Richard Beddard: this is one of my favourite businesses

22nd October 2021 14:53

by Richard Beddard from interactive investor

It has a tendency to scare investors with straight-talking about short-term trading issues but in the long term it delivers. Find out why our companies analyst scores it highly.

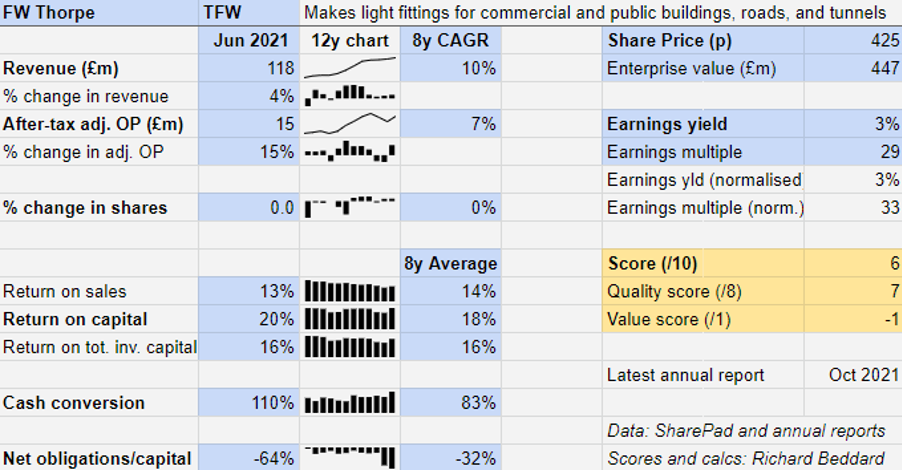

Judging by the numbers, there is nothing to worry about at FW Thorpe (LSE:TFW), a manufacturer of lighting systems.

Despite Brexit, the pandemic and a fire that gutted the factory of Lightronics, a significant Dutch subsidiary, the company achieved modest revenue growth in the year to June 2021, an improvement in profitability and excellent cash conversion.

You would not know that the pandemic and delays in shipments due to Brexit had resulted in increased costs, component shortages and the loss of a few overseas customers due to shipments held up at ports.

Nothing to worry about in the numbers

Thorlux, by far the biggest of FW Thorpe’s seven businesses, performed well, as did TRT Lighting. TRT specialises in road and tunnel lighting and benefited from a large-scale tunnel refurbishment project on the M25.

Lightronics, which makes street and exterior lighting, is second to Thorlux in terms of size. The fire did not destroy much stock, and thanks to a quick relocation to a temporary site production barely faltered. Lightronics achieved similar revenue to the previous year.

FW Thorpe had hoped that Lightronics, acquired in 2015, would be the main bridgehead for Thorlux’s much broader range of products into Europe, but takeup has been low and Lightronics sold only £0.5 million of Thorlux product in 2021.

From now on Famostar, another Dutch subsidiary that specialises in emergency lighting, will take the lead because it has closer relationships with specifiers and end customers, Thorlux’s preferred route to market. Lightronics sells mainly through distributors.

- Richard Beddard: a new hot stock for the portfolio?

- Read more of our content on UK shares here

- Check out our award-winning stocks and shares ISA

Although Famostar, acquired in 2017, also had a good year, some of Thorlux’s smaller businesses faltered. Philip Payne, which supplies stylish emergency lighting to restaurants, hotels and offices did not win any large scale orders in the year but remained profitable. FW Thorpe is introducing Famostar’s products to the UK market through Philip Payne.

The group has started the new financial year with a strong order book. It believes customers plagued by uncertainty are not inclined to take a chance on lesser known brands, which has worked in its favour in the UK and the Netherlands. The trend is a hindrance, though, in markets where FW Thorpe is less well established like the UAE and Australia.

Fulfilling the burgeoning order book may also be tricky. The company says shortages of steel, plastics, cardboard, microchips and electronic components are making day to day operations tense and frustrating and it is having to quote longer lead times.

Workers from Europe have returned home, and it is harder to recruit UK replacements to help it ramp up production.

Nevertheless, FW Thorpe has the cash resources to stock up when it can, and is confident enough to recommend the payment of a special dividend.

