Richard Beddard: scoring two good long-term investments

It’s hard to invest when trading is tough, but these businesses might have cracked it.

5th February 2021 15:19

by Richard Beddard from interactive investor

It’s hard to invest when trading is tough, but these businesses might have cracked it.

When businesses have the wherewithal to invest while trading is tough, it can be a sign of past prudence and a harbinger of future strength. Competitors hamstrung by weaker finances will be disadvantaged when things return to normal.

Investing in spite of everything

Despite the pandemic, lift component manufacturer and distributor Dewhurst (LSE:DWHT) is building a new factory for Dupar Controls, its Canadian subsidiary.

The factory will be more efficient and its greater capacity will supply increasing demand across North America. Dewhurst expects to start manufacturing there in March.

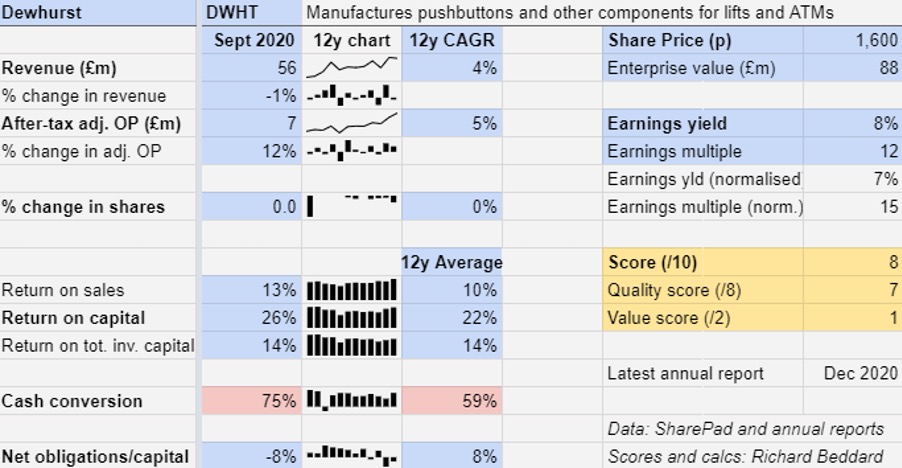

Judging by every metric I measure barring flat revenue in the year to September 2020, Dewhurst is an improving business. Profit growth, return on capital, and cash conversion are all above their historic norms and the company’s financial obligations are below average.

Dewhurst earns by far the most revenue from lift components, but its resilience in 2020 was due to the sudden flourishing of its much smaller Transport division. Dewhurst’s Traffic Management Products subsidiary, a supplier of bollards, is a beneficiary of the government’s enthusiasm for cycle lanes.

A third division that manufactures keypads for ATMs experienced a reduction in revenue, and is probably in decline due to the diminishing use of cash.

The statistics indicate Dewhurst is a highly profitable business that is growing modestly. The only slight blemish in its financials is cash flow, suppressed somewhat by the requirement to pay money into an underfunded pension scheme and, particularly over the last two years, heavy investment.

Scoring Dewhurst

Lifts are installed late in the construction of new buildings and although the revenue decline in the lift division was a modest 4% in 2020, a slowdown in construction projects caused by lower demand for office space and hotel accommodation may drag on revenue for some years to come.

Nevertheless, Dewhurst earns considerable income from repairs and maintenance and the public sector, which shields it from the worst excesses of contractions in the construction market.

Although Dewhurst must buy in touchscreens and other components often at lower margin than manufactured components like pushbuttons, by developing assemblies like car operating panels and hall lanterns it has adopted new technologies without compromising profitability.

One of its newest products is the contactless car operating panel that graces the front of its annual report. It summons lift cars with a wave.

In an industry where the failure of relatively minor and inexpensive components can be expensive to put right, Dewhurst supplies robust products and efficient service in many parts of the world.

Two-thirds of revenue comes from abroad.

Does the business make good money? [2]

+ High returns on capital

+ Decent profit margins

? Reasonable cash conversion

What could stop Dewhurst growing profitably? [1]

+ Strong finances and diverse markets

? New technologies mean more bought-in components

? Lower demand for office space and hotel accommodation

How does its strategy address the risks? [2]

+ Design of robust and attractive components

+ Adds value through assembly

+ Increased emphasis on distribution

Will we all benefit? [2]

+ Service ethos benefits customers

+ Very experienced management

+ Managers are owners, and modestly remunerated

Is the share price low relative to profit? [1]

+ Yes, a share price of £16 values the enterprise at about 15 times adjusted profit (calculated using the company’s average return on capital)

Dewhurst is currently ranked first out of the 38 companies by my Decision Engine. With a score of eight out of 10, it is probably is a good long-term investment.

Advancing the market

Victrex (LSE:VCT) is also investing through thick and thin.

Its growth aspirations are dependent on developing new uses for PEEK, a polymer that sits atop a pyramid of plastics.

