Share Sleuth: taking action on two high-scoring shares

5th August 2021 09:16

by Richard Beddard from interactive investor

The difference between the scores of these two shares is a tiny fraction, but one has been reduced and the other increased. Richard Beddard explains why.

This month, I have, in one sense, swapped like for like. I reduced the Share Sleuth portfolio’s holding in Dewhurst (LSE:DWHT), the fifth-ranked share in my Decision Engine, and increased its holding in Bloomsbury Publishing (LSE:BMY), the eighth-ranked share. Both shares score 7 out of 9 for profitability, risk, strategy, fairness and price.

The difference between their scores is a tiny fraction, hence the like-for-like swap. In other respects they are, of course, different. Dewhurst makes lift components, keypads and bollards. Bloomsbury publishes books and electronic collections for academic libraries.

The reason for the swap has nothing to do with my confidence in their prospects as long-term investments.

- Shares for future: this small-cap is top of my latest rankings

- Read more Richard Beddard articles here

- Check out our award-winning stocks and shares ISA

It is because the portfolio owned far more Dewhurst shares than Bloomsbury shares. Immediately before the transactions, Share Sleuth’s Dewhurst holding was worth £19,331 (9%) of Share Sleuth’s portfolio’s total value, which was £6,845 more than the portfolio’s ideal holding size.

The ideal size is determined by a company’s score, the higher the score, the more the Decision Engine tells me to hold. This is another way of saying the Decision Engine was telling me to reduce the portfolio’s holding by £6,845.

Bloomsbury, on the other hand, was worth just £4,740 on the eve of the transactions, which was 2.3% of the portfolio’s total value. The Decision Engine recommended I add shares to the value of £6,740 to achieve its ideal holding size.

In fact, I was a bit more conservative in executing both trades. I reduced Dewhurst and increased Bloomsbury by just over £5,000, or 2.5% of the portfolio’s total value.

That is the minimum percentage of the portfolio I trade, a stipulation that stops me frittering.

Reducing Dewhurst

Reducing Dewhurst was a somewhat emotional decision for two reasons. I first added the shares on 9 September 2009, the day I created the portfolio.

The value of that trade was £998 including fees. Little more than a year later in January 2011, I added shares to the value of £1,246. It is a little humbling to think that an investment of £2,244 was worth £19,311 a little over a decade later.

I would be a liar, though, if I did not admit Dewhurst’s awesome performance so far this year had not surprised me. The share had steadily and satisfactorily grown in value at a similar rate to the portfolio during its first decade, a true stalwart, before this happened:

Past performance is not a guide to future performance

While I try not to take any notice of share prices, I could not help but panic a little at the magnitude of this rise. However, I still would not have traded had the Decision Engine not recommended it, so emotional though I felt, reason did win the day.

On 23 July, I reduced the portfolio’s holding in Dewhurst by 203 shares at a bid price of £25.60*, which raised £5,186.80 after the deduction of £10 in lieu of broker fees.

*Please see final section of this article for explanation why I didn’t use broker price for the trade on this occasion.

Adding more Bloomsbury

Adding more shares in Bloomsbury was easy as the company has recently published its annual report and I had just re-scored it.

Bloomsbury is a much more youthful member of the Share Sleuth portfolio. I first added it in November 2019, but the share price caught a pandemic-induced fever. It recovered when traders probably realised that people had rediscovered books during lockdowns, and libraries appreciated digital collections that students, teachers and lecturers could access from home.

Past performance is not a guide to future performance

On the same day, 23 July, I added 1,381 Bloomsbury shares to the Share Sleuth portfolio at a price of just over £3.76, the actual price quoted by my broker.

The total cost of the transaction, after the deduction of £10.00 in lieu of broker fees and £26.00 in lieu of stamp duty, was £5,234.90.

I should add a couple of footnotes to my Bloomsbury analysis though.

A letter from many famous authors to the most recent edition of The Sunday Times has warned of a potential weakening of copyright law. This is because the government is considering the regime that will replace EU rules still in operation despite Brexit.

The authors fear they will be prevented from limiting the sale of foreign editions of books in the UK.

- Subscribe to the ii YouTube channel and catch all our latest interviews and video content

- Read more of our content on UK shares here

Obviously, publishers are likely to be affected as well as authors, if cheap foreign editions from non-UK publishers undercut UK sales, but Bloomsbury did not include this as a principal risk in its annual report because it is still working out how significant the threat is (it described it as an “emerging risk”).

Generally, I trust good businesses like Bloomsbury to adapt to new circumstances, indeed its strategy has already reduced its dependence on print books and UK sales. But I will consider this risk when I score the company next year.

My Bloomsbury write-up also included an estimate of the publisher’s Harry Potter revenue derived from a figure published on an employee’s Linkedin profile some years ago.

A reader has sent me his calculation, which casts doubt on that figure and implies a higher Harry Potter total. On Twitter, another investor has reported the result of a different calculation to arrive at a lower figure for Harry Potter revenue than the estimate I originally published.

The spread is about £15 million (derived from an estimate of £13.5 million to £14 million for the 2020 financial year) to £37 million.

I have a mathematical conundrum to resolve, which is not my favourite kind...

How things stand

The two near-equally ranked shares now have a more equal status in Share Sleuth. As of the close on Monday 2 August, Dewhurst represents about 6% of the portfolio and Bloomsbury about 4.5%.

