Fund trading: Playing it safe over the election

With the pound up sharply since the summer and possibly going higher, Saltydog analyst is taking action.

9th December 2019 13:19

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

With the pound up sharply since the summer and possibly going higher, Saltydog analyst is taking action.

At Saltydog Investor we believe that people should actively manage their investments rather than adopt the ‘buy and hold’ strategy championed by so many in the financial services industry. They say look to the long term and that you have to go through the bad times to get the good. The truth is that it’s only you who go through the bad times, their charges always seem to keep ‘them’ good.

Are you willing to be a bystander as circumstances dictate your financial future, or do you want to take control?

In this week’s General Election, the two major parties have completely different plans on how to run the country and its economy - it’s been a long time since there’s been such a dramatic contrast. If there’s a hung parliament, there’s the added confusion of minority parties having a disproportionate amount of power.

So, what action should you take? At the end of the day it is a personal decision, but it should be an informed decision.

Unfortunately, I haven’t got a crystal ball, but if the General Election on the 12th were to result in a Tory government with a working majority, then it is reasonable to expect that the value of sterling will continue to make progress against the US dollar, especially if you believe that Boris Johnson will get a sensible trade deal with the European Union.

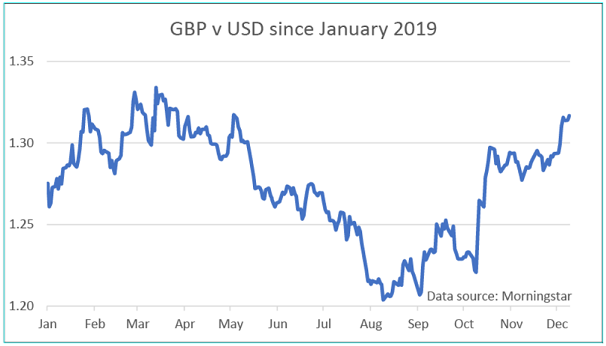

When he was first elected as Prime Minister, at the end of July, sterling was on a downward trend and at levels that we hadn’t seen since just after the EU referendum in 2016. Since then we’ve seen a strong recovery.

Today, the dollar is at over $1.31 to the pound, but before the referendum result three years ago it was $1.50 and it dropped down to $1.20 when the result was announced. It is therefore reasonable to expect that a Tory working majority will produce movement. How much is the question – well, your guess is as good as mine?

It is worth looking at the adverse percentage effect of any upwards movement in sterling on any dollar-denominated funds that are in your portfolio.

1.31 to 1.35 = a loss of 3.0%

1.31 to 1.40 = a loss of 6.9%

1.31 to 1.45 = a loss of 10.7%

1.31 to 1.50 = a loss of 14.5% (losing £1,450 for every £10,000 of investment)

What can you do? You could of course do nothing and wait out the recovery. This could make sense if you only have a small percentage of your portfolio in dollar denominated funds. If, however, you have a larger amount, then perhaps you should give serious consideration to moving this type of investment quickly, albeit temporarily, into cash.

Then, when the dust settles and you believe that the currency volatility has reduced, or even stabilised, then buy the same funds back. It will have cost you the value of your trades, but this will be considerably less than the percentages in the table above. At Saltydog Investor, we believe that it is always better to make a calculated move and maybe miss out on a gain, than to take a loss.

Of course, all of this has to be balanced against an election which results in a Labour majority or a Hung Parliament. In these cases, it is not unreasonable for there to be a fall in the value of sterling, in which case a further investment into dollar denominated funds would be a good option.

1.31 to 1.20 = a gain of 8.4%

At the end of the day, it depends on what you believe is going to happen on 12th of December. Good luck with that!

In our demonstration portfolios, we are going to sell (or reduce) any holdings that might be affected by a significant change in the value of the pound. We can always buy them back again next week, if the storm has passed.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.