets above £500 million.

This proposition may fit the needs of investors with a lower risk profile, who seek regular and progressive income combined with some capital appreciation. The trust could form part of a core portfolio or be used as a complementary income engine.

- Find out why this fund is on the ii Super 60 investments list

- Click here for more information on this fund, including price, yield and charges

If you enjoyed this article, you may also like other funds picked for interactive investor's Super 60 range of high-conviction investment ideas. Click here to find out more.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.