Richard Beddard: why I rate this market leader with a winning culture

16th December 2022 14:02

by Richard Beddard from interactive investor

Shares in this company rose sevenfold over five years, and after a significant decline this year, our columnist thinks the business is a good long-term investment.

IT reseller Softcat (LSE:SCT) has blazed its way to the number one spot in the UK by the somewhat old-fashioned technique of schmoozing customers.

Software catalogue

Softcat was founded in the early 1990s as a software catalogue for small businesses, but as it has grown so has the catalogue and the customer list.

These days, it earns about half of its revenue from small and medium sized businesses and half from large businesses and the public sector. The company sells software, hardware, and services, collectively an organisation’s IT infrastructure.

- Find out about: Transferring a Stocks & Shares ISA | Share prices today | Top UK shares

All manner of organisations come to a reseller like Softcat instead of buying direct from companies such as Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT) and Dell (NYSE:DELL) because IT and the terms under which it is supplied are complicated and there is an overwhelming choice of vendors.

Softcat has the market knowledge and vendor relationships, and that enables it to pick and choose a fitting solution from a wide range.

It also has the customers to bring those vendors a great deal of business, which is why so many of them use the company as a UK sales channel.

Last year, Softcat overhauled Computacenter to become the biggest IT reseller in terms of UK market share (about 5%).

It expects to keep growing market share even as the UK market grows, and it is also considering the expansion of a small international branch network that currently supplies UK customers overseas.

Profitable growth

Softcat’s long-term record of revenue growth had been polluted by changes to the accounting rules implemented in 2018 and reinterpreted in 2021, which reduced the amount of revenue the company recognised significantly in those years.

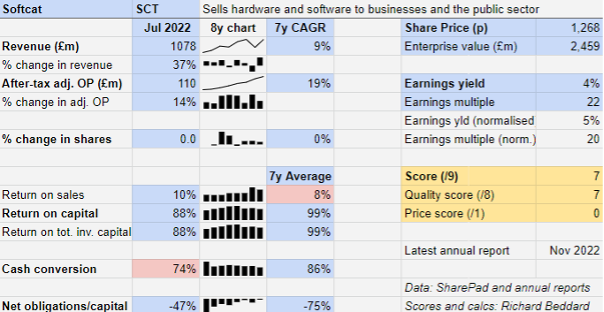

Were I to use a consistent revenue measure, either the old standard or the new one, Softcat’s revenue growth would be higher than the 9% Compound Annual Growth Rate (CAGR) calculated from reported revenue. The effort would be considerable though, and the statistics are good enough to tell us the company has an enviable track record since it floated in 2015.

Softcat claims 68 quarters (17 years) of uninterrupted growth in income, an alternative measure that gets around the revenue problem, and profit.

Profit, which is unaffected by these accounting standard changes, has grown at 19% CAGR over the last seven years, without recourse to adjustments or acquisitions.

Although Return on Sales (profit margin) and Return on Capital are both impacted by the shape-shifting revenue calculation, the statistics are sufficiently robust to confirm the business is highly profitable.

A humdrum 8% average profit margin implies most of the value in each sale goes to suppliers. Softcat makes so much profit because it sells large volumes of their products for a relatively small capital outlay.

Profit margins improved over the pandemic and are declining now it is over, because employees could not visit customers, or gather at internal events, reducing costs in the short-term. Softcat did not welcome this because it hindered the development of long-term customer relationships and its staff.

There is one red flag in the numbers: uncharacteristically low (but nevertheless healthy) level of cash flow compared to profit. This was due to a big increase in receivables, which is money owed to Softcat by customers, in the main.

The company explains this was due to the implementation of a new finance system in the period before the year end, which caused a “temporary disruption to collection procedures”.

There is little risk of customers defaulting on a significant chunk of the money they owe. Softcat says no customer owed it more than 3% of all receivables at the year end in July, and by the time of the publication of the annual report in November things were getting back to normal.

Nevertheless, Softcat is a trusted IT adviser so it gives a bad impression if its own implementations do not go smoothly.

While it still had a substantial cash balance at the end of the financial year, the reduced cash flow explains why net cash was lower than the end of the previous year.

Seeing ghosts?

Softcat’s growth through thick and thin shows it has been a resilient business, and its scale puts it in a strong position. The company is not dependent on any particular vendor, and it offers them unrivalled access to many thousands of customers.

Since IT is increasingly central to the way organisations operate, the market should keep growing. Because of the proliferation of products and systems, Softcat says customers need more help than ever choosing and implementing them.

Judging by the company’s annual report, Softcat expects to keep growing its share of a growing market for decades, but my admittedly inexpert knowledge of developments at software companies gives me the jitters.