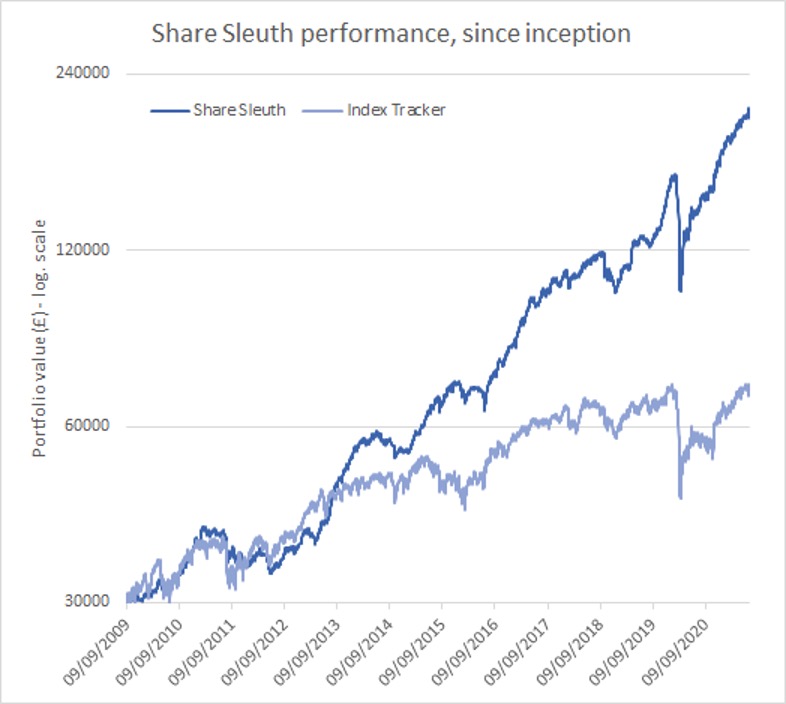

The Share Sleuth portfolio is worth a notional £208,699, 596% more than the £30,000 invested during the year following that first trade in Dewhurst in September 2009.

The same amount invested in accumulation units of a FTSE All-Share Index tracking fund would have appreciated to £69,482 over the same period.

The cash balance has risen slightly due to a dividend from Anpario (LSE:ANP), but at £2,163 it is still lower than the portfolio’s minimum trade size of just over £5,200 (2.5% of its value).

If there are any more new additions in the coming months, they will have to be funded from disposals.

| Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

|---|---|---|---|---|---|

| Cash | 2,163 | ||||

| Shares | 206,536 | ||||

| Since 9 September 2009 | 30,000 | 208,699 | 596 | ||

| Companies | Shares | Cost (£) | Value (£) | Return (%) | |

| ANP | Anpario | 1,874 | 6,593 | 13,024 | 98 |

| BMY | Bloomsbury | 2,676 | 8,509 | 9,286 | 9 |

| BNZL | Bunzl | 201 | 4,714 | 5,375 | 14 |

| BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,763 | 4 |

| CHH | Churchill China | 341 | 3,751 | 5,823 | 55 |

| CHRT | Cohort | 1,600 | 3,747 | 9,440 | 152 |

| D4T4 | D4t4 | 1,528 | 3,509 | 5,730 | 63 |

| DWHT | Dewhurst | 532 | 1,754 | 12,502 | 613 |

| FOUR | 4Imprint | 190 | 3,688 | 5,330 | 45 |

| GAW | Games Workshop | 76 | 218 | 8,763 | 3,920 |

| GDWN | Goodwin | 266 | 6,646 | 7,940 | 19 |

| HWDN | Howden Joinery | 1,368 | 8,223 | 12,391 | 51 |

| JDG | Judges Scientific | 159 | 3,825 | 10,176 | 166 |

| JET2 | Jet2 | 456 | 250 | 5,766 | 2,207 |

| NXT | Next | 106 | 6,071 | 8,450 | 39 |

| PRV | Porvair | 906 | 4,999 | 5,581 | 12 |

| PZC | PZ Cussons | 1,870 | 3,878 | 4,638 | 20 |

| QTX | Quartix | 1,085 | 2,798 | 5,175 | 85 |

| RM. | RM | 1,275 | 3,038 | 3,086 | 2 |

| RSW | Renishaw | 92 | 1,739 | 4,761 | 174 |

| SOLI | Solid State | 986 | 2,847 | 8,923 | 213 |

| TET | Treatt | 763 | 1,082 | 8,050 | 644 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 8,540 | 287 |

| TRI | Trifast | 2,261 | 3,357 | 3,256 | -3 |

| TSTL | Tristel | 750 | 268 | 4,575 | 1,605 |

| VCT | Victrex | 534 | 10,812 | 14,098 | 30 |

| XPP | XP Power | 240 | 4,589 | 12,096 | 164 |

Table notes:

Reduced holding in Dewhurst, added more shares in Bloomsbury.

Costs include £10 broker fee, and 0.5% stamp duty where appropriate.

Cash earns no interest.

Dividends and sale proceeds are credited to the cash balance.

£30,000 invested on 9 September 2009 would be worth £208,699 today.

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £69,482 today.

Objective: To beat the index tracker handsomely over five-year periods.

Source: SharePad, 2 August 2021.

Past performance is not a guide to future performance.

Some hand-wringing about liquidity

*Normally I use the actual price quoted by a broker, but on this occasion my broker did not offer a price to trade, so I used the bid price.

The most likely explanation for my broker’s inability to trade the share, is that there were not enough willing sellers to fulfil my order. Dewhurst is quite thinly traded.

As I wrote up the trade for this article, I realised that I should not have taken this shortcut.

I should have tried again another time, or split my trade into smaller orders, as my intention is to ensure that the Share Sleuth model portfolio simulates a real portfolio as closely as possible.

Since Dewhurst has been available at this size (at exactly its bid price) on other occasions recently, and the trade is small, I have allowed this one-off transgression.

As Share Sleuth grows, the problem of selling illiquid stocks will become more common and so my policy in future will be to stick to trades at prices my broker offers.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Dewhurst and Bloomsbury Publishing.

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.