The funds these four experts are buying to take risk off the table

With caution the watchword, we name the defensive funds professional investors are buying.

9th September 2019 09:54

by Marina Gerner from interactive investor

With caution the watchword, we name the defensive funds professional investors are buying.

The markets sighed with relief when the G20 summit in Japan brought truce between Donald Trump and Xi Jinping. But then in early August Trump announced tariffs on $300 million of Chinese imports at 10%, validating our managers' more cautious approach.

Our fund experts are turning to credit to de-risk their portfolios. Some add diversification by increasing their exposure to infrastructure, absolute return, private equity and healthcare. One of our managers believes that now is a time to buy UK-focused funds. Below, they tell us about the new funds they have recently bought, the funds they have increased their holdings in and the ones they have trimmed or sold.

Peter Hewitt

BMO

Bull point: The US Federal Reserve is expected to cut interest rates to stabilise growth over the next 12 months.

Bear case: Ongoing US-China trade dispute yet to be resolved and would affect global growth prospects if significant and permanent tariffs were applied to imports from China into the US.

Bought: Hewitt's new purchase is Merian Chrysalis Investment trust (LSE:MERI), which invests in late-stage private companies with rapid long-term growth prospects. The trust uses its size "to gain positions in often quite substantial private companies a year or two before they undertake an IPO". This, he says, "significantly" adds to its returns. Unlike many other private equity investors, this manager will often hold after listing and even invest more. The companies it invests in are dubbed "tech-enabled disruptors" and include TransferWise and Secret Escapes.

Increased: One increased holding is BB Healthcare investment trust. "It is a high-conviction, unconstrained vehicle investing in global healthcare equities, with around 35 holdings." Some 90% of assets are in the US, and the portfolio is underweight in large cap pharma companies, in favour of higher-growth sectors such as diagnostics and healthcare IT . It pays a dividend equivalent to 3.5% of the net asset value annually.

Trimmed: Hewitt has decreased his position in Sequoia Economic Infrastructure investment trust, which invests in a diversified portfolio of private loans and bonds across a range of industries. "The main reason for investing is the income, which has been consistent, with dividend yield of 5.3%," he says.

"The reduction was due to valuation, as the premium of the share price when compared to net asset value had risen to 12%, which leaves the shares vulnerable to a de-rating."

Ayesha Akbar

Fidelity Investments

Bull point: It is possible to see the decline in growth bottoming out and dovish central bank policy combine to maintain the rally into the second half of the year.

Bear case: If we see continued weakening in growth from the US and China, and a reduced ability of monetary policy to sustain the risk rally, this could lead markets to give back some of their strong year-to-date gains.

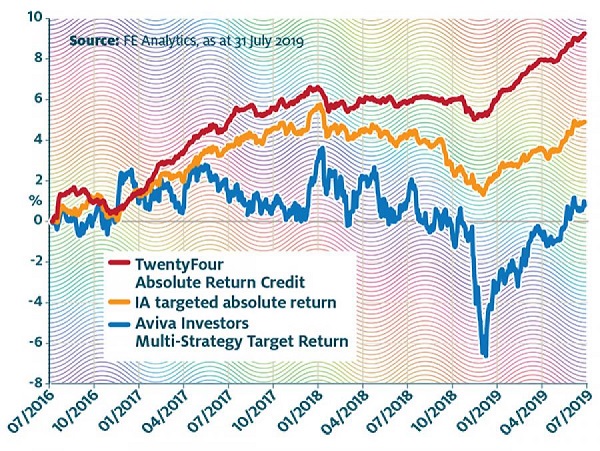

Bought: "In this late-cycle environment, it makes sense to add to strategies designed to provide exposure which is uncorrelated to traditional assets," argues Akbar. That's why she chose the Aviva Investors Multi-Strategy Target Return, which seeks to profit from changes in interest rates, currencies and market volatility. The fund aims to return an average 5% a year over the Bank of England base interest rate (before fees) over a three-year period, with only half the volatility of global equities.

