ii investment performance review: Q3 2022

19th October 2022 09:24

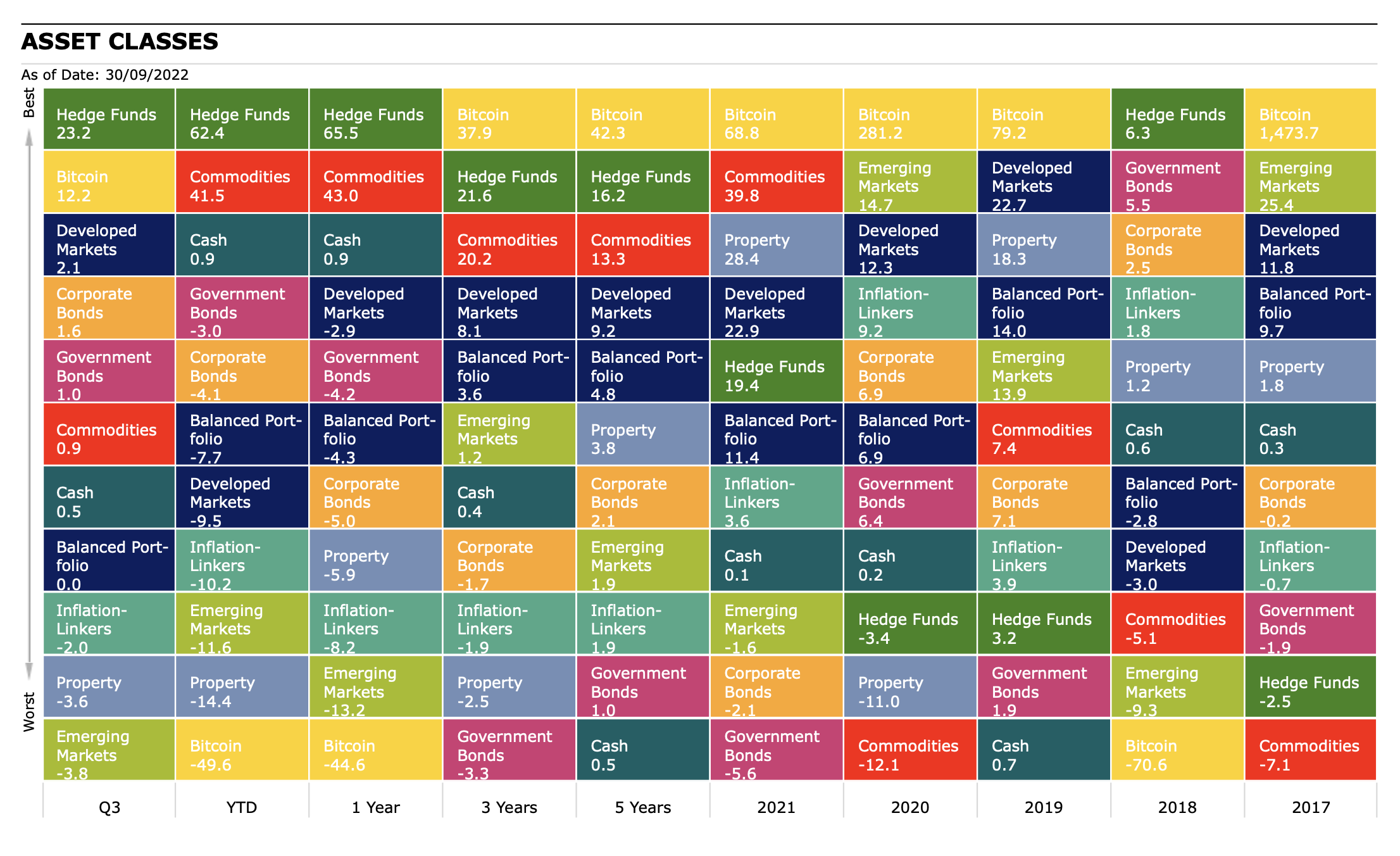

In one of the most tumultuous years in history for markets, stocks and bonds both record losses for three consecutive quarters for the first time since reliable index data began.

Market round-up

2022 will likely go down as one of the most tumultuous years in history for markets and be remembered alongside 1929, 1973, 1987, 2000, 2008 and the first half of 2020 as periods of real pain. Stocks and bonds both recorded losses for three consecutive quarters for the first time since reliable index data began.

There has been nowhere to hide. Hiding cash under your mattress would have protected absolute capital, but with inflation touching double digits the buying power of said cash would have greatly diminished.

- Discover: How to buy Shares | Free regular investing | Super 60 Investment Ideas

Equities fell in the third quarter, but the magnitudes were not enormous. However, for parts of the bond market, namely sterling corporates and governments, losses were severe and many bond funds have suffered their worst-ever losses year-to-date.

