Share Sleuth: this share has become too hot to handle

Richard Beddard waves goodbye to a holding that has served the portfolio well over the past two years.

4th February 2021 13:10

by Richard Beddard from interactive investor

Richard Beddard waves goodbye to a holding that has served the portfolio well over the past two years.

The last week has been crazy even by the stock market’s normal standards.

Catching up on the dumping and pumping of GameStop (NYSE:GME) and other shares in the newspaper on Saturday, I was breathless and slightly disoriented by the time I came to an article on Bloomsbury Publishing.

Bloomsbury (LSE:BMY) is a Share Sleuth share, and I had already read the company announcement the day before. The article was unremarkable, but the solitary comment below was like a fresh breeze on a stiflingly hot day.

Somebody had written: “Glad to be holding these [Bloomsbury shares] in my SIPP and ISA accounts...One of those stocks that is not part of a big crowd, thus the share price is doing well simply because of the value in the company rather than sentiment that surrounds...”

This is the kind of share I seek to include in the Share Sleuth portfolio.

Before deciding whether to trade this month, I experimented with a new trading formula that should encourage me to concentrate the Share Sleuth portfolio more in the most undervalued shares I follow.

New formula to balance a portfolio

I score each share out of 10 (see this article for an explanation of the scoring system) and use the scores to determine how many shares in each holding the portfolio should hold.

The higher the score, the more undervalued the share and the more of it I should, in theory, hold.

The ideal size of a holding is 75% of the share’s score expressed as a percentage.

The table below is a ready reckoner showing how the ideal holding size decreases with the score:

Score | Holding size (score * 75%) |

10 | 7.5% |

9 | 6.75% |

8 | 6% |

7 | 5.25% |

6 | 4.5% |

5 | 3.75% |

This formula has worked well enough, but I wonder if a share that scores 10 is really only twice as good as a share that scores 5. In fact, a share scoring 10 is a rare and wonderful thing, and to my mind shares that score 5 are all too common and may be rather mediocre long-term investments.

This is the new alternative formula:

Score | Holding size (score -10-score2 |

10 | 10% |

9 | 8.5% |

8 | 7% |

7 | 5.5% |

6 | 4% |

5 | 2.5% |

It stretches the range of holding sizes so the biggest ideal holding size is 10%, encouraging me to put more money in the highest-scoring shares and less in the lowest scoring.

Since shares scoring less than 5 rarely interest me, it makes sense that the holding size for a share scoring 5 equates to my minimum holding size, which is 2.5% of the portfolio.

Under this system, a share scoring 10 is four times as good a share scoring five.

I have not decided whether to adopt the new formula permanently, but it opens up many possibilities.

The original formula restricts me to relatively few trades and, I fear, increasing mediocrity as shares that once scored highly are re-rated by the market and lose some of their allure but are retained in relatively large holdings.

This is the situation after applying the new formula:

