What’s gone wrong at Lindsell Train?

26th April 2022 09:00

by Sam Benstead from interactive investor

Disappointing stock selection and the rotation from ‘growth’ to ‘value’ is hurting Nick Train’s fund group.

Fund group Lindsell Train – where star manager Nick Train manages money – is going through a tough period.

Its two biggest funds, the £7 billion Lindsell Train Global Equity and £5.4 billion Lindsell Train UK Equity, have failed to beat their benchmark – and their peers – over one and three years.

The global fund has lagged for over five years, but has comfortably outperformed over 10. The UK strategy has doubled the return of its benchmark and sector over 10 years and performed well over five years.

| Time period (years) | Lindsell Train Global Equity (%) | Sector (%) | Benchmark (%) | Lindsell Train UK Equity (%) | Sector (%) | Benchmark (%) |

|---|---|---|---|---|---|---|

| One | -6 | 2 | 9 | 0 | 2 | 11 |

| Three | 13 | 36 | 44 | 10 | 13 | 15 |

| Five | 64 | 56 | 68 | 36 | 22 | 25 |

| 10 | 308 | 181 | 240 | 206 | 106 | 102 |

All data, sourced from FE FundInfo, is to 12 April 2022. Past performance is not a guide to future performance.

Train has acknowledged that his funds are struggling, telling investors in the global fund that 2021 was a “harrowing” year.

He said: “This has been a harrowing year for us and our investors, with the absolute performance barely positive and relative performance collapsing versus the benchmark, with the fund underperforming by over 20% – the worst year of relative performance we have ever had.”

He told shareholders in Lindsell Train Limited, an investment trust that follows the same global investment approach, that the group was experiencing “arguably the worst period of relative investment performance in our 20-year history”.

So what’s gone wrong?

Lindsell Train has missed investing in some of the best-performing stocks of the past five years. It is also facing a shift in investors’ preferences from the “growth” stocks it buys to “value” stocks.

In the global funds, where the problems are most acute, ignoring technology giants Microsoft, Alphabet (the Google parent) and Amazon has negatively impacted performance. As these stocks have grown more than three-fold in value over the past five years, the index and other fund managers have bought more and more of them.

In contrast, consumer staple stocks such as Unilever (LSE:ULVR) and Heineken (EURONEXT:HEIA), which Train owns in both the UK and global funds, have delivered underwhelming returns. Other favourite stocks, such as the London Stock Exchange and PayPal, are struggling as acquisition costs mount and growth slows.

Aside from stock-picking challenges, Lindsell Train’s approach to investing is facing broader difficulties.

- Nick Train: The Richard Hunter Interview Podcast

- Video: The Richard Hunter Interview: Lindsell, Train…and Bullock

As inflation – and interest rates rise – investors begin to degrade the importance of future earnings and focus instead on companies that make a lot of money today relative to their share prices. This means that “value” shares do well, such as those in the banking or energy sector, while expensive stocks that are prized for their future earnings potential do less well.

Train said: “It turns out your portfolio is even more growth-oriented than I thought. Certainly, almost every ‘growth’ investment in the portfolio fell in January (2022), in line with the sell-off in the Nasdaq.

“It almost seemed the better the trading news the companies delivered, the worse the share price hit.”

In response, he said he was encouraged that such a high proportion of the portfolio is perceived to be “growth”, because that is what he wants from a portfolio.

He said: “Deliberately the portfolio is constructed around companies with strong franchises, strong intellectual property or strong brands, all with the potential for strong profitability and secular growth,” he said.

