Eight star fund managers you can buy on the cheap

11th May 2022 11:12

by Sam Benstead from interactive investor

Double-digit discounts at investments trusts run by well-known investors are a rarity and could prove to be bargains.

The stock market rout this year has created a rare opportunity to buy shares in investment trusts run by star managers at large discounts to the value of their investments.

Headline bargains include a 38% discount on Pershing Square Holdings, run by Bill Ackman, a 10% discount for Smithson Investment Trust, part of Terry Smith’s Fundsmith group, and a 6.5% discount for Nick Train’s Finsbury Growth and Income.

In the technology sector, Polar Capital Technology is trading at a 14% discount and Allianz Technology is at a 12% discount. Both are managed by veteran tech investors with excellent track records.

Baillie Gifford trusts, which buy fast-growing companies that are often unprofitable, are also under pressure. Scottish Mortgage is at a 5% discount and Edinburgh Worldwide is at a 15% discount.

Value investors can also pick up a bargain by buying Alex Wright’s Fidelity Special Situations at a 6% discount.

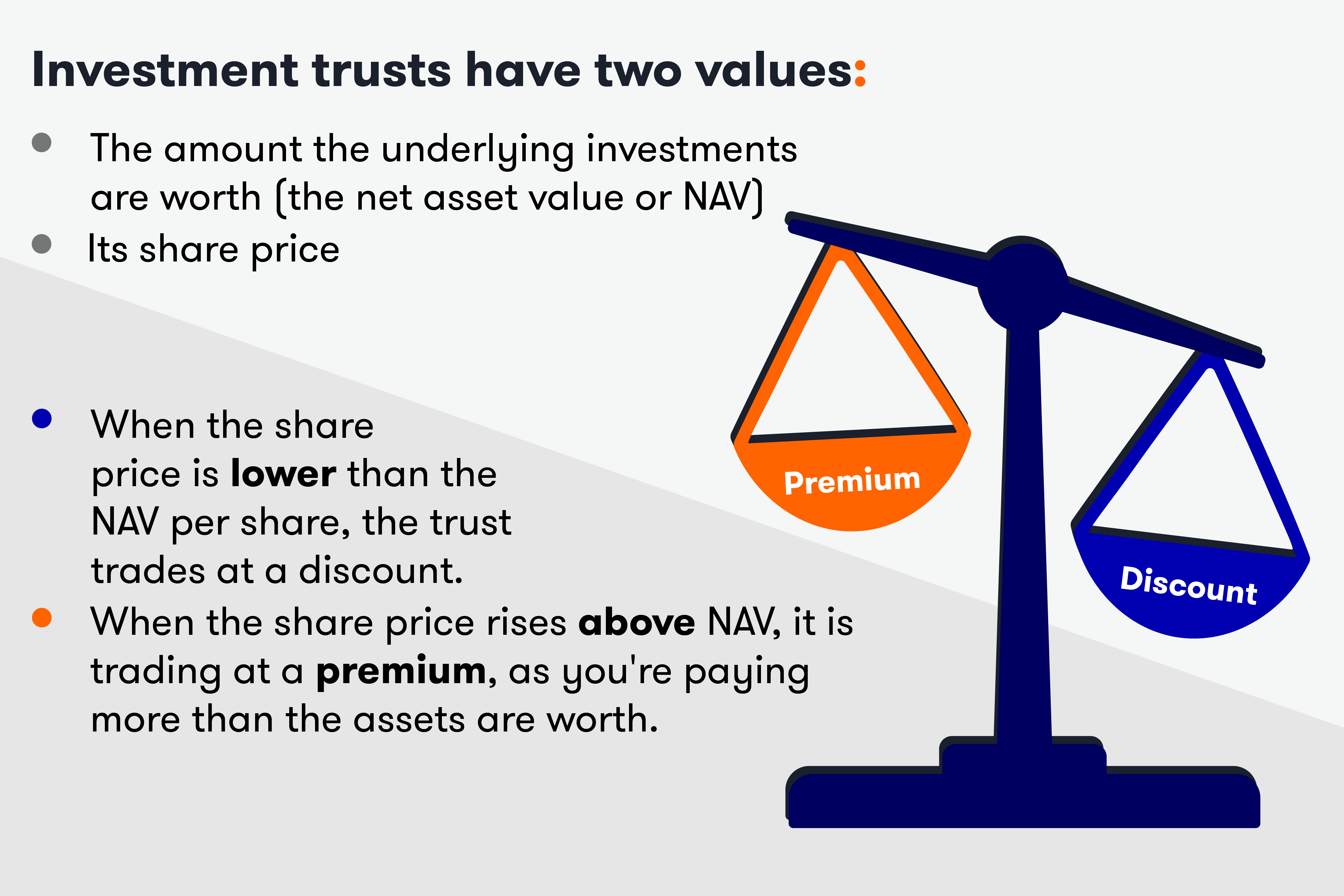

Investment company share prices trade separately to the value of the investments (the net asset value, or NAV), meaning that wide discounts often open when markets drop.

The use of gearing (or borrowing) by trusts also magnifies losses as well as gains, causing them to drop more than similarly managed open-ended funds when markets fall but rise more when they go up.

Each of the eight trusts have delivered strong long-term performance, despite a difficult recent period. Pershing Square, before banking a $400 million loss on a mistimed purchase and sale of Netflix (NASDAQ:NFLX), has returned 17.1% a year on average for 18 years compared with a 10.2% return for the S&P 500 index of America’s largest companies.

Train’s UK equity trust, which normally trades at a slight premium, has returned 183% compared with a 99% return for the UK market over a decade. Fidelity Special Values has delivered a 220% return over this period.

Scottish Mortgage has made investors 577% over a decade compared with 218% for a global stocks index. However, Edinburgh Worldwide is close to wiping out a decade of strong performance. Following a 60% drop in its shares from their peak in February last year, it has now returned 226% over 10 years compared with 218% for a global index.

Smithson Investment Trust is now trailing its benchmark since launch in 2018 despite following Terry Smith’s investment approach (but applying it to smaller companies) of buying good companies and leaving the returns to compound.

Ewan Lovett-Turner, head of investment company research at stockbroker Numis, said periods of share price weakness for highly regarded managers were often a good time to pick up shares. Purely on a discount play, he thinks Pershing Square stands out.

- Why it’s important to avoid being overexposed to one fund house

- Baillie Gifford retains crown as active investors’ favourite fund firm

Lovett-Turner said: “This has been a consistently wide discount despite very strong performance, but the shares have not kept up with net asset value (NAV) performance (which reflects the performance of the underlying investments). The manager has also put on timely market hedges in recent years so the discount seems unjustified, although fees can be an issue.” The trust has a yearly fee of 1.56%, which is higher than most trusts.

James Carthew, head of investment company research at QuotedData, believes Scottish Mortgage’s discount presents a buying opportunity as the board is very proactive at buying back shares to keep the discount narrow.

He said: “This is a good opportunity to drip-feed money into the trust. The discount won’t get much bigger and shares are 50% cheaper than they were at their peak last year. While James Anderson, who managed the trust for more than 20 years, has retired, there will be no change in the investment strategy.”

- Scottish Mortgage: time to buy the country’s most popular trust?

- Fund and trust alternatives to Scottish Mortgage and Fundsmith Equity

- Jeff Prestridge: I love funds, but not these ones

Fidelity Special Values also represents a good investment opportunity, according to Carthew. He said that the cheap shares it invests in should perform well in an environment of rising interest rates, although it is not overweight the top-performing energy and materials sectors.

Anthony Leatham, head of investment trust research at Peel Hunt, also said Fidelity Special Values was worth buying.

Leatham said: “It is rare to see FSV trading on a 7% discount. In fact, we have seen only three such dislocations in the last five years. From a style perspective, we would characterise this as an all-cap value approach, with a propensity to be contrarian.

“Heightened volatility and dispersion in markets has often been a precursor to the manager, Alex Wright, delivering outperformance of the market. We see value at these levels.”

Another area that Carthew likes is the technology sector, which he argues at current discounts presents a bargain. Polar Capital Technology is particularly attractive, he says, as the manager Ben Rogoff had been moving into safer businesses and taking advantage of lower prices to buy well-established and growing stocks.

However, Lovett-Turner said that there was no obvious catalyst for discounts narrowing in trusts buying expensive stocks.

“It is more a case of asset class or style coming back into favour. If that happens, you tend to get an attractive double whammy of the impact of strong underlying NAV performance and narrowing discount.”

He added that there were other “cheap” trusts to consider, such as RIT Capital (LSE:RCP) which has a defensive investment approach and 6% discount, and Caledonia Investments, which invests in public and private businesses and has 14% in cash, at a 30% discount.

- How to invest for difficult times

- Funds and trusts four professionals are buying and selling: Q2 2022

- Nick Train: The Richard Hunter Interview Podcast

Finsbury Growth & Income and Smithson Investment Trusts are names to avoid right now, Carthew argues.

He said that Train’s trust could keep suffering as its expensive shares will come under pressure as interest rates rise, and Smithson also was too focused on richly valued stocks for this environment.

“Train owns defensive companies and therefore should, in theory, be protected from market falls. But these stocks have become very expensive and valuations are contracting. Some brands also aren't as defensive as they used to be due to the internet and the ability for new brands to launch,” he said.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.