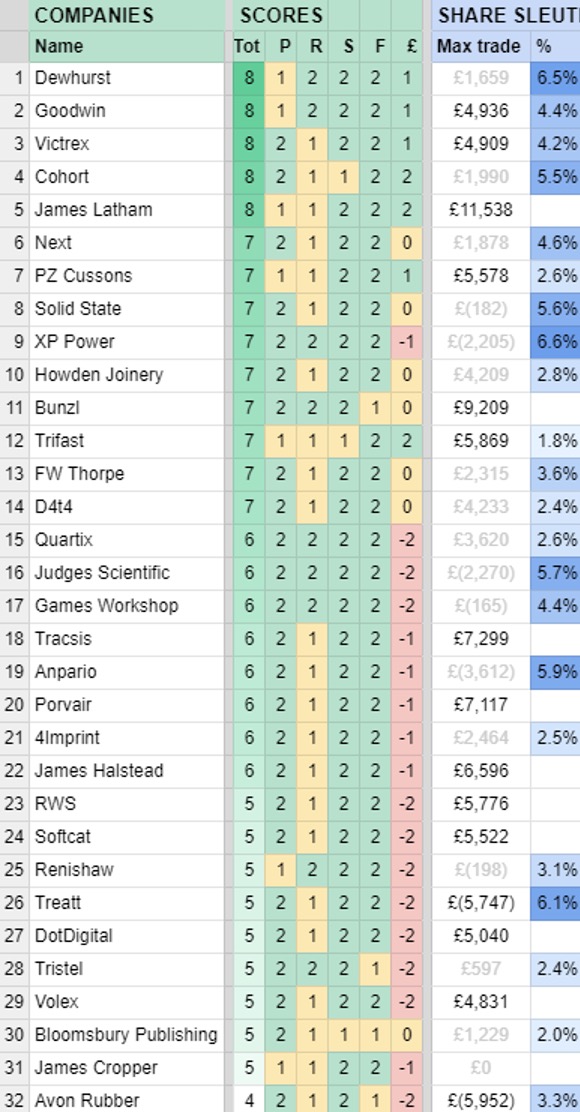

Scores and stats: Richard Beddard. Data: SharePad and annual reports. Tot: Total score, P: Profitability, R: Risk, S: Strategy, F: Fairness, £: Price

The blue column on the right hand side of the table shows each holding’s value as a percentage of the total value of the portfolio. The deeper the shade of blue the bigger the portfolio’s holding in the share, and if a cell is white it means the share is not in the portfolio.

The “Max trade” column next to it shows the value of the shares I would need to add or remove to achieve the ideal size determined by the formula.

Trades involving less than 2.5% of the portfolio (£4,531) are greyed out because that is my minimum trade size as well as my minimum holding size.

Once a month I trade, aiming to lighten dark coloured cells near the bottom of the blue column by reducing the size of low-scoring holdings or darken the cells nearer the top of the blue column by increasing the size of high-scoring holdings.

This month, the formula is telling me to take money out of Avon Rubber (LSE:AVON) and Treatt (LSE:TET) and invest it in some of Goodwin (LSE:GDWN), Victrex (LSE:VCT), James Latham (LSE:LTHM), PZ Cussons (LSE:PZC) and perhaps even Bunzl (LSE:BNZL).

I might well do all of that in the fullness of time, but since I trade only once (or, very occasionally, twice) a month, I am starting with Avon Rubber, a share I re-evaluated earlier this month.

Avon Rubber: too hot to handle

Avon Rubber has earned the portfolio excellent returns, and over an unusually short-term time period. I added 192 shares exactly two years ago on 28 January 2019 at a cost of £2,510 including charges in lieu of fees and stamp duty.

On 28 January 2021, I removed the entire holding, realising £5,394 after deducting £10 in lieu of broker fees. The share price was £30.96 and the return including dividends was 139%.

Avon Rubber is leaving the portfolio because it scores only 4 out of 10.

It was not me that changed, it was the company and its standing among traders.

In the course of the last financial year, it made two acquisitions and a disposal that changed the nature of the business. The company believes it will grow faster in its new configuration, but to my mind it made Avon Rubber a riskier proposition.

The risk I perceive in the business is not enough to rule it out of contention for the Share Sleuth portfolio. Buyers have driven the price up, valuing Avon Rubber at nearly 40 times normalised and adjusted profit. It is the combination of my uncertainty about the business and my uncertainty about the share price that has led to its departure.

Avon Rubber is not a crazy situation like GameStop, and if I can understand it better, or indeed the share price falls, I might add it back to the portfolio.

At the moment, though, it is a bit too hot for me to handle.