Investing for the long term

FW Thorpe is one of my favourite businesses. It has a tendency to scare investors with straight-talking about short-term trading issues but in the long term it delivers.

Established in 1936, the founding family are still represented on the board by the founders’ two grandsons who are controlling shareholders and now non-executive directors. James Thorpe, a great grandson of the founder, is also a member of the board. He is business development director.

The company invests in staff, product development and facilities for the long-term and its commitment to staff may be exemplified by its chairman and joint chief-executive Mike Allcock. He joined the business as an apprentice in 1984.

Its subsidiaries operate as separate entities but sell each other’s products where relevant and incorporate each other’s technologies.

The company promises the lowest lifetime cost of ownership believing customers and specifiers like architects and designers want functional, reliable, and efficient products, and spares and support for their lifetimes, which is 10 years or more.

To tempt them away from cheaper alternatives it restlessly innovates to make lighting simpler and more useful. For example, the Flexbeam suspended acoustic luminaire has a sound absorbing body made from recycled bottles (the bodies are also recyclable), taking away the need for separate sound absorbing panels in exposed ceilings.

The SmartScan platform used across many FW Thorpe subsidiaries’ indoor and exterior products networks light fittings equipped with sensors to collect data about the environment. Lights automatically switch on or off depending on the proximity of people and dim or brighten in response to daylight, maximising energy savings and the life of the lights.

The colour temperature in rooms can be programmed to change with the time of day and users can monitor energy usage and other data gathered by the light fittings, including data unrelated to lighting, like air quality.

A case study in this year’s annual report claims that SmartScan installations and 12,000 new light fittings have reduced the lighting bill of United Lincolnshire Hospitals NHS Trust by 91%.

The company practices what it preaches. Not only are energy saving products fundamental to the lowest-cost of ownership promise and helping customers achieve their own environmental goals, FW Thorpe is saving energy in its own factories by installing solar panels and using electric vehicles.

It has been planting trees in Monmouthshire for a decade to offset the diminishing amount of grid supplied energy it consumes.

In the past I have worried that the transition of lighting from inefficient incandescent systems to LED systems had brought forward spending, and since the luminaires last ten years or more, a hangover could follow once many customers had upgraded.

Today I am more relaxed about the LED boom. Though 90% of FW Thorpe’s sales are LED I think there is still plenty of upgrading to be done. And the LED lighting revolution is a decade-or-so old, so we may be beginning to enter the replacement cycle for early systems that are not as sophisticated as those of today.

Overseas ambition

While its overseas ambitions took a knock in 2021, FW Thorpe has gradually expanded overseas, most significantly the Netherlands where it earned 27% of revenue and 33% of operating profit in 2021.

Spain may also be developing into a significant market. After the year-end in August FW Thorpe acquired Zemper, which has annual revenue of €20 million. Like Philip Payne and Famostar, Zemper specialises in emergency lighting.

FW Thorpe likes the niche characteristics of emergency lighting, and also I suspect, the fact that it does not compete directly with Thorlux’s product range. Maybe, like Famostar in the Netherlands, Zemper could be a conduit for Thorlux products in Spain.

FW Thorpe owns 40% of Luxintec, another Spanish lighting company and a supplier of LED lenses to the group.

Does the business make good money? [2]

+ High returns on capital through thick and thin

+ High profit margins

+ Good cash conversion

What could stop it growing profitably? [2]

+ Very strong finances

+ Plenty of competition (addressed by strategy)

? Diversity of products and customers reduces recession risk

How does its strategy address the risks? [2]

+ Differentiated products e.g. SmartScan platform

+ Works closely with specifiers and end users

+ Pursuing international growth through local subsidiaries

Will we all benefit? [2]

+ Very experienced management, not excessively paid

+ Staff development is one of four strategic pillars

+ Communicates well with shareholders

Is the share price low relative to profit? [-1]

− No. A share price of 425p values the enterprise at nearly £450 million, which is about 30 times adjusted profit

Even though FW Thorpe’s high share price suggests traders are well aware of its qualities, a score of 7 out of 9 means it is probably a good long-term investment.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in FW Thorpe.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.