Investment trusts offer value after sell-off

1st November 2018 13:01

by Fiona Hamilton from interactive investor

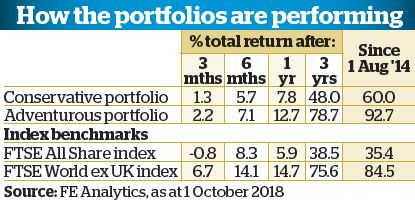

A sell-off in UK markets has hit both our conservative and adventurous investment trust portfolios, but there are opportunities, writes Fiona Hamilton.

Our conservative and adventurous investment trust portfolios are rebalanced each July so that they have roughly equal exposure to nine different categories of trusts. Two of those categories focus on UK equities, namely UK mainstream and UK smaller companies.

This means the portfolios generally start their annual progress with around 23% invested in the UK. This has proved a handicap over the past three years, during which worries about Brexit have helped make UK equities increasingly unpopular with UK as well as overseas investors. The result is that the FTSE All-Share index has lagged a long way behind the FTSE World ex UK index.

The growing aversion to UK equities, even if they are multinationals with substantial overseas exposure, proved particularly painful over the past quarter. Lowland and Rights & Issues both proved a drag on the adventurous portfolio, while Temple Bar and BlackRock Throgmorton Trust were among the weakest performers in the conservative portfolio.

They could remain a drag while fears of a hard Brexit persist, even though THRG can use contracts for difference to capitalise on falling markets. On the other hand, they could bounce quite usefully if the UK achieves a relatively good ongoing partnership with the EU, particularly for goods.

The adventurous portfolio was once again buoyed by impressive performances from Allianz Technology Trust and Baillie Gifford Shin Nippon; they were hard hit in the October sell-off. Pantheon International has so far proved more resilient.

ATT and PIN, plus Monks, contribute much of the adventurous portfolio's 21 % exposure to the US stockmarket, which was helpful while the US market remained strong. In contrast, the conservative portfolio's North American weighting derives mainly from its holding in Foreign & Colonial Investment Trust. At 8%, it is substantially lower, which proved a handicap during the period under review.

Schroder Asia Pacific (SDP) was the most disappointing holding overall, having recorded a 5.1% fall and losing further ground in October. The main culprit was the trust's substantial holdings in Chinese internet companies, which had previously served it well. Like other Asia Pacific trusts, SDP is suffering from the tariffs tussle between the US and China.

JPMorgan Japanese also had a disappointing quarter in share price terms, although its NAV returns were the best in its sector. Its shares look good value on a double-digit discount.

Past performance is not a guide to future performance

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.