Share Sleuth: new addition takes number of holdings up to 30

7th April 2022 09:22

by Richard Beddard from interactive investor

A great company to work for often makes a great investment, points out Richard Beddard.

It is, I suspect, a long-forgotten fact that in its first year, 2009 to 2010, the Share Sleuth portfolio went by a different name. It was called The Thrifty 30.

What’s in a name?

The name was chosen to reflect the portfolio’s value investing mandate, but it came a cropper when we launched another portfolio called the Nifty Thrifty in 2010. Shares in the Nifty Thrifty used an algorithm based on simple fundamental investment ratios to select good companies at cheap prices.

My portfolios were originally published in Money Observer magazine, and we decided that running two portfolios with such similar names was confusing, especially as the Nifty Thrifty always had exactly 30 members, and the portfolio that included that magic number in its name, never had that many shares.

So we changed the name of the Thrifty 30 to Share Sleuth.

The Nifty Thrifty is no more. It lasted nine years. It tracked the index tracking fund minus one or two percent mostly because of trading costs. The whole point was to beat the passive investment.

Just as bad, my index tracker took away all the joy of investing (i.e. working out which companies would make good investments) and retained all the stress and hassle of making (simulated) trades.

In fact, since every share in the portfolio was traded once a year, there was much more trading in the Nifty Thrifty.

- Share Sleuth: my first trades of 2022 lead to a new holding

- Shares for the future: how I pick the best ones

- Richard Beddard: this share is near the top of my shopping list

My editor wanted me to go on for another year, but nine years of inputting seemingly senseless trades and then trying to explain them was a tedious nightmare and I begged her to axe the column a year early.

Ironically, I had already incorporated an algorithm into Share Sleuth by then, but it is an algorithm that requires me to work out which shares should make good long-term investments by scoring qualities I associate with winners: high levels of profitability, manageable risks, strategies that address those risks, fairness so that we will all benefit, and a reasonable price to give us a decent return on our investment.

Most weeks you can read about that algorithm in action when I score a share, and every month we publish a ranked list of shares, a snapshot of my “Decision Engine”, so you can see which shares are ranked highest.

I also use the Decision Engine to inform the trades that I make in the very much alive and kicking Share Sleuth portfolio.

So, some of the algorithmic spirit of the Nifty Thrifty lives on in its sibling and today, I can triumphantly reveal that, more by accident than design, for the first time there are 30 shares in the Share Sleuth portfolio!

And then there were 30

On Monday 21 March, I added 400 shares in Focusrite (LSE:TUNE) at a price of £11.30 per share, the actual price quoted by a broker.

The transaction cost £4,530 including £10 in lieu of broker fees.

Focusrite designs electronic equipment for creating, playing and broadcasting music.

My enthusiasm should come as no surprise, Focusrite narrowly lost out to RWS (LSE:RWS) last month. In Februrary’s Share Sleuth update, I explained that I might well go on to add the shares in March.

I had scored the company for the second time in January, when I liked everything but the share price. Since then, the share price had fallen considerably.

I am not a market timer. I trade once a month when it is convenient. I like to schedule a day when there are no other pressures on me (such as article deadlines or company meetings) and I can think clearly.

Had I been luckier with my timing I might have added Focusrite shares at a price of 40% below the price in January but the discount on the January price was only 23% by the time I got round to it.

Still, I am pleased with my purchase. From what I have read, it is a great company to work for, and those are often great companies to invest in. While the price was higher than I like to pay, I believe Focusrite’s quality will more than compensate.

- Richard Beddard: look at the right numbers and this stock will impress

- Read more articles by Richard Beddard here

A disclosure: interactive investor’s policy is that freelance writers are not allowed to trade a share one week either side of the publication of an article they have written about the same share.

Since I use the Decision Engine to inform trades in my personal share portfolio and trading is usually a low priority left to the end of the month, I end up deciding which shares to trade just before publication of this column. That means I cannot buy the shares myself until at least a week after you read about the Share Sleuth portfolio trades.

On this occasion though, I made my decision more than two weeks before publication, so I have already pocketed the shares.

Rest assured, I am no pumper and dumper. It is most unlikely I will trade Focusrite again until I have re-evaluated the company after it publishes its next annual report in January 2023.

As always, my hope is to hold the shares for at least ten years, be that virtually in the Share Sleuth portfolio or actually in my own.

