New forecasts for Shell and Wall Street

14th June 2022 08:00

by Alistair Strang from Trends and Targets

Independent analyst Alistair Strang gives his view on the FTSE 100 oil giant and 'the current spiral of misery' in the US.

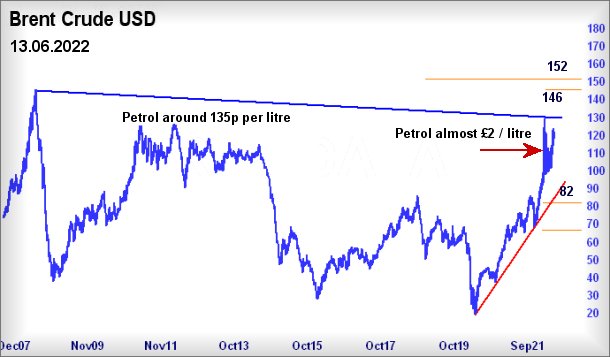

Why are fuel prices so high? Nearly £2 a litre makes little sense as crude oil was at this price level from 2008 through to 2014. VAT and fuel duty were roughly at current levels too!

Past performance is not a guide to future performance.

Given the price of fuel, along with reports of record profit levels, we'd expect Shell (LSE:SHEL) to be enjoying a share price that is soaring to new levels. Unfortunately, this appears not to be the case, quite the opposite. We're fond of treating the pre-pandemic price level for shares as a benchmark, requiring prices to solidly exceed a value before Covid-19 hit everything.

In the case of Shell, their share price matched the pre-pandemic level, even exceeded it slightly, and now appears destined to experience some reversals.

At least people are returning to their offices, so they can work harder to afford the extra cost of fuel to return to their offices...Things appear to be messy from virtually any perspective.

- ii view: Shell profit breaks records as oil boom continues

- ii People’s Interest Rate Panel: our maiden vote on UK interest rates

Currently for Shell, price movement below 2255p risks triggering near-term reversal to a pretty tame-sounding 2191p. The share price level, pre-pandemic, was around 2300p, so this scenario isn't particularly nasty. The danger comes, should Shell manage to close a session below 2191p, as further reversal to our secondary of 1983p calculates as possible.

As the chart below highlights, this is a big issue, returning Shell's share price below the blue downtrend and placing it in a region where an eventual return to the £12 level calculates as possible. Unfortunately, such a mess also makes a lot of visual sense.

It's quite a lot of doom and gloom against this share price. But please remember, we're indulging in a worst-case scenario, especially as the share price needs to close a session below 2191p to tick the first box.

Past performance is not a guide to future performance.

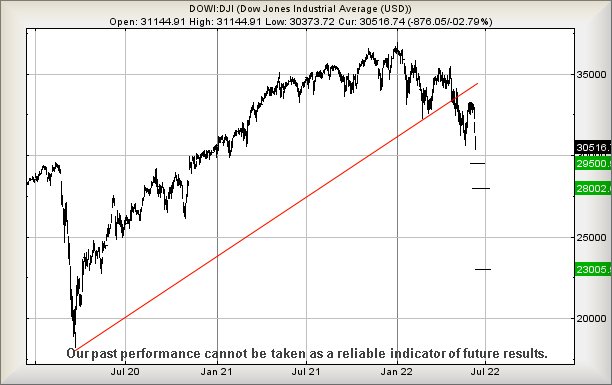

When we reviewed Wall Street a month ago, our thoughts about a target level of 30,000 points where relegated to the final paragraph. To employ a technical term, oops!

The index has managed to shed 2,000 points and is virtually at our initial drop target. Things have gotten really messy with the US index and if the market fails to bounce above 30,100 points, it could easily continue a slide down to 29,500. Our secondary, if such a level breaks, calculates down at 28,000 points, a price level where a bounce is almost mandatory.

Currently, Wall St needs astounding movement above 33,700 points, just to confirm a serious escape attempt from the current spiral of misery.

Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.