New threat to triple lock and link to workers’ pay

The state pension looked set for a bumper 8.5% hike from April due to a sharp rise in wages, but the government is reportedly weighing up a lower increase. Craig Rickman explores what’s going on.

18th October 2023 12:43

by Craig Rickman from interactive investor

The long-term future of the state pension triple lock may still be uncertain, but one short-term aspect has now become clearer. If the government keeps its pledge and maintains the policy next year, the state pension will increase by average wages.

This morning it was confirmed that UK inflation held steady at 6.7% in September, coming in slightly higher than expected. Economists believed the UK Consumer Prices Index, or CPI, had fallen to either 6.6% or 6.5% last month. But although food prices, the cost of household appliances and air fares all dropped, these were offset by higher fuel and hotel costs.

- Invest with ii: Open a SIPP | What is a SIPP | SIPP Cashback Offers

This development has implications for the triple lock, which uprates the state pension every year by the higher of inflation, wage increases, or 2.5%.

With the inflation figure used in the government’s calculations now established, and average wages increasing by 8.5%, it’s the latter that’s the highest element. If applied this will boost the full state pension above £11,500 a year.

However, as is often the case with the triple lock, it’s not quite that cut and dried. There are reports that the government may opt for a lower earnings metric, one that strips out bonus payments, to the potential detriment of retirees.

Let’s look at what’s going on and examine how this might impact what happens to the state pension next year.

How much is the triple lock set to rise next year?

Much of the previous debate focused on whether the government will scrap the triple lock next year. But both Prime Minister Rishi Sunak and Chancellor Jeremy Hunt have recently pledged to honour the policy for 2024-25 – good news for the current crop of retirees.

Last year pensioners received a bumper 10.1% increase due to 40-year high inflation. And while inflation is still rising at strikingly high levels, price rises are now being outpaced by wages for the first time in two years.

Interestingly, not every component of the triple lock is calculated in the same way. For inflation, it’s the 12-month figure to September that’s taken into account, but the earnings element is determined by wage activity in the three months from May to July. During that period wages grew an eye-watering 8.5%, with this figure boosted by one-off payments to NHS staff and civil servants to settle pay disputes. Pay increases have cooled recently due to falling job vacancies but remain north of 8%.

- Seven pension tips I learned as a financial adviser

- Autumn Statement 2023 preview: what might Jeremy Hunt have in store?

However, if the bonus payments are stripped out, regular pay increases drop to 7.8%. In a potential blow to pensioners, the government is reportedly weighing up whether to use the lower figure when calculating the triple lock, a move that would save the Treasury almost £1 billion next year.

So, if the government opts for either 8.5% or 7.8%, how would this impact how much the state pension rises next year?

Well, if the 8.5% measure is used, the basic state pension will rise by £13.30 a week to £169.50 (£8,814 a year), while the full new state pension will hike £17.35 a week to £221.20 (£11,502 a year).

However, if the government opts for 7.8% and excludes bonuses, the basic state pension will rise by £12.20 a week £168.40 (£8,756 a year), whereas the full new state pension will rise by £15.90 a week £219.75 (£11,427 a year).

These may not appear huge differences, but it’s worth remembering that with inflation still high every penny matters to many pensioners right now. According to Office for National Statistics (ONS) data, some 1.2 million households are mainly reliant on the state pension to provide the bulk of their retirement income.

Those in this group will urgently seek clarity on how much state pension they will pocket next year so that they can plan their finances accordingly.

Long-term future hanging in the balance?

Regardless of what the government decides to do with the state pension in the 2024-25 tax year, the triple lock’s longer-term future remains a bone of contention.

In August, the Times reported that if costs continue their current trajectory, by 2025 the state pension will become more expensive than the Department for Education, Home Office, and Ministry of Defence combined.

And in July, the Office for Budget Responsibility (OBR) identified the triple lock as a fiscal risk, saying that costs are spiralling higher than previously planned.

