Preparing our fund's portfolio for a difficult October

Saltydog investor has trimmed his stake in these top performers, but he'll buy again if they do this.

7th October 2019 12:59

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog investor has trimmed his stake in these top performers, but he'll buy again if they do this.

October has a reputation for being a scary month for investors.

The Wall Street Crash of 1929 began in October and the Dow Jones then continued to fall until the summer of 1932. It didn't fully recover until the end of 1954. October 1987 witnessed the largest one-day percentage decline in US stock market history and is often referred to as Black Monday. This was partially blamed on automated trading systems and, as a result, it was decided that after a 7% drop trading would temporarily be suspended and, after a 13% drop was reached, trading would be stopped again. In October 1997 these limits were broken, and the New York Stock Exchange ended trading early. This mini-crash was caused by an economic crisis in Asia.

I struggle to see why any particular month should be inherently more prone to stock market crashes than another, and there have been many significant falls in other months. However, this year October does pose problems for investors in the UK as we head towards yet another Brexit deadline on the 31st October.

After a relatively stable September, with all of the major stock market indices making gains, October hasn't started well. After two days the FTSE 100 index was down 3.9%, having suffered it's worse one day drop since before the EU referendum.

In the US, the S&P v500 and the Dow Jones Industrial Average were both down 3%. The French CAC40 and German DAX were down more than 4%. Fortunately, they have subsequently started to recover, but still ended the first week of October in negative territory.

In our portfolios we haven't made many changes as we were already holding relatively high levels of cash. In our most cautious portfolio, the Tugboat, cash currently accounts for more than 40% of the overall value.

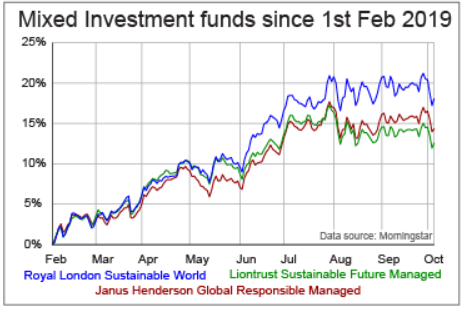

The next largest holdings are in three funds from the Mixed Investment 40-85% Shares sector, Janus Henderson Global Responsible Managed, Liontrust Sustainable Future Managed, and Royal London Sustainable World. We first went into two of these funds in February of this year and, although they're not the most exciting funds in the world, they did make steady progress up until the beginning of August, making gains of over 15%. Over the last couple of months, they've been more volatile and haven't really gone anywhere.

We did reduce our exposure to these funds in September and are keeping a close eye on them. If they revert back to the upward trajectory that we saw earlier in the year then we will consider topping them up. If not, it may be time for further cuts.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.