The sector Buffett’s betting on – and where to find value in it

After years in tech’s shadow, healthcare stocks are going cheap. Here’s how to spot the real opportunities – and steer clear of the traps.

29th August 2025 09:02

by Theodora Lee Joseph from Finimize

- Healthcare’s trailed way behind tech since 2020, held back by regulatory uncertainty, innovation lags, and pandemic-era hangovers

- Valuations are now at multi-decade lows – but “cheap” doesn’t equal “safe”, and the gap between winners and laggards in the sector has never been wider

- The real opportunity lies in being selective: leaning into big pharma with cash to spend, device makers with steady demand, and biotech firms with M&A upside – while steering clear of policy landmines.

Healthcare has been out of fashion for years, overshadowed by tech’s AI-fueled rally. But Warren Buffett just bought a big stake in UnitedHealth Group Inc (NYSE:UNH) – and when the world’s most famous value investor makes a move, it turns heads.

US healthcare stocks are now trading at the steepest discounts we’ve seen since the ’90s. For the Oracle of Omaha, that’s a green light. And for you, well, it might just be the signal you’ve been waiting for.

What’s changed for the sector?

None of this happened overnight. Drug approvals slowed sharply during the pandemic era. Demand for Covid-related treatments and tests rocketed, and then fell off a cliff. Hospitals and life sciences firms struggled with staffing shortages and rising costs. And, even as new tech kept finding ways to solve old problems, healthcare – for the most part – stood still.

For investors, this seemed like more than just a rough patch: uncertainty around regulation and drug pricing started to feel like a constant. Biotech IPOs flopped. And the few stocks that did outperform – like Eli Lilly and Co (NYSE:LLY), with its industry-leading weight-loss drug – only masked the sector’s broader ills.