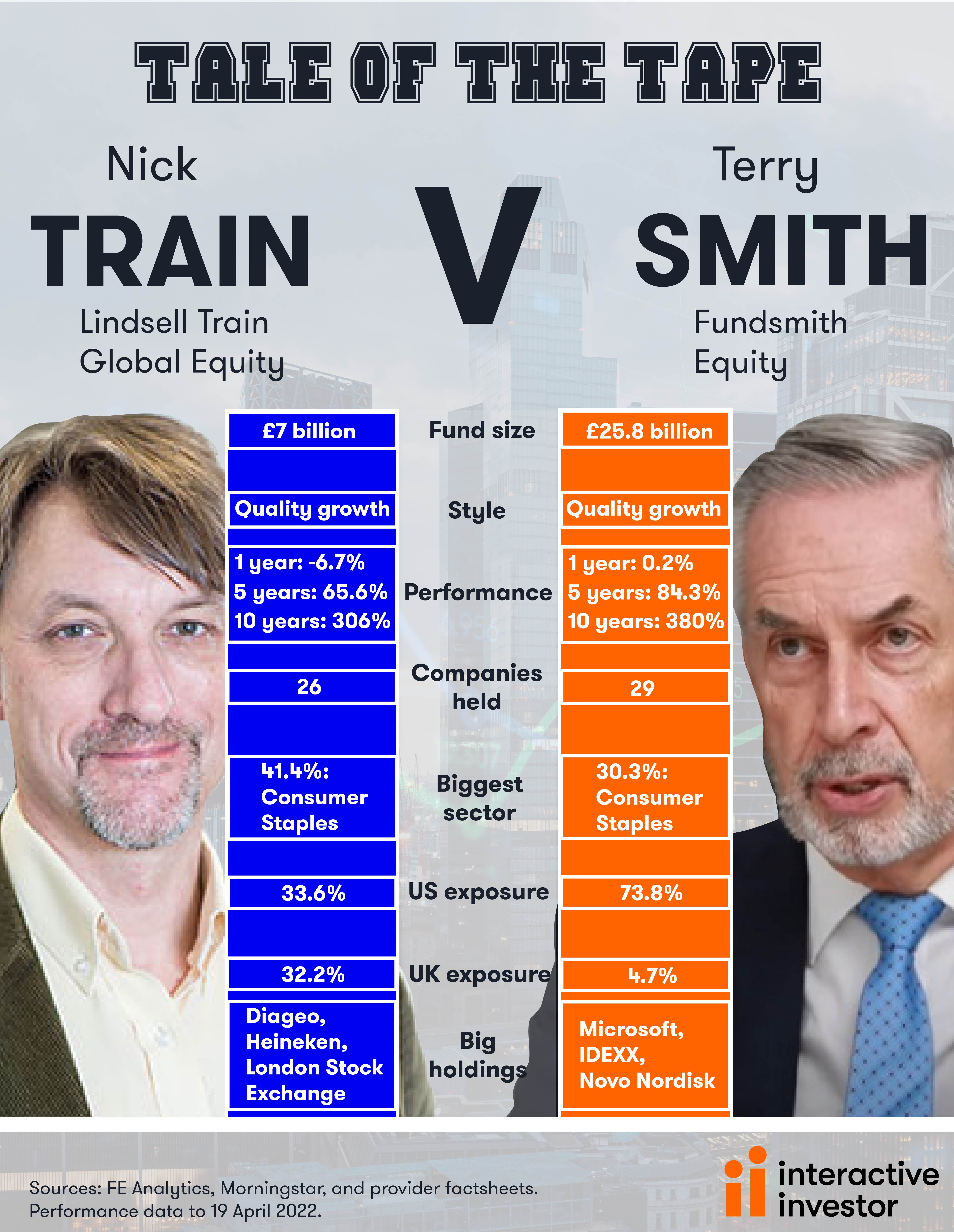

In contrast, Fundsmith Equity, managed by Terry Smith, has held up better over the past year. Smith and Train have a similar investment style - backing high-quality growth companies for the longer term. However, over both the short and long term Smith's Fundsmith Equity has been the better performer.

What is Lindsell Train doing about it?

The short answer is not a lot. There have been no new disclosed investments in the global fund since 2019, although James Bullock, a manager on the fund, revealed that it had begun building a new position. He also noted that Pearson had been sold. The publisher lost its place in the firm’s UK portfolios last year.

Bullock said: “We haven't bought a new stock since summer 2019. We are buying more of the stuff we already own so long as the investment thesis is intact. There will always be something shinier out there on a short-term view."

Bullock added that he was still happy with the portfolio, despite struggling share prices. He said: “We are pretty encouraged by the underlying businesses of the companies we own. Almost all of them exit the pandemic in strong shape as business leaders in attractive sectors and with strong balance sheets.”

- What is the metaverse and should you invest in it?

- Tech specialists ditch Facebook but Terry Smith keeps faith

- Terry Smith buys Alphabet for Fundsmith

Lindsell Train recently launched a new strategy: Lindsell Train North American Equity, which is managed by James Bullock and Madeline Wright. It is the first fund not managed by either Train or his co-founder Michael Lindsell.

The strategy follows the same investment philosophy of buying “quality” companies with proven business models and solid growth prospects, but has been more open to embracing technology firms.

Top 10 holdings include cloud computing firm Oracle and Alphabet, but there is still no sign of Microsoft or Amazon, which are both owned by rival Terry Smith’s Fundsmith Equity fund.

What should you do?

Lindsell Train UK Equity is on the interactive investor Super 60 list of recommended funds after passing a review process in 2019.

Dzmitry Lipsky, head of funds research at interactive investor, said: “The fund has an outstanding long-term performance record since inception. It has benefited from its investment style being in favour for the past decade and so could potentially struggle when value and lower-quality stocks eventually begin to outperform.

“The quality-growth strategy employed by the fund can be diversified by blending it with a value-focused UK equity fund in a well-diversified portfolio.”

John Monaghan, research director at fund analysis firm Square Mile, also said it was worth sticking with Lindsell Train.

“There has been a style rotation in the last few months. The best performers have been ‘value’ shares, such as energy and mining, and the fund does not own these.

- Growth shares versus value shares: the investment styles explained

- A guide on how investors can protect against inflation

- Smithson manager calls for patience as expensive stocks crash

- Meet the ‘new FAANGs’ the pros are getting excited about

“Lindsell Train’s process is not broken – but investors need to understand the risks when they invest. Longer-term returns are strong, but there could now be a period of more underperformance.”

Monaghan added that the growing prominence of Wright and Bullock at the firm was a good thing, as founders Train and Lindsell would not be working forever.

“They have learnt off the founders and are taking on more responsibility. However, there are no signs that Train and Lindsell are going to step back just yet.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.