My favourite of these two buy rated stocks

Share prices at this pair have fallen sharply in the past month, but analyst Rodney Hobson believes the decline represents a buying opportunity. There’s also an update on Tesla.

8th October 2025 08:36

by Rodney Hobson from interactive investor

Experts are divided over whether The Home Depot Inc (NYSE:HD) or Lowe's Companies Inc (NYSE:LOW)represents the best value in the American home improvements sector. While either company looks to be a decent investment, the sharp fall in Lowe’s shares is looking increasingly like a buying opportunity.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The sector has certainly been squeezed over the past couple of years as higher interest rates deterred homeowners from making improvements. However, the easing of US interest rates this year, with the prospect of another reduction soon, has changed the picture considerably.

As the largest in the sector, Home Depot has the advantage of stronger purchasing power in the supply chain. It has over 2,300 stores against around 1,750 for Lowe’s, so its name is more widely spread among the community. It sells more per store as well, with annual sales of around $160 billion, almost double the Lowe’s total of $84 billion. The gap is growing slightly, as most recent figures showed Home Depot stores increasing same store sales by 1.4%, while those at Lowe’s were up 1.1%.

Home Depot has also moved faster to lure professional contractors into its stores by providing a dedicated sales force and a loyalty programme to support them. This is important, because professionals not only spend more than the amateur punter, but they provide much more consistent repeat business.

- US results preview: big upgrades for tech and finance stocks

- Stockwatch: prepare for volatility and range of outcomes

Last year, Home Depot acquired SRS, which distributes roofing products, landscape supplies and swimming pool equipment and this year it has agreed to take over GMS, a distributor of specialty building products such as walls, ceilings and steel framing.

These acquisitions will allow Home Depot to sell more materials in bulk to contractors, although this will probably squeeze margins a little – and already on gross margins Home Depot does not have the advantage.

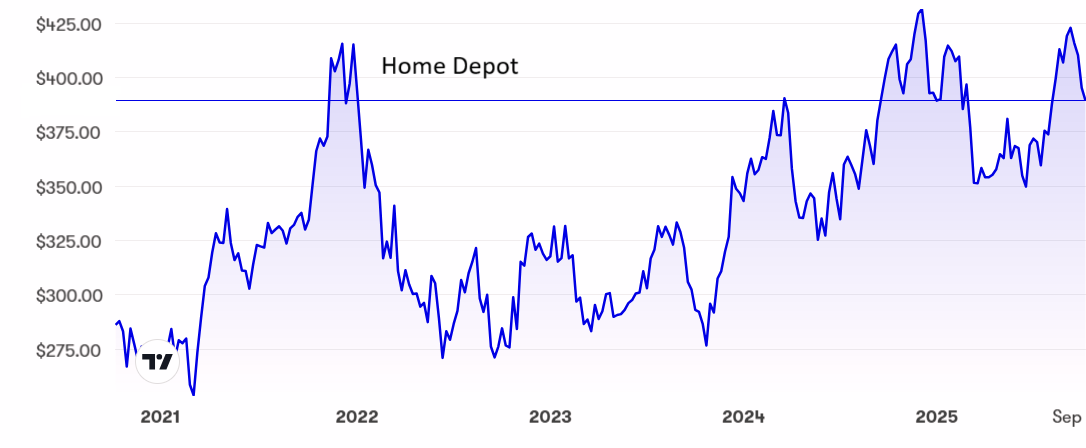

Source: interactive investor. Past performance is not a guide to future performance.

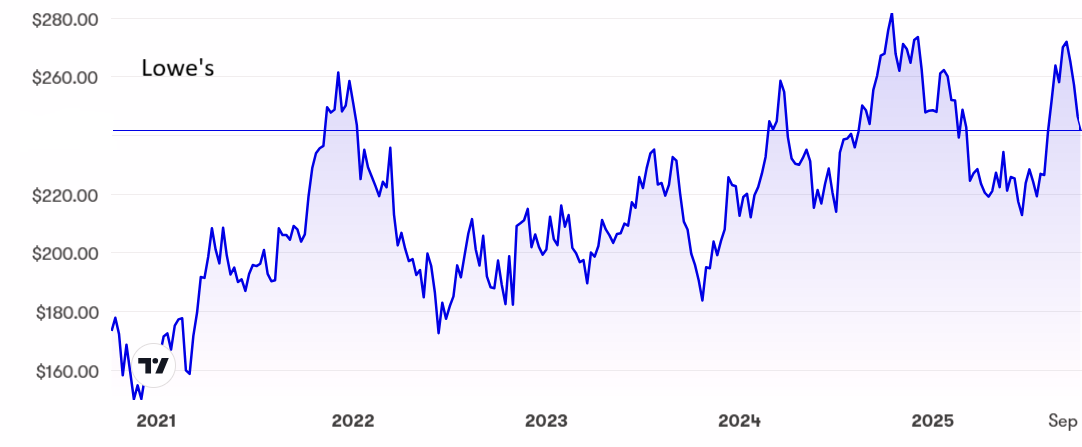

However, Home Depot’s position as top dog is now more than reflected in a divergence of the respective share prices in recent months. Both shares are down over the past 12 months, but Lowe’s is off 8% to $387 and Home Depot’s just 2.5% to $238. Lowe’s price/earnings (PE) ratio is just under 20 while Home Depot’s is 26.5, although neither rating looks excessive by American stock market standards. The yields are 1.9% and 2.35% respectively.

One point worth noting is that Lowe’s has a new management team poached from Home Depot, so the gap in performance could narrow sharply in the near to medium term.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I rate both shares a buy, with a slight bias at this stage towards Lowe’s for recovery. Its next results due on 19 November should show the start of a solid improvement.

Update: For as long as US President Donald Trump continues his somewhat quixotic attitude to economic matters, financial announcements across the Atlantic will continue to throw up quirks. Thus, there was a surprise 7.6% surge to nearly 500,000 in sales of Tesla Inc (NASDAQ:TSLA) cars in the July-September quarter.

- ii view: tax credits drive Tesla deliveries to new high

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

This is not part of a resurgence of Tesla, rather that Americans took note of Trump’s decision in July to end a tax credit of up to $7,500 on the purchase or lease of electric vehicles on 30 September. Tesla threw in finance deals and discounts as a further boost to sales. These are not sales wins for Tesla but simply the pulling forward of sales that would otherwise have been made in the current quarter, which are likely to show a corresponding drop. Meanwhile, Tesla sales in Europe continue to struggle with a 22.5% fall.

Tesla shares have inexplicably doubled from $220 to a peak of $460 over the past six months but are on the slide again. I still cannot see any attraction in a company under so much pressure that is owned and run by a man who is milking it for all he can get. Sell.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.