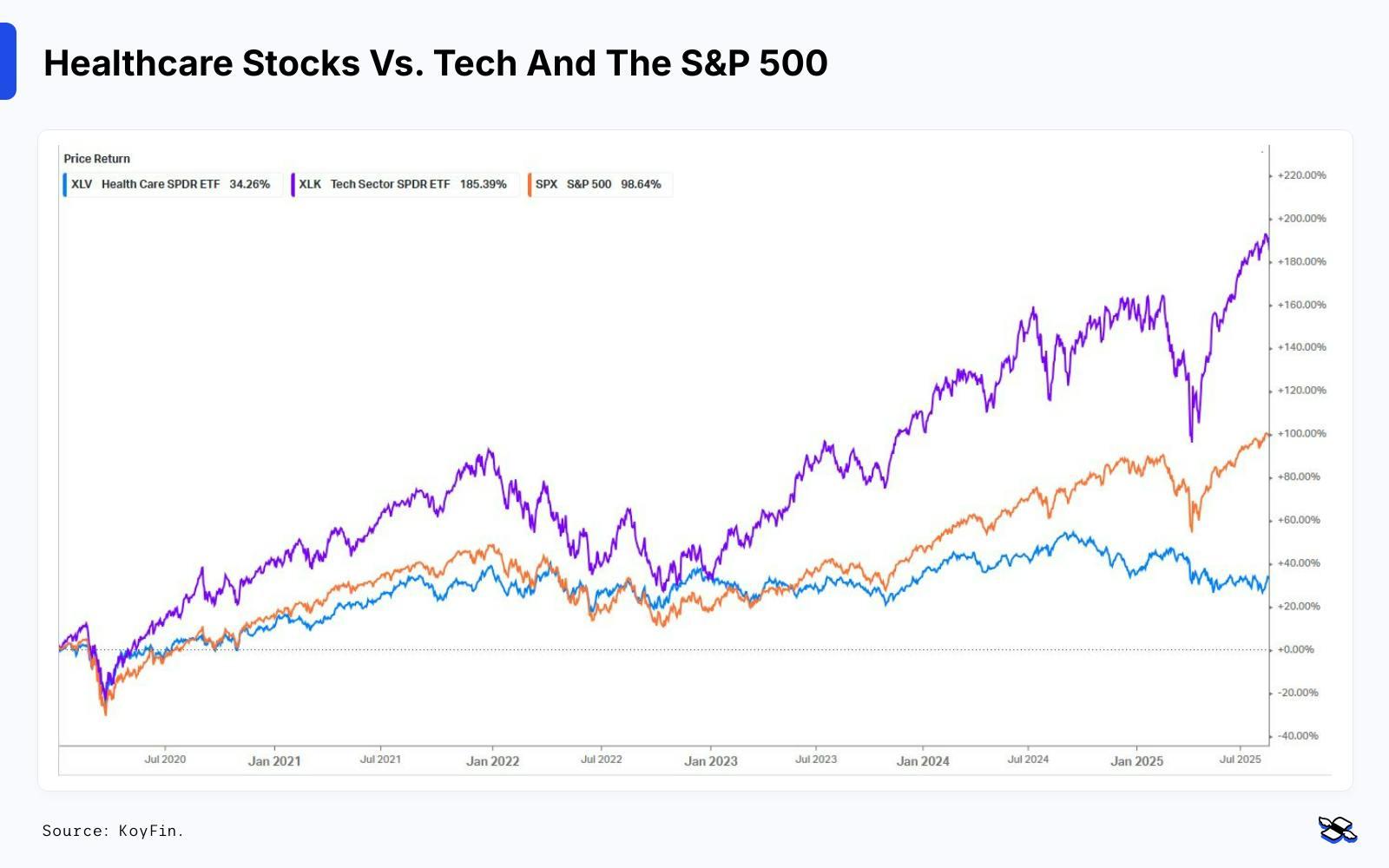

So, tech surged, and healthcare stayed flat.

The US healthcare sector (blue) has mostly underperformed tech stocks and the broader index since 2020. Source: KoyFin. Past performance is not a guide to future performance.

What do the stock prices say about the sector now?

On the surface, healthcare seems like a bargain. On a price-to-earnings (P/E) basis, the sector goes for less than the broader market, and some parts – like biotech and managed care – are near historic lows. For example, the sector trades around 12x forward earnings, but that’s actually skewed upward by the obesity-injection leaders. Most drug-making stocks trade in the single digits or low teens.

Low prices don’t tell the whole story, though. See, earnings growth hasn’t kept up in some areas, especially in biotech, where commercial failures and high burn rates have sapped investor trust. But certain medical device companies – like Boston Scientific Corp (NYSE:BSX) and Stryker Corp (NYSE:SYK) – have done well, supported by steady innovation and smart spending.

The gap between winners and losers has only widened in recent years. And that’s forced investors to consider whether this is a sector-level opportunity or one that depends entirely on picking the right names.

So, what’s the opportunity here?

With healthcare lagging badly, the easy trade is to buy the sector and wait for “mean reversion” – when the market eventually pushes stocks back to more-normal-looking valuations. But the smarter move is to be selective.

Here’s where I’d look:

Big pharma on sale

The industry-wide discount to the S&P 500 means that even high-quality drugmakers are trading cheap relative to their history. Patent cliffs and pipeline fears have weighed on valuations for a while, but strong balance sheets and steady cash flows create lots of room for recovery. Meanwhile, weight-loss breakthroughs show how one or two blockbuster therapies can drive a repricing across the space.

Medical devices and diagnostics

Ageing demographics mean an increase in chronic diseases – and those two things point to steady healthcare demand. Medical devices and diagnostic tools tend to carry fewer regulatory risks and benefit directly from structural healthcare trends, making them a defensive investing play.

Biotech (with a safety net)

Sure, biotech’s IPO boom fizzled, but those firms’ low valuations mean the prospects of mergers and acquisitions (M&A) are back on the table. Bigger players need to replenish their drug pipelines, after all – which they could do by simply snapping up smaller innovators with promising assets. And that combination of consolidation support and innovation upside makes biotech one of the most “asymmetric” opportunities out there.

But don’t turn a blind eye to the risks. Healthcare stocks are cheap for a reason: profit growth has been weak, the regulatory picture murky, and innovation sluggish. For a real rebound to happen, key things would have to shift – whether that’s M&A flows unlocking value, policy clarity easing investor nerves, or a rush of Food and Drug Administration (FDA) approvals that get the pipeline moving again.

For now, healthcare is a contrarian growth play: it’s not where the herd is going (at least not yet). But in a market where much of tech is already priced high and betting on perfection, this is one corner where expectations are low and there’s still room for upside surprises – if you know where to look.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of Aberdeen.

finimize is a newsletter, app and community providing investing insights for individual investors.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.