Investing for a sustainable future with these top performers

These funds are willing to take an ethical position and are providing competitive returns.

17th February 2020 13:04

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog analyst talks through some great funds willing to take an ethical position and which also provide competitive returns.

Russian-American writer and philosopher Ayn Rand said, “We can ignore reality, but we cannot ignore the consequences of ignoring reality, and rest assured there will be consequences”.

This year’s World Economic Forum’s 50th Annual Meeting was held at Davos in Switzerland towards the end of January. It aims to be ‘the foremost creative force for engaging the world's top leaders in collaborative activities to shape the global, regional and industry agendas at the beginning of each year.’

This year’s theme was ‘Stakeholders for a Cohesive and Sustainable World’.

The main story of the Annual Meeting was climate-change action, and how to move to net-zero carbon emissions by 2050 or earlier.

The forum covered many issues including:

- The launch of the 1t.org initiative to grow, conserve and restore 1 trillion trees by the end of the decade.

- 140 of the world’s largest companies agreeing to develop a core set of common environmental, social and governance (ESG) metrics.

- Oil companies being challenged to reduce the impact of fossil fuels and debating a document produced by the World Economic Forum on ‘neutralizing emissions at the pump’.

Politicians can often act first and pause for contemplation later. A number of countries have agreed to cease production of diesel and petrol driven vehicles by the middle of this century. Britain has chosen 2035 as an appropriate year. Undoubtedly, removing these pollutants will be a big step forward and the decision is to be applauded. However, the chaos that this is going to cause to manufacturing and employment is difficult to comprehend, and what will be the replacement energy generation that will allow travel to become all electric while still being green?

Sustainability and good ethical governance are now mainstream issues that we should all be concerned about, and more and more investors are keen to ensure that their money is being invested in a socially responsible way.

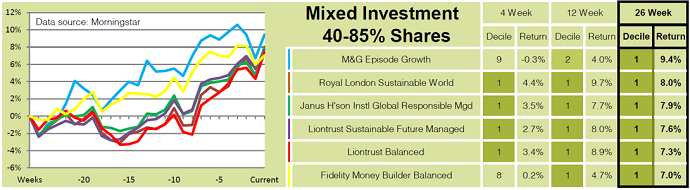

For the last year the Saltydog demonstration portfolios have been holding three funds from the Mixed Investment 40-85% Shares sector, that belong to a growing number of funds which are managed with ethical or socially responsible criteria in mind.

The three funds are Liontrust Sustainable Future Managed, Janus Henderson Institutional Global Responsible Managed and Royal London Sustainable World Trust.

In the case of Liontrust, they offer five Sustainable Future managed funds. These funds have a range of exposures to a blend of equities, bonds and cash.

They have their ‘Sustainable Future Process’ for selecting equities.

‘The process is based on the belief that in a fast-changing world, the companies that will survive and thrive are those which:

- Improve people’s quality of life, be it through medical, technological or educational advances.

- Drive improvements in the efficiency with which we use increasingly scarce resources.

- Help to build a more stable, resilient and prosperous economy.

The process seeks to generate strong returns while benefiting society through identifying long-term transformative developments, such as technological and medical advancements, and investing in companies exposed to these powerful trends that have a positive impact and can make for attractive and sustainable investments.’

The Janus Henderson fund has a similar objective: ‘To provide capital growth by investing in a mix of assets including UK and overseas equities and fixed income securities. The fund will seek to invest in companies that are responsibly run giving due consideration to environmental, social and governance issues. The fund will avoid investing in companies that the Investment Manager considers to potentially have a negative impact on the development of a sustainable global economy.’

The fund ‘invests globally in companies strategically aligned with environmental and social megatrends (climate change, resource constraints, growing populations, and ageing populations) and avoids investing in fossil fuels and companies that stand to be disrupted by the transition to a low-carbon economy.’

The Royal London fund also has to operate within its climate change policies and is committed to the ‘explicit inclusion of Environmental, Social and Governance (ESG) factors in the investment decision-making process’.

Just because these funds are willing to take an ethical position doesn’t mean that they can’t also provide competitive returns, and that has certainly proved to be the case over the last year. They’ve regularly featured in our performance tables of the leading funds in each sector, and were all in last week’s shortlist based on their returns over the last 26 weeks.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.