The leading Japan fund we’ve just bought

After tracking the strong recent performance of Japanese equities, Saltydog Investor has finally invested.

13th March 2024 09:45

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

A few weeks ago, I highlighted a couple of funds from the Japan sector that had recently come to our attention.

They were WS Morant Wright Nippon Yield and Man GLG Japan CoreAlpha.

We had just run our latest “6 x 6” report, where we go in search of funds that have gone up by more than 5% in each of the last six six-month periods. We did not find any, but these two funds had managed to achieve the target five out of six times. There was only one other fund that had done this, Invesco Global Equity Income.

- Invest with ii: Top ISA Funds | FTSE Tracker Funds | Open a Stocks & Shares ISA

As I was writing, the Nikkei 225 had already risen above 38,000, but still had not reached the all-time high that it set more than 34 years ago in December 1989. However, since then it has gone on to close above 39,000, for the first time, and briefly pushed on through 40,000.

So far this year, it has risen by more than 18% and last year it made 28% (both in local currency), which is also better than most other stock market indices. The FTSE 100 went up only by 3.8% in 2023.

The US stock markets have also had a good run recently with the Dow Jones Industrial Average, S&P 500, and the Nasdaq all setting new all-time highs this year.

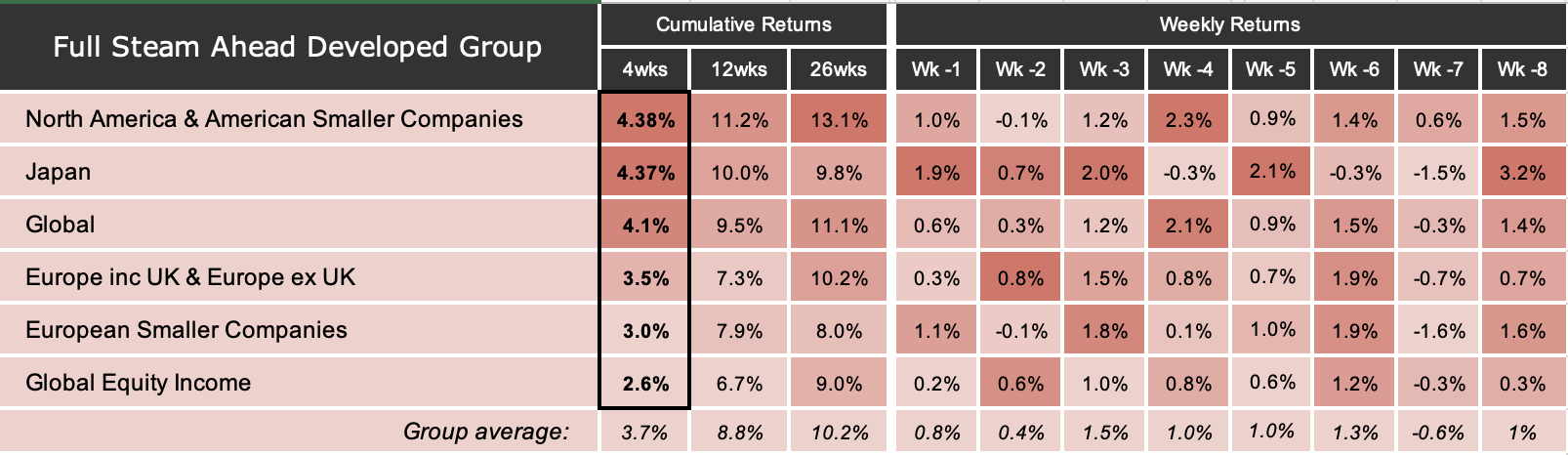

In our regular weekly analysis, we look at the relative performance of the Investment Association (IA) sectors and group them based on how volatile they have been in the past. The Japan and American sectors both sit in our “Full Steam Ahead Developed” group. Here is an extract from last week’s report showing how they were doing.

Data source: Morningstar. Past performance is not a guide to future performance.

As you can see, there is not much to choose between the North American and Japanese sectors over the past four weeks. The combined North America and North American Smaller Companies sector rose by 4.38% and the Japan sector by 4.37%. Over 12 and 26 weeks, the US funds are slightly ahead, but in the past couple of weeks the Japanese funds have had the edge.

We invested in the UBS US Growth fund, from the North America sector, last June and have been happy with its progress, up over 24%. Until recently we have not been holding any other funds from the sectors in our Full Steam Ahead Developed group, preferring the Technology & Technology Innovations and India/India Subcontinent sectors, which are in different groups. However, a couple of weeks ago we did buy one of the Japan funds.