All of the software companies I follow are at various stages of shifting to cloud-based delivery of software as a service, which shifts responsibility for maintaining software and hardware away from the end user, Softcat’s customer, and substitutes complex licence agreements for recurring fees.

This simplification, as well as the simplification of software interfaces so products work out of the box and users can self-select the elements they want and automate processes, may, over time, lessen the need for intermediaries.

Softcat sees things differently. The migration of software to the cloud is an opportunity, not a threat, because it requires planning and migration, managed services, and the consideration of security and privacy. Its customers cannot make the transition alone.

Longer-term though, I wonder whether the cloud is an opportunity for software companies to take more control of distribution, and for larger businesses taking a more strategic view of IT, to purchase directly.

Classic sales operation

Softcat is almost as pure a sales operation as can be. Eighty per-cent of staff serve customers in a sales, advice, or customer service capacity.

Its strategy evokes companies of yore, like Marks & Spencer (LSE:MKS) in its heyday, by putting employees first. If they are motivated and empowered by incentive schemes, perks, and a sense of belonging, they will provide outstanding customer service.

Happy employees make customers happy, and that means Softcat is always at the top of their minds when they need new IT.

Founder Peter Kelly tells of how in its early years employees democratically elected managers and voted on their own pay, sometimes allotting less money than was available so it could be invested to grow the business.

I do not know to what extent these radical practices have survived Mr Kelly’s retirement and the company’s rapid growth, but Softcat still describes its employee focus as the bedrock of its strategy.

It prefers to hire sales people at entry level, straight out of school or university, and train them up. This gives staff confidence they will be able to progress within the business without people being drafted in and blocking promotion.

- Investor poll: fears, predictions and strategies for 2023

- 10 top themes for investors to consider in 2023

It also recruits people from disadvantaged backgrounds, and encourages them to flourish through minority interest groups operating within the business.

These policies are high-minded, but also Softcat probably finds it easier to recruit talent where others are not looking and cheaper to train up entry level staff than poach experienced sales people.

The median salary at Softcat is just over £25,000 but commission plays an important role. In 2022, the median employee earned total pay of just under £45,000.

A comparison with Computacenter (LSE:CCC), may be instructive. It pays UK staff much higher salaries and much lower bonuses. Overall, they do better. They earned median total pay of just over £49,000 in the year to December 2021.

The disparity will be greater when times are tough. Commission accounts for 35% of Softcat’s operating costs, and since commission depends on sales, when sales are weak the company has a natural cost reduction mechanism. This is one of the reasons Softcat is so profitable.

Further validation of Softcat’s culture comes from the awards it routinely wins, its high rating on recruitment site Glassdoor, and its own employee engagement and customer satisfaction surveys. Employees are slightly less engaged than they used to be, and customers slightly less satisfied, but by both surveys the company still scores 90% or more. The pandemic and subsequent scramble for talent may have impacted them temporarily.

One other vote of confidence comes from an unlikely but credible source. Neil Murphy, the chief executive of Bytes Technology, a rival that has subsequently listed, revealed in an interview in 2018 that the competitor he admired most was Softcat.

Scoring Softcat

I like Softcat. It puts employees first, which is the mother of all competitive advantages.

Peter Kelly still holds a 33% controlling interest in the shares and has the right, never taken up, to nominate a non-executive director. His replacement as chief executive Martin Helliwell has been chair since 2018, when Graeme Watt succeeded him as chief executive.

Mr Watt is retiring in August next year, and will succeed Mr Helliwell as chair. Chief financial officer, Graham Charlton, will be promoted to the top job.

Corporate governance norms advise against the promotion of chief executives in this way, but I think Softcat’s contravention of this guidance is one of the ways it ensures its winning culture survives board transitions.

New faces provide fresh perspectives, though, and the company says the new chief financial officer will be an external appointment.

Even more so than the employees, the chief executive is lavished with bonuses and share options. In 2022, he earned 64 times median total pay.

Does the business make good money? [2]

+ High return on capital

? Profit margins are reasonable for a distributor

+ Good average cash conversion

What could stop it growing profitably? [1]

+ IT market tends to grow through downturns

+ Scale and cultural advantages make it a good competitor

− Market might get more difficult for resellers

How does its strategy address the risks? [2]

+ Motivates and trains employees

+ Acquires more customers, sells more to them

? Expansion: larger enterprises and international

Will we all benefit? [2]

+ Very experienced management

+ Happy employees

? Executive pay

Is the share price low relative to profit? [0]

+ It is reasonable. A share price of £12.68 values the enterprise at about £2.5 billion, or 20 times normalised profit.

A score of 7 out of 9 indicates Softcat is a good long-term investment.

Although I have reservations about the competitive position of resellers in future, I may be giving those fears too much credence. The future is unfathomable to me at the best of times.

Softcat is ranked 13 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.