Performance

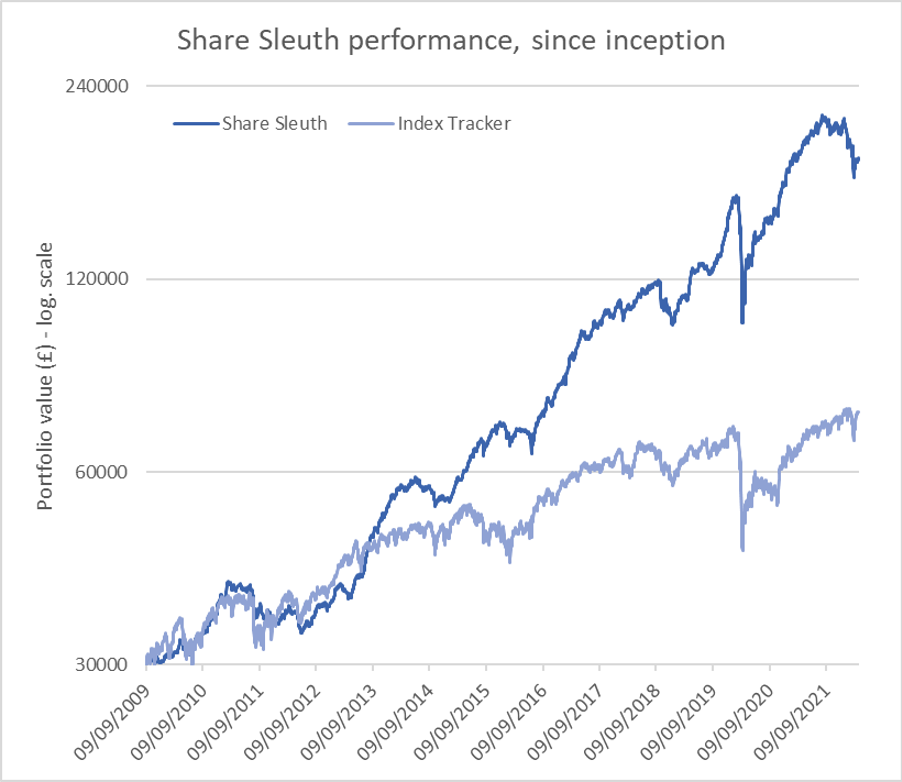

At the close on Monday 4 April, the Share Sleuth portfolio was worth £185,545, 518% more than the notional £30,000 invested in the portfolio’s first year, from September 2009.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 637 | ||||

Shares | 184,908 | ||||

Since 9 September 2009 | 30,000 | 185,545 | 518 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 6,070 | 50 |

BMY | Bloomsbury | 2,676 | 8,509 | 11,440 | 34 |

BNZL | Bunzl | 201 | 4,714 | 6,096 | 29 |

BOWL | Hollywood Bowl | 1,615 | 3,628 | 4,078 | 12 |

CHH | Churchill China | 341 | 3,751 | 4,774 | 27 |

CHRT | Cohort | 1,600 | 3,747 | 7,600 | 103 |

D4T4 | D4t4 | 1,528 | 3,509 | 3,935 | 12 |

DWHT | Dewhurst | 532 | 1,754 | 6,916 | 294 |

FOUR | 4Imprint | 190 | 3,688 | 5,463 | 48 |

GAW | Games Workshop | 76 | 218 | 5,666 | 2,499 |

GDWN | Goodwin | 266 | 6,646 | 9,283 | 40 |

HWDN | Howden Joinery | 1,368 | 8,223 | 10,818 | 32 |

JDG | Judges Scientific | 159 | 3,825 | 10,653 | 179 |

JET2 | Jet2 | 456 | 250 | 5,303 | 2,021 |

LTHM | James Latham | 400 | 5,238 | 4,860 | -7 |

NXT | Next | 106 | 6,071 | 6,532 | 8 |

PRV | Porvair | 906 | 4,999 | 5,545 | 11 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,787 | -2 |

QTX | Quartix | 1,085 | 2,798 | 4,123 | 47 |

RM. | RM | 1,275 | 3,038 | 1,913 | -37 |

RSW | Renishaw | 92 | 1,739 | 3,603 | 107 |

RWS | RWS | 1,000 | 4,696 | 3,708 | -21 |

SOLI | Solid State | 986 | 2,847 | 10,895 | 283 |

TET | Treatt | 763 | 1,082 | 8,683 | 702 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 9,200 | 317 |

TRI | Trifast | 2,261 | 3,357 | 2,589 | -23 |

TSTL | Tristel | 750 | 268 | 2,400 | 795 |

TUNE | Focusrite | 400 | 4,530 | 5,300 | 17 |

VCT | Victrex | 292 | 6,432 | 5,373 | -16 |

XPP | XP Power | 240 | 4,589 | 8,304 | 81 |

Table notes:

Added Focusrite on 21 March

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £185,545 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £74,423 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, 4 April 2022.

The portfolio’s cash balance has shrunk to £637, diminished by the purchase of Focusrite and augmented by dividends from Treatt (LSE:TET) and FW Thorpe (LSE:TFW).

There is not enough cash to fund new additions at my minimum trade size of 2.5% of the portfolio’s total value (about £4,700).

If I add a share in April, it will have to be funded in part by a disposal.

Past performance is not a guide to future performance

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all of the shares in the Share Sleuth portfolio.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.