Lighter, tougher, quieter and easier to shape than metal, it is usually used in relatively small quantities, for example in brake parts for cars and medical implants. It makes planes lighter and more fuel efficient, cars quieter, and parts in general more reliable and cheaper to manufacture.

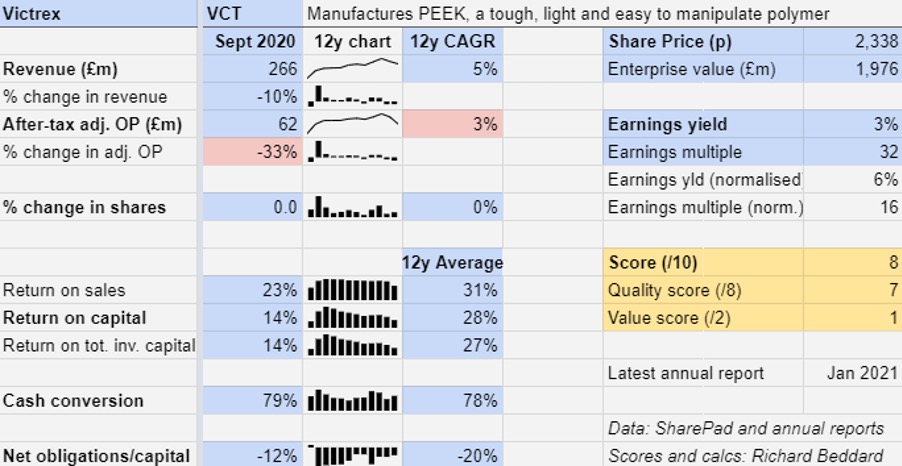

In the year to September 2020, Victrex spent £16.7 million on research and development into new grades of PEEK and new parts, which was only slightly down on the prior year and amounted to a similar percentage of revenue (6%).

Capital expenditure increased in 2020, although a project to remove production bottlenecks remains on hold until the capacity is required.

- Richard Beddard: to diversify or not to diversify?

- Are you saving enough for retirement? Our calculator can help you find out

Victrex manufactures PEEK in the UK, but for now it is shifting investment to China, where Victrex is spending £32 million on a new facility capable of producing 1,500 tonnes of PEEK a year. Mostly it will supply Chinese manufacturers required by government policy to source more components locally.

At 2020’s average selling price of £76/kg, the capacity equates to £114 million of PEEK, about 10% of current global capacity (which Victrex dominates), albeit shared with a Chinese minority partner.

The pandemic was something of a perfect storm for Victrex, affecting the medical and industrial divisions. Cancelled operations and reductions in the production of cars and planes due to the pandemic were the principal reason Victrex’s revenue fell 10% and profit fell 33% in the year.

Include £9.8 million of voluntary redundancy costs deemed exceptional, and profit would have fallen further.

Statistically at least, even when it is half as profitable compared to its twelve-year average and earning 14% return on capital, Victrex looks like a good business.

Scoring Victrex

When demand in industrial markets falls, so does Victrex’s revenue and profit so its near-term prospects are uncertain. Long-term prospects are too.

Victrex dubs the biggest of its new opportunities, such as knee implants, gears and oil pipe, “mega-programmes”, but breaking into new markets means lengthy trials, product certifications, and unexpected hold-ups.

Most of the mega-programmes have yet to earn meaningful revenues of £1 million let alone their projected maximum revenues of £50 million. The proportion of revenue from PEEK grades or parts launched since 2014 is growing slowly, and it reached 5% of revenue in 2020.

Buying or holding shares in Victrex requires faith that over the long-term demand for the material will continue to grow as it has since Victrex invented it in 1978.

It also requires Victrex to continue reaping most of the benefit, while a handful of rivals producing different PEEK grades with different processes take some mostly lower margin business.

As the market leader in terms of sales, capacity, and know-how, the only chemicals company focused solely on PEEK and the only one developing parts as well as materials, the lead is Victrex’s to lose.

One way to do that, would be to skimp on investment. Another way would be to take its chemists and engineers for granted. Victrex does neither.

Does the business make good money? [2]

+ High return on capital even during downturns

+ High profit margins

+ Strong cash flow

What could stop it growing profitably? [1]

+ Very strong finances, diverse markets

? Limited competition commoditising some PEEK grades

? Failure to develop new mega-programmes

How does its strategy address the risks? [2]

+ Developing new grades and forms of PEEK

+ Building new markets in parts

+ Protection of intellectual property

Will we all benefit? [2]

+ High employee engagement and low turnover (4%)

+ High average pay, 90% participation in share schemes

? Highly-remunerated CEO and CFO are relatively new

Is the share price low relative to profit? [1]

+ A share price of £23.38 values the enterprise at about 16 times adjusted profit (calculated using the company’s average return on capital)

A total score of eight out of 10 means Victrex probably is a good long-term investment. It is ranked three out of 38 shares in my Decision Engine.

Richard owns shares in Dewhurst and Victrex.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.