A great prospect for those seeking to buy and hold

There looks to be more upside than downside at one of America’s biggest companies, while another is one to tuck away, reckons analyst Rodney Hobson.

16th July 2025 07:45

by Rodney Hobson from interactive investor

American pharmaceutical stocks seem to have gone out of favour as investors concentrate on big tech stocks and prospects for artificial intelligence. However, the positive factors for a solid if less exciting sector, with aging populations adding to healthcare demands, remain.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

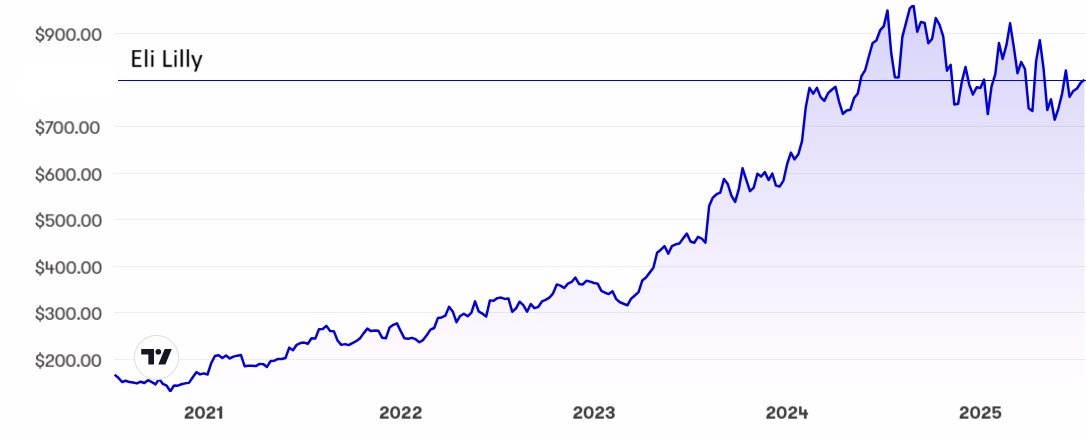

For example, Eli Lilly and Co (NYSE:LLY) shares were on a roll in 2023 and the first half of 2024, trebling from $315 to topside of $900, but they came off the boil nearly a year ago and have slipped erratically to around $770.

This has presented great opportunities for short-term investors to get in and out but has been quite disconcerting for those who like to buy and hold.

The shares had admittedly run too far ahead of themselves but there has been no news that justifies the extent of the fallback. The most recent results, for the first quarter issued in early May, showed net income up 23% to $2.76 billion on revenue leaping 45% to $12.7 billion.

It was therefore a bit disappointing that the company merely reaffirmed its full-year guidance on revenue and actually downgraded its outlook on earnings per share, although this figure should still be up about 70% on last year’s $11.71.

The biggest gains in sales have come from weight-loss drug Mounjaro and diabetes treatment Zepbound. While Mounjaro has proved somewhat controversial, it has garnered considerable free publicity and continuing obesity problems in developed nations will drive demand for both products.

Gross profit is a remarkable 83% of revenue but all pharmaceutical companies have to invest heavily in research and development to keep the product pipeline going. Marketing also is costly in a quite competitive marketplace.

- ii investment performance review: Q2 2025

- The big, not-entirely-beautiful impact of the new US tax and spending law

Buying up promising smaller rivals is likewise expensive. Lilly proposes to spend over $1 billion on acquiring Verve Therapeutics Inc (NASDAQ:VERV) to expand its presence in genetic medicines for cardiovascular disease. And that’s without an absolute guarantee that Verve’s biggest potential blockbuster gene suppressant to reduce high cholesterol will pass Phase 3 trials.

Eli Lilly shares are still not cheap with a price/earnings (PE) ratio of 64.5 and a yield of only 0.7%.

Source: interactive investor. Past performance is not a guide to future performance.

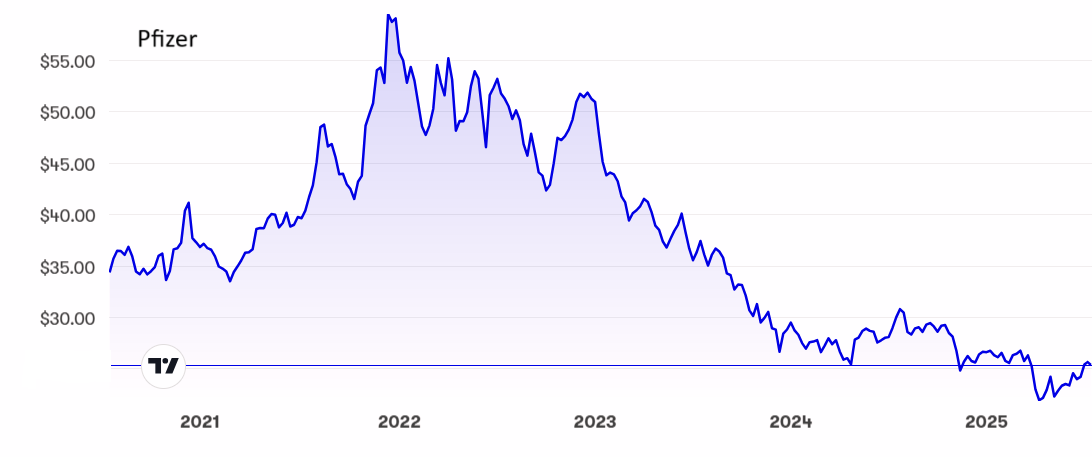

Pfizer Inc (NYSE:PFE) shares have recovered some ground since dropping to $21.50 in April but at under $25 they are still well below the 12-month peak of $31 at the end of July last year. The shares look quite cheap with a PE of only 18.6 and a juicy yield at 6.6%.

The company has narrowed its once sprawling product range that used to include chemicals, and now has a focussed portfolio of prescription drugs and vaccines that are solid if a little unexciting. Unfortunately, one vaccine, for Covid-19, was a short-lived boost and Pfizer revenue and profit figures have tailed off over the past couple of years.

- High stakes ahead of US banks’ earnings season

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Net income fell 4.8% to just under $3 billion in the first quarter on revenue down 7.8% at $13.7 billion. Better days could lie ahead as the group cuts costs by $2 billion a year while sales of other drugs increase. Full-year revenue is set to nearly equal last year as comparatives get easier.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Eli Lilly shareholders should stay in as there looks to be more upside than downside with a floor around $760. If that floor fails to hold, look to get in anywhere below $730. Verve shareholders should hold on and accept Lilly’s generous offer of more than twice the previous stock market price.

Pfizer shares are unlikely to fly into the stratosphere, but they do look a great prospect for those seeking to buy and hold for a solid return. The short-term upside looks limited to $27 but that ceiling will eventually be broken and there is a decent dividend to enjoy in the meantime.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.