Markets globally have shifted somewhat away from actual inflation or economic figures to having a laser focus on central bank policy, with developed markets continuing to tighten policy, apart from Japan, where intervention was needed in the currency market as the Bank of Japan stated its commitment to easy monetary conditions.

UK investors holding non-GBP assets were handed something of a windfall from a very weak pound, with the Bank of England seen to be softer than other central banks, while the new Conservative government’s expansionary mini-budget sent the pound falling and gilt yields tumbling, to a point where the Bank of England had to intervene to keep the market liquid.

Source: Morningstar

Shares

US and, as a result, global equities suffered another quarter of falls, despite promising signs in July that provided investors with some respite. Due to the weakening of the pound, UK investors were actually able to make positive absolute returns investing in US assets, with the S&P 500 gaining 3.48% in sterling terms for the quarter, with sterling investors in the major US index being almost 8.5 percentage points better off over the quarter than their dollar counterparts.

July saw high single-digit gains for US and global markets, but central banks have remained steadfast in their hawkish nature for the most part. Data releases and comments from central bankers now lead to speculation on the hiking cycle and can send markets up or down 2-3% daily. That kind of move was previously newsworthy, but now it’s just a regular occurrence.

The UK market was weak over the quarter: investors worried about the credibility of the new government, and a central bank that began hiking before others, but is no longer matching the magnitude of the Federal Reserve or European Central Bank on rate rises. In theory, the weaker pound should have been a benefit for UK large-cap companies, which earn the bulk of their revenues overseas, so market falls highlight the general negative sentiment in the market.

Elsewhere, Japanese equities made gains in sterling terms and a small loss in base currency. Its central bank committed to easy policy for a number of years, which caused the yen to plumb record lows and the government to intervene in the currency market. The Bank of Japan now owns 63% of all locally listed exchange-traded funds (ETFs), according to the Financial Times.

European equities also fell over the quarter, in a similar magnitude to UK stocks. Emerging market stocks fell, too, in sterling, but country dispersions were wide, with China losing 15% and India gaining the same amount and Brazil even more.

| Performance (%) | Q3 | YTD | 1 Year | 3 Years | 5 Years |

| Brazil | 18.09 | 35.32 | 26.00 | -2.02 | 2.01 |

| India | 15.86 | 9.51 | 8.78 | 15.25 | 12.03 |

| Russia | 8.79 | -100.00 | -100.00 | -98.87 | -92.67 |

| S&P 500 | 3.48 | -7.63 | 2.10 | 11.79 | 13.33 |

| World | 2.06 | -9.51 | -2.93 | 8.06 | 9.25 |

| TOPIX Japan | 1.30 | -8.81 | -13.53 | 0.78 | 2.89 |

| Europe Ex UK | -2.02 | -17.12 | -12.81 | 1.61 | 2.39 |

| FTSE 100 | -2.72 | -3.66 | 0.90 | 1.20 | 2.56 |

| FTSE All Share | -3.45 | -7.87 | -4.00 | 0.80 | 2.17 |

| Emerging Markets | -3.80 | -11.62 | -13.17 | 1.21 | 1.87 |

| FTSE Small Cap | -4.89 | -19.27 | -18.70 | 5.30 | 3.57 |

| Asia Pacific Ex Japan | -5.05 | -10.68 | -11.77 | 2.22 | 3.09 |

| FTSE 250 | -7.30 | -25.28 | -23.50 | -2.72 | -0.46 |

| China | -15.68 | -16.55 | -21.97 | -4.07 | -2.02 |

Source: Morningstar Total Returns to 30/09/2022.

Sectors

Interestingly, despite the focus on central bank actions and interest rates, which would have generally favoured value-oriented sectors, it was growth that performed stronger across all developed markets during the third quarter.

Having said that growth sectors did better, one of the more traditional value sectors, energy, still performed strongly, as gas prices continued to rise and, while falling, oil prices stayed high enough to generate hefty margins for big oil companies, with many publicly saying that they expect a windfall tax as a result.

The consumer discretionary sector, which features names such as McDonald's Corp (NYSE:MCD) and Amazon.com Inc (NASDAQ:AMZN), was one of the top performers globally and accounted for most of the outperformance of growth versus value by making strong absolute gains in the first half of the quarter, before a reversal left the sector closer to par in base currency terms for the quarter.