Increased: Inflation is still low, but Akbar believes it's worth hedging against the risk of it, given "a decade of unconventional monetary policy." She says: "Inflation-linked bonds are an important asset for many investors." She considers the Standard Life Global Index Linked Bond an attractive option, noting that Standard Life has been involved in the inflation-linked asset class since the latter's inception many years ago, and governments often ask the firm to advise them on their inflation programmes.

Trimmed: "We have seen high-yield markets perform strongly this year after a difficult end to 2018," says Akbar. But she now considers these market to be vulnerable to any change in course from the major central banks or shift in market sentiment. While she likes the process of the JPM Global High Yield Bond, she "would need to see a more promising growth outlook to add further to high yield, given the broader market backdrop."

Jordan Sriharan

Canaccord Genuity

Bull point: Strong employment points to healthy consumer spending, which in turn should support corporate profitability. Despite the skills shortage, wages have (conversely) been too stubborn to rise to levels seen in previous recoveries, which has helped keep a lid on inflation.

Bear case: The purchasing managers indices (PMIs) in most developed markets have been trending lower, particularly for the manufacturing sector. This could bleed into the service sector which accounts for the lion's share of GDP in the developed world.

Bought: "With a view to taking risk off the table," Sriharan has invested in Aviva Investors Global Convertible , a bond fund. He says this fund is run by an experienced team with a clear, disciplined process in place. "It has a genuinely thoughtful approach to what is a challenging asset class," he says, adding that it also boasts an attractive sharpe ratio - that's risk-adjusted returns or "bang for your buck" in plain English.

Increased: Sriharan has increased his position in the TwentyFour Absolute Return Credit Fund. "With a shorter-duration profile and minimum investment grade credit quality, we expect the fund to more effectively protect valuations in our credit portfolios," he says

Trimmed: Meanwhile, he has trimmed his holding in the Polar Capital Global Technology Fund. He says: "Both the short- and long-term performance have been strong, which has benefited the portfolio's more alternative allocations." He says he remains committed to the fund and the technology sector, but "trimming our holding in technology and increasing our exposure in infrastructure fits with our current strategy."

Absolute return funds: adopt a range of strategies

David Hambridge

Premier Asset Management

Bull point: A global recession in the near term now looks unlikely.

Bear case: Investment appetite is suppressed by ongoing trade dispute between the US and China, and by Brexit.

Bought: "We have just added GAM UK Equity Income to our Premier Multi-Asset Monthly Income fund," says Hambidge. He argues that UK equities look cheap in a world where very low interest rates have made many assets appear expensive. The fund currently yields over 4.5%. It invests in large, medium and smaller companies, with a bias towards financial and consumer-facing companies.

Increased: "We have added to Montanaro UK Income, which invests in medium and smaller-sized companies with strong balance sheets and paying sustainable dividends," says Hambidge. This fund has 21% of its holdings in consumer cyclicals, 16% in industrials and 15% in the technology sector.

Sold: Hambidge sold Primary Health Properties (LSE:PHP). He says his team previously "made excellent returns from our exposure to the primary healthcare property sector this year". He explains that "after the merger of MedicX (LSE:MXF) and Primary Health Properties (LSE:PHP), investors were well-rewarded". He decided to take profits and recycle the proceeds into other areas of the portfolio.

Multi-manager biographies

Jordan Sriharan is an investment director at Canaccord Genuity Wealth Management. He previously worked at Mercer, Fidelity Investments and the Wellcome Trust.

David Hambidge is head of multi-asset investment at Premier Asset Management. He helped set up Premier’s fund-of-funds operation in 1995 and is regarded as one of the UK’s most experienced multi-managers.

Ayesha Akbar is a portfolio manager in Fidelity’s multi-manager team. Prior to joining Fidelity, she worked at Barclays Wealth, where she was instrumental in helping establish the firm’s multi-manager business.

Peter Hewitt is a director and investment manager with the BMO global equities team, and fund manager of the BMO Managed Portfolio Trust, where he specialises in investment trusts.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.