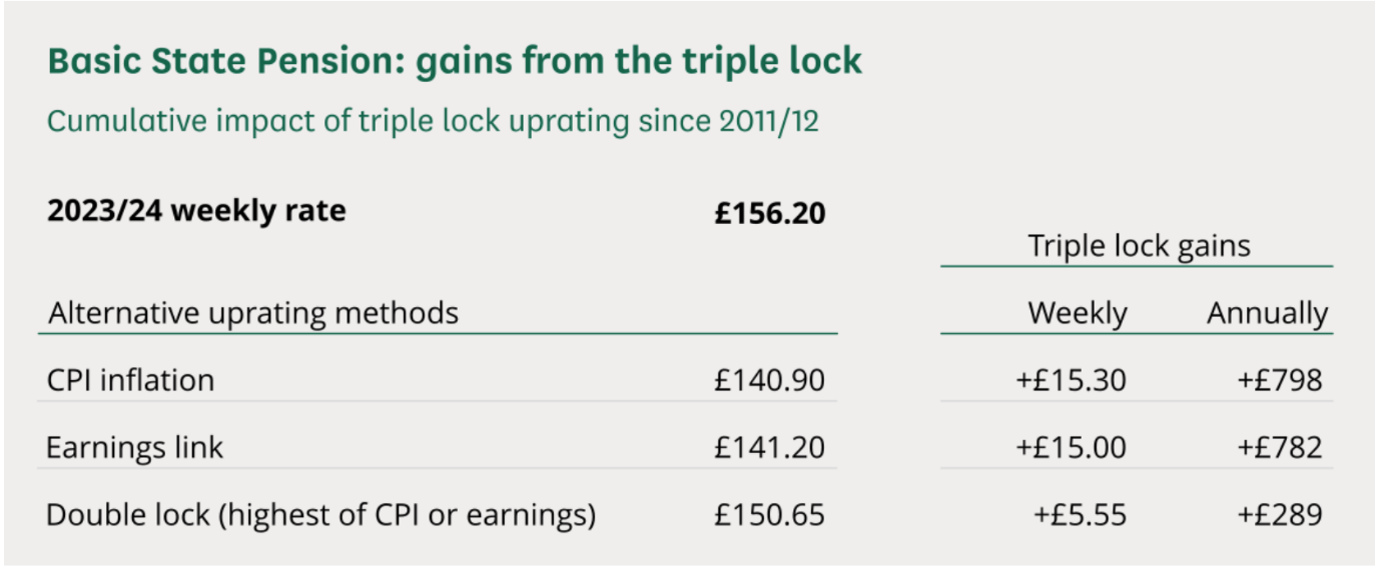

The graphic below shows how the policy has impacted increases to the basic state pension - compared to alternative uprating methods - since its introduction in 2011-12:

Source: House of Commons library

If the triple lock had risen in line with inflation over the past 12 years, pensioners would now be £798 a year worse off. The government, however, would’ve saved around £10 billion.

Even if a double lock (highest of inflation or earnings) had been used, the state pension would still be almost £300 a year lower than it is today.

- Eight essential questions to ask your partner before you retire

- 10 things to know about running a retirement portfolio

Others are equally concerned about the potential strain posed by the triple lock. According to the Institute for Fiscal Studies (IFS), keeping the policy makes it trickier for the government to plan its future finances.

“Based on our calculations, a reasonable estimate (taking place 80% of the time) for additional spending on the state pension in 2050 due to the triple lock, above and beyond earnings indexation, would be between £5 billion and £45 billion a year in today’s terms (taking into account the growing size of the pensioner population). This range is so large because of the uncertainty over the path of the state pension that the triple lock creates,” the IFS said.

Whatever the government decides to do with the triple lock this year, most agree that it must choose carefully. With a general election looming, any decision to water-down the policy will not prove popular with older voters, especially those who rely on the state pension to meet every-day needs.

As you may recall, the government suspended the earnings element of the policy for the 2022-23 tax year, with wage rises artificially boosted by workers coming off furlough. This delivered a 3.1% increase to the state pension, in line with inflation, instead of 8.1% had the triple lock been honoured.

All eyes now turn to Jeremy Hunt’s Autumn Statement, when the policy’s short-term future will be rubber-stamped. But given the event is still more than a month away, it might be wise for the government to reassure pensioners about its plans beforehand.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.