In the UK, the worst-hit sector was real estate investment trusts (REITs), where interest rates have had a big impact. It is interesting to see UK REITS losing close to 20%, while the direct property market was down 3.68%, reflecting the equity market adjusting discount rates much faster than the valuers of direct assets.

| Performance (%) | Q3 | YTD | 1 Year | 3 Years | 5 Years |

| Consumer Discretionary | 9.03 | -17.16 | -10.60 | 9.06 | 11.21 |

| Energy | 7.23 | 48.24 | 54.17 | 10.78 | 7.12 |

| Industrials | 2.50 | -10.65 | -5.84 | 4.36 | 5.77 |

| Financials | 2.20 | -5.96 | -2.84 | 4.96 | 4.98 |

| Information Technology | 1.96 | -20.09 | -9.92 | 15.65 | 18.13 |

| Health Care | 1.42 | 1.44 | 8.96 | 12.58 | 11.73 |

| Consumer Staples | 1.35 | 1.99 | 11.19 | 5.07 | 7.50 |

| Materials | 0.40 | -7.66 | 1.15 | 8.39 | 7.10 |

| Utilities | -0.36 | 4.20 | 15.40 | 3.64 | 8.12 |

| Real Estate | -3.97 | -13.97 | -5.15 | -1.07 | 4.60 |

| Communication Services | -5.32 | -23.80 | -25.44 | 1.70 | 4.36 |

Source: Morningstar Total Returns to 30/09/2022.

Bonds

Fixed income investing is where the real pain has been felt this year, which is perhaps not unexpected given action in rate and inflation markets, although the magnitude and relentless nature would have come as a surprise to many. Investors looking to de-risk into bonds have found no refuge and UK bonds have really suffered.

UK investors holding global bonds in the third quarter suffered some losses if hedged to sterling, or small gains if unhedged, but losses in the UK gilt market and the UK corporate bond market were extreme in the third quarter, both in double digits, with gilts now 25% lower than at the start of the year and corporate bonds not much behind.

It was a quarter that ended with a mini-budget and soft central bank signals that resulted in market conditions so extreme that the Bank of England had to step in and provide liquidity to keep pension funds and liability-driven investment (LDI) strategies working.

| Performance (%) | Q3 | YTD | 1 Year | 3 Years | 5 Years |

| Global High Yield | 5.95 | -1.60 | -2.76 | 0.46 | 3.41 |

| Global Corporate | 1.60 | -4.15 | -5.01 | -1.69 | 2.10 |

| Global Aggregate | 1.24 | -2.80 | -3.89 | -2.58 | 1.34 |

| Global Government | 1.01 | -3.02 | -4.25 | -3.34 | 0.98 |

| EURO Corporate | -1.25 | -11.33 | -13.97 | -5.24 | -1.94 |

| Global Inflation Linked | -2.04 | -10.19 | -8.17 | -1.85 | 1.87 |

| UK Inflation Linked | -9.68 | -30.27 | -27.03 | -9.76 | -2.35 |

| Sterling Corporate | -11.59 | -22.56 | -22.25 | -6.97 | -2.31 |

| UK Gilts | -12.85 | -25.10 | -23.29 | -9.58 | -3.35 |

Source: Morningstar Total Returns to 30/09/2022.

Commodities and Alternatives

Oil prices continued to fall throughout the third quarter, although remaining elevated relative to recent history. Brent crude fell through $100 a barrel and got as low as $82, with WTI falling into the high 70s, before OPEC supply cuts were brought into play.

Natural gas was higher over the quarter, although that was partly due to the quarter starting at the end of a sharp fall. It then rose rapidly, testing $10/Million Thermal Units as gas demand appears to be higher than previously thought, and geopolitics continued to influence prices, with the viability of Russian alternatives coming in and out of focus over the quarter.

Precious metals were weaker over the quarter but industrial metals such as copper were roughly flat, and some soft commodities made gains, indicating a cloudy economic picture. As mentioned above, the UK commercial property market was weaker in the third quarter, but not by the same extent as REITs.

While house prices remained generally robust in the third quarter, according to lenders, the rapid increase in mortgage rates could see house prices come under pressure as buyers exit the market.

| Performance (%) | Q3 | YTD | 1 Year | 3 Years | 5 Years |

| Hedge Funds | 23.22 | 62.40 | 65.50 | 21.63 | 16.20 |

| CBOE Market Volatility (VIX) | 19.82 | 122.80 | 65.05 | 29.05 | 31.93 |

| Global Natural Resources | 3.81 | 14.19 | 21.99 | 12.78 | 9.67 |

| Commodity | 0.93 | 41.52 | 43.03 | 20.15 | 13.31 |

| Cash | 0.47 | 0.85 | 0.88 | 0.43 | 0.52 |

| Gold | 0.34 | 11.51 | 16.73 | 7.47 | 9.33 |

| Global Infrastructure | -1.69 | 9.09 | 13.57 | 3.22 | 5.93 |

| Brent Crude Oil | -16.65 | 37.21 | 35.31 | 16.90 | 12.94 |

| UK REITs | -19.38 | -34.82 | -27.59 | -7.37 | -2.77 |

Source: Morningstar Total Returns to 30/09/2022.

Most-traded shares on the ii platform in Q3 2022

Most-bought shares in Q3 |

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.