Nick Train: ‘the one stock everyone should own’

20th May 2022 08:53

by Sam Benstead from interactive investor

The veteran investor tips this consumer staples stock to prosper for decades to come.

With more than 40 years’ successful experience picking British stocks, Nick Train knows how to identify companies that are built to last, regardless of economic conditions.

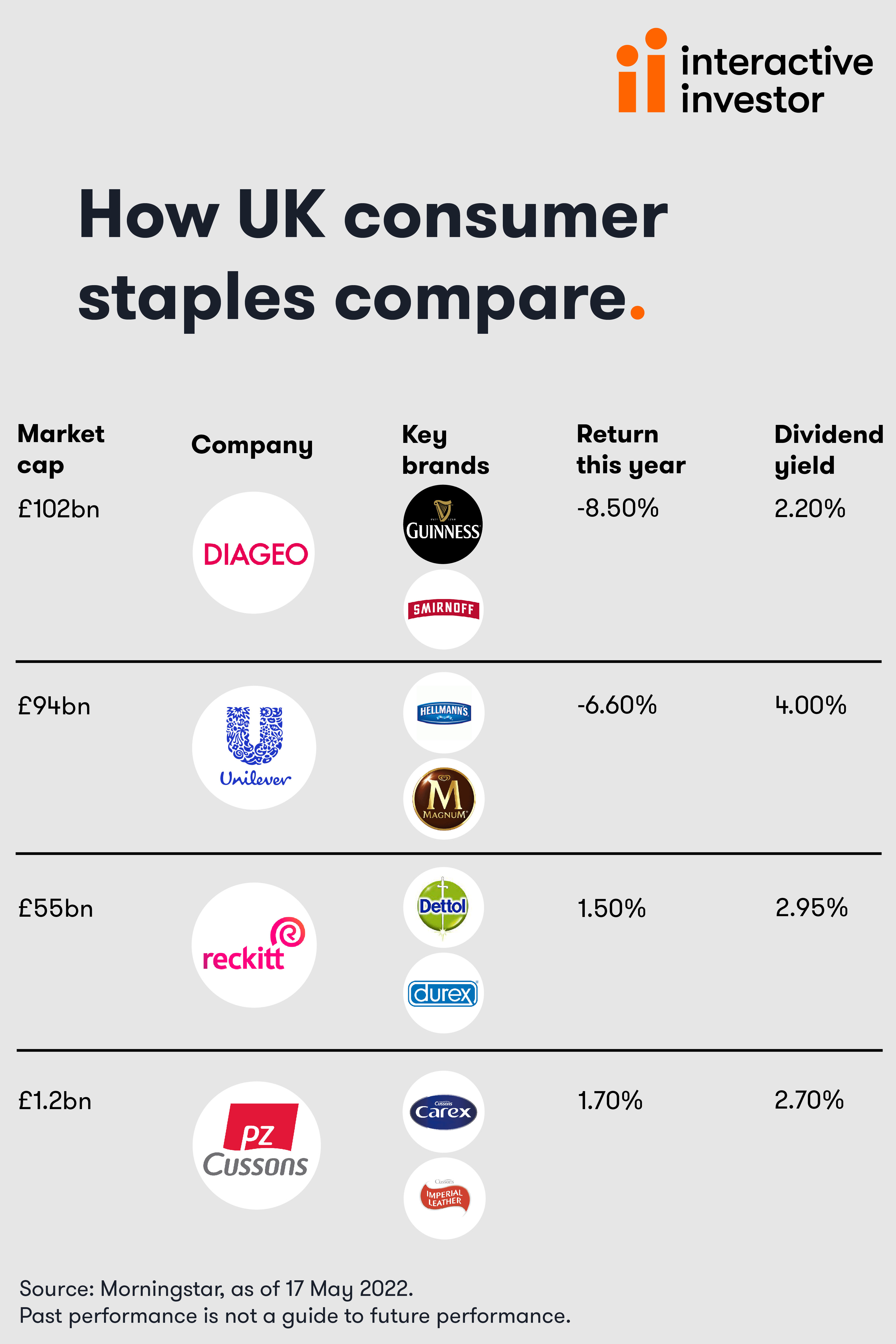

But one company stands out for the Finsbury Growth & Income manager as a particularly outstanding business and suitable for all investors to own: premium spirits group Diageo (LSE:DGE).

Speaking to professional investors at an event this week, he said: “I sincerely hope that Diageo is a core holding in everyone’s mandates here. Whether it is a UK mandate, global equity mandate, or even for your personal accounts. Everyone should own some of this, the world’s best alcoholic beverage business.”

He added that he could not conceive of a company offering more certain protection against monetary inflation than Diageo, and also praised its growth potential.

He said: “Over and above that inflation protection, Diageo offers access to a secular growth opportunity. That opportunity is also available to the sister investments we have in Finsbury Growth & Income, namely Fevertree Drinks (LSE:FEVR) and Remy Cointreau (EURONEXT:RCO) – the only way that public market investors can access premium cognac.”

Train said that all three of those businesses were benefiting from the “observable, global trend towards the consumption of less but better-quality alcohol”.

That's a big opportunity, he noted, and pointed out that in the case of Diageo the average spirits-drinking household still spends only $1 a day on spirits so there is a long runway of growth ahead still for the UK firm.

Diageo shares have returned 55% over the past five years and yield around 2%. However, they have been under pressure this year, falling 13% as investors punish stocks that are expensive relative to profits. Diageo trades at a price-to-earnings ratio of 27.5, roughly double the average for the UK market.

- Eight star fund managers you can buy on the cheap

- Nick Train apologises for failing to deliver ‘acceptable’ performance

Nick Train’s UK funds have failed to return more than the FTSE All-Share index over the past three six-month periods.

He has apologised for this disappointing performance, saying that the “major holdings in the portfolio have failed to deliver acceptable performance for your company over what is now no trivial period”.

However, his long-term record is still excellent. Since taking over Finsbury Growth & Income in 2000, it has returned 585% compared with 183% for its benchmark.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.