On the hunt for growth shares at knockdown prices

Stocks offering "growth at a reasonable price" are out there - if you know where to look.

30th October 2019 12:31

by Ben Hobson from Stockopedia

Stocks offering "growth at a reasonable price" are out there - if you know where to look.

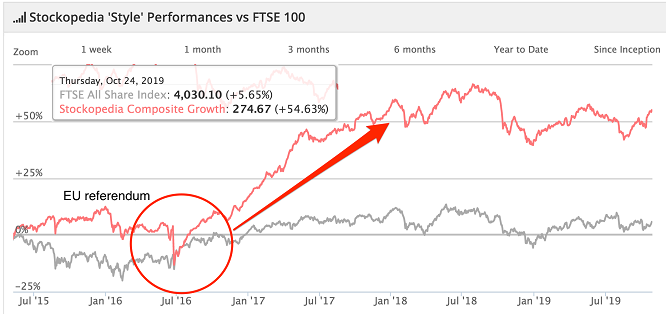

In the 18 months after the EU referendum in mid-2016, growth shares were some of the stock market's biggest winners. Strategies that zero in on small and mid-cap stocks with fast growing earnings did well. Strategies that chase factors like 'value' and 'quality' were left trailing in their wake.

But while the EU vote was a springboard for equities, the Brexit 'bump' that propelled growth shares didn't last. By early 2017 growth strategies were coming under pressure and there was a slump in the number of stocks passing their rules. That got worse, and over the past 18 months, growth and momentum strategies have, on average, underperformed almost every other investing style... until recently...

Source: Stockopedia

Since the summer there has been a pick up in the performance of growth strategies. While it's too early to tell whether the market is turning bullish on fast-growing shares, it's evidence at least that stocks offering "growth at a reasonable price" (GARP) are out there - if you know where to look.

So far this year, a GARP strategy tracked by Stockopedia has achieved a steady return of 8.5%. Over five years, the hypothetical return comes in at 107.8% on a pre-costs basis. The strategy looks for strong earnings growth and strong momentum without overpaying for them. There are several ratios that can be used to screen for this kind of share, but a typical GARP screen would look for:

- Double digit compound earnings-per-share growth rate over three and five years

- Below average PE Ratio (and it must be below 20x)

- Double digit Return on Capital Employed that is growing year-on-year

- Net margins that are growing year-on-year

- Positive relative price strength against the market over the past year

A classic example of a share that currently has this kind of profile is Dart Group (LSE:DTG). Dart is behind the package holiday firm Jet2 Holidays, and also runs a distribution and logistics business. Over the course of nearly a decade, it has been a phenomenal success for investors.

Back in 2012, Dart was a popular value share among DIY stock pickers. Given its highly cyclical nature, the ride for shareholders has sometimes been turbulent, but the impressive returns are undeniable. In the seven years between August 2012 and August 2019, Dart's share price rose from 73p to 790p - or 930%.

That sounds good, but it actually excludes the impact of a recent major shift in the competitive landscape for package holidays - the collapse of Thomas Cook.

Earlier this year Dart issued an upbeat set of full-year results but warned that consumer sentiment was a cause for concern. Yet the subsequent news of the demise of Thomas Cook has had a dramatic impact on Dart's shares. Since the start of September, the price has risen by 65% alone - reinforcing what is already a remarkable growth stock success story.

Dart Group plc

Source: Stockopedia

Dart Group currently tops the current list of shares passing these GARP rules. Here is the full list:

| Name | Mkt Cap m | EPS CAGR % 5y | P/E Ratio | ROCE % | Relative Strength % 1y | Sector |

|---|---|---|---|---|---|---|

| Dart (LSE:DTG) | 1,861.20 | 31.7 | 13 | 12.8 | 43.6 | Industrials |

| Barratt Developments (LSE:BDEV) | 6,542.90 | 19 | 8.9 | 16.4 | 26.6 | C/Cyclicals |

| Safestore Holdings (LSE:SAFE) | 1,478.20 | 28.8 | 11.6 | 12.1 | 26.6 | Financials |

| Sirius Real Estate (LSE:SRE) | 773.2 | 12 | 6.8 | 13.6 | 25.2 | Financials |

| Wincanton (LSE:WIN) | 311.4 | 25 | 6.9 | 2,275.00 | 12.6 | Industrials |

| Taylor Wimpey (LSE:TW.) | 5,483.90 | 26.9 | 8.1 | 21.9 | 9.7 | C/Cyclicals |

| Motorpoint (LSE:MOTR) | 217.9 | 25.9 | 12.9 | 84.2 | 7.1 | C/Cyclicals |

| Morgan Sindall (LSE:MGNS) | 585.8 | 30.1 | 8.8 | 19.5 | 2.5 | Industrials |

| S & U (LSE:SUS) | 254.9 | 15.7 | 8.9 | 13.5 | 1.5 | Financials |

Buying growth at a discount?

The current crop of stocks passing these GARP rules have a very cyclical flavour, with strong exposure to UK consumer sentiment. In the mix are housebuilders, credit lenders, auto retailers and, of course, the package holiday group, Dart. Arguably these shares a prone to pullbacks if and when the domestic economy comes under pressure. With the uncertainty of Brexit, it perhaps no surprise that these kinds of firms are being marked down by the market.

In bullish conditions, growth stocks can produce stunning returns against the rest of the market - but they are the first to falter when uncertainty sets in. For investors looking for growth, a GARP strategy can be an ideal way of finding potentially strong returns at relatively cheap prices. But in volatile markets, it's a strategy that needs careful watching.

About Stockopedia

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

- Interactive Investor readers can enjoy a two-week free trial and £50 discount to Stockopedia using the coupon code iii014 - click here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.