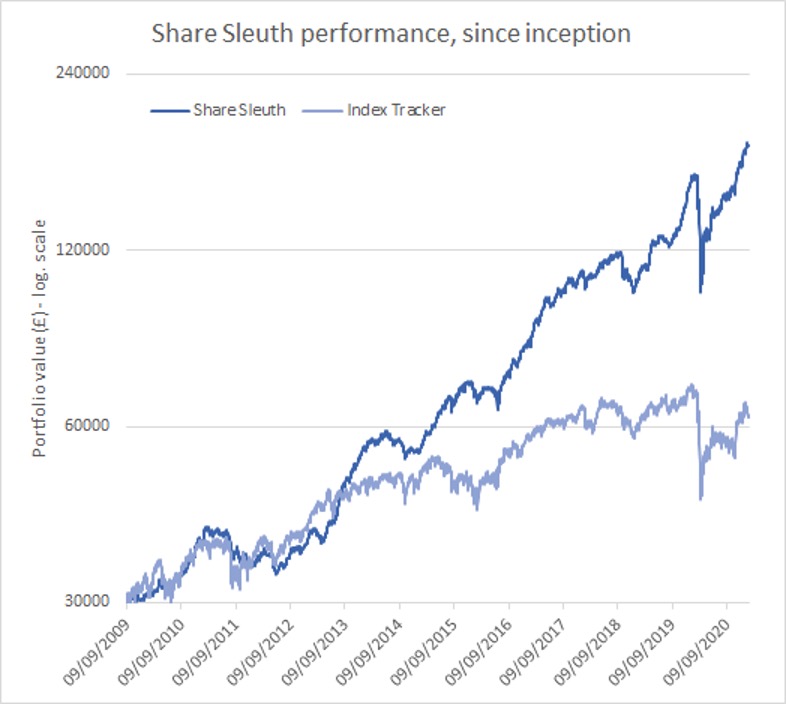

Share Sleuth performance

The Share Sleuth portfolio now has 25 holdings plus just over £10,000 in cash. This is how it has performed over the long term:

Share Sleuth

Cost (£) | Value (£) | Return (%) | |||

Cash | 10,272 | ||||

Shares | 170,890 | ||||

Since 9 September 2009 | 30,000 | 181,162 | 504 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | 1,874 | 6,593 | 10,682 | 62 | |

BMY | 1,256 | 3,274 | 3,642 | 11 | |

BOWL | 1,615 | 3,628 | 3,052 | -16 | |

CHH | 341 | 3,751 | 4,314 | 15 | |

CHRT | 1,600 | 3,747 | 9,920 | 165 | |

D4T4 | 1,528 | 3,509 | 4,813 | 37 | |

DWHT | 735 | 2,244 | 11,760 | 424 | |

FOUR | 190 | 3,688 | 4,532 | 23 | |

GAW | 76 | 218 | 7,813 | 3,484 | |

GDWN | 266 | 6,646 | 8,060 | 21 | |

HWDN | 748 | 3,228 | 5,184 | 61 | |

JDG | 159 | 3,825 | 10,208 | 167 | |

JET2 | 456 | 250 | 6,083 | 2,333 | |

NXT | 106 | 6,071 | 8,387 | 38 | |

PZC | 1,870 | 3,878 | 4,638 | 20 | |

QTX | 1,085 | 2,798 | 4,904 | 75 | |

RM. | 1,275 | 3,038 | 2,722 | -10 | |

RSW | 92 | 1,739 | 5,538 | 218 | |

SOLI | 1,546 | 4,523 | 9,894 | 119 | |

TET | 1,222 | 1,734 | 11,047 | 537 | |

TFW | 2,000 | 2,207 | 6,500 | 195 | |

TRI | 2,261 | 3,357 | 3,245 | -3 | |

TSTL | 750 | 268 | 4,425 | 1,550 | |

VCT | 323 | 6,254 | 7,552 | 21 | |

XPP | 240 | 4,589 | 11,976 | 161 | |

Table notes:

No new holdings, Avon Rubber removed.

Costs include £10 broker fee, and 0.5% stamp duty where appropriate.

Cash earns no interest.

Dividends and sale proceeds are credited to the cash balance.

£30,000 invested on 9 September 2009 would be worth £181,162 today £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £62,256 today.

Objective: to beat the index tracker handsomely over five-year periods.

Source: SharePad, 1 Feb 2020

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

He owns shares in Avon Rubber and all the shares in the Share Sleuth portfolio.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.