There are plenty to choose from and there is not much difference in performance between the leading funds.

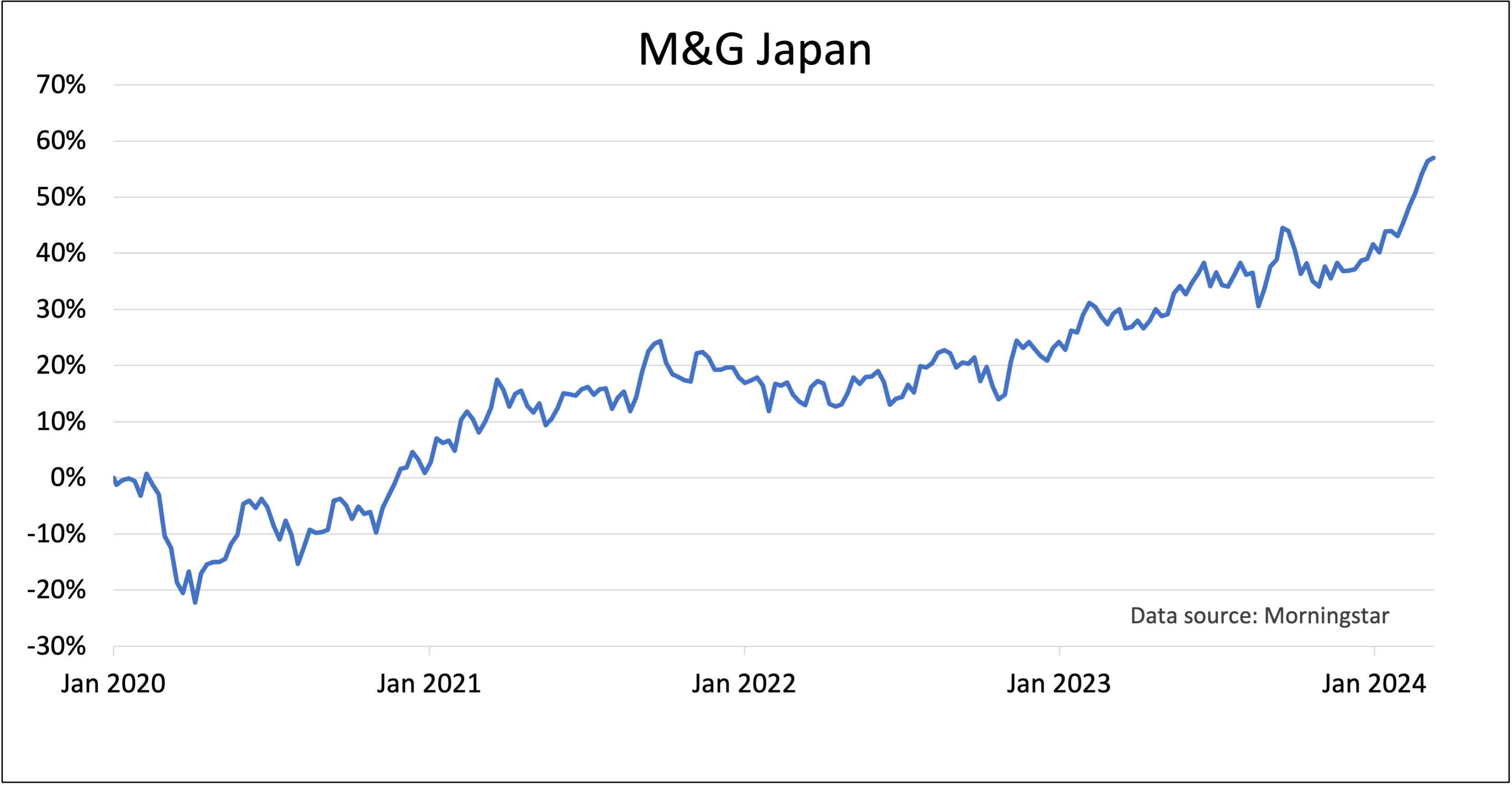

We invested in the M&G Japan fund.

Past performance is not a guide to future performance.

Like most funds, it fell in early 2020 as markets reacted to the spreading Covid-19 virus. However, by the end of the year it had recovered and continued to grow through 2021. It then remained relatively flat during 2022, but rose by 14% last year, and has already gone up by 9% this year.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.