Nuclear power resurgence energises these three funds

Saltydog Investor takes a closer look at one of the hottest investment themes right now: demand for uranium.

30th January 2024 09:05

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

At Saltydog Investor we review the performance of thousands of unit trusts, open-ended investment companies (OEICs), investment trusts, and exchange traded-funds (ETFs). Each week, we provide new reports to our members, highlighting which sectors are gaining momentum and picking out the leading funds in each sector.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Most of our analysis is based on unit trusts and OEICs. We feel that they have several advantages:

- There are lots of them

- They are highly regulated

- They cover fixed income, mixed investment, and equity asset classes

- They spread risk by investing in a range of securities

- They are run by a professional fund manager

- They are neatly classified by the Investment Association (IA)

We also tend to find that our new subscribers, who may not have a lot of investment experience, are more familiar with them and may already hold some in their pensions or ISAs. There is a common misconception that they are expensive to buy and have high management costs. While that may have been true when there were 5% initial charges, and ongoing kickbacks to the IFAs who originally sold them, that is no longer the case. There are several fund supermarkets offering a wide range of funds that can be traded relatively cheaply.

However, I know that some of our more experienced members like to use investment trusts and ETFs. We also notice that from time-to-time they highlight trends in some of the more niche sectors of the market that are not accessible through open-ended funds.

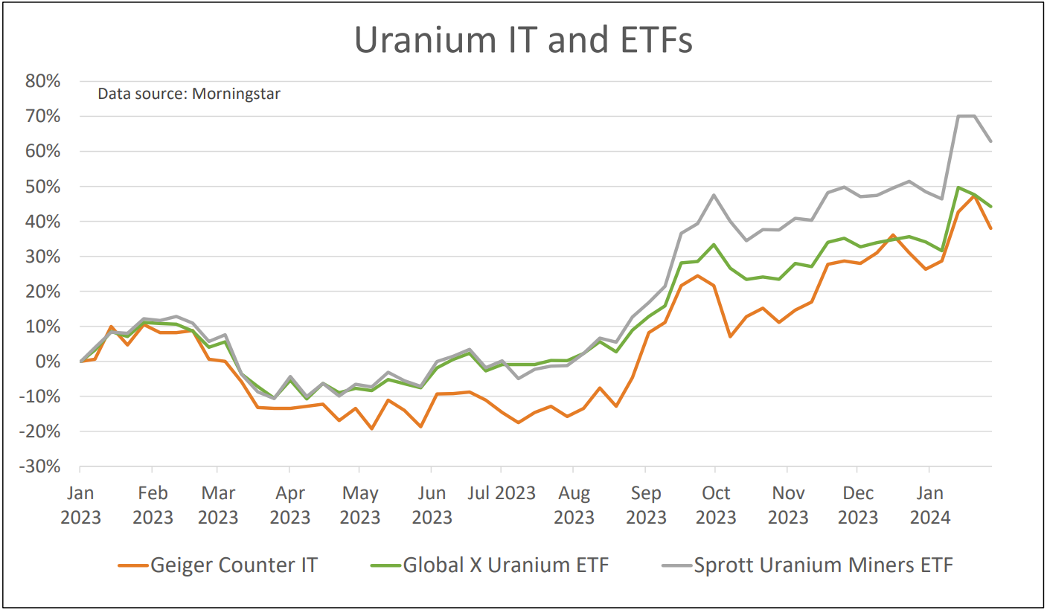

Over the last few months, one investment trust and a couple of ETFs have caught our attention. They are the Geiger Counter Ord (LSE:GCL), Global X Uranium ETF USD Acc (LSE:URNU), and the Sprott Uranium Miners ETF Acc (LSE:URNM). Last week, they had a bit of a dip, but overall they have done pretty well since the beginning of August.

Past performance is not a guide to future performance.

The objective of the Geiger Counter investment trust is to “provide investors with the potential for capital growth through investment primarily in the securities of companies involved in the exploration, development and production of energy, predominantly within the uranium industry”.

The Global X Uranium ETF “seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Uranium & Nuclear Components Total Return Index”.

The Sprott Uranium Miners ETF aims to “track the price and yield performance, before fees and expenses, of the North Shore Sprott Uranium Miners Index”.

Although they are all slightly different, the underlying thing they have in common is that their performance is closely linked to the demand for uranium.

The primary demand for uranium is as the fuel for nuclear reactors, which create electricity, although it has some other industrial uses (radiation therapy for cancer, industrial radiography, density measurement equipment, and alloys for the aerospace industry).

There have always been mixed feelings towards nuclear power plants.

The advantages are that they produce large amounts of electricity with low greenhouse gas emissions, provide a stable and consistent output, and on the whole are very reliable. Unfortunately, when things do go wrong, they can be catastrophic, such as the Chernobyl disaster in 1986 and the failure of the Fukushima Daiichi plant in 2011. There are also issues surrounding the disposal and management of the radioactive waste produced during the nuclear fission process, and decommissioning the plants when they come to the end of their operational lives.

- 10 hottest ISA shares, funds and trusts: week ended 26 January 2024

- Where to invest in Q1 2024? Four experts have their say

The public concern about safety, the long construction time, and high initial costs made nuclear power a hard sell for governments after the Fukushima disaster. The momentum shifted towards wind, solar and other forms of renewable energy. Plans for new nuclear plants were shelved and the decommissioning of existing plants was accelerated.

However, it feels as though the tide may have turned. When the Russians invaded Ukraine, it highlighted how dependent the West, and particularly Europe, was on Russia for its energy supplies. The recent troubles in the Red Sea also show the vulnerabilities of relying on fuel from the Middle East. The argument for countries to have control over their own energy supply is gaining traction and popular support. For many, the preferred option is more solar panels and wind generators. The problem is that there are many places where the sun does not always shine, and the wind does not always blow. They have also proven to be more expensive to produce and maintain than anticipated.

If we want to reduce our reliance on fossil fuels, and governments want to achieve security of supply and hit their net-zero targets, then there is a compelling argument for bringing more nuclear energy on stream.

At the same time, technology is continually improving. The world’s first generation IV nuclear reactor became operational at the end of last year in China. There are also a number of companies, including Rolls-Royce Holdings (LSE:RR.), who are capable of building small modular reactors. These are designed to be built in a factory and then shipped to wherever they are needed.

If the amount of nuclear energy that we generate does go up, then the demand for uranium will increase, which should be good for any funds that are investing in the